Question

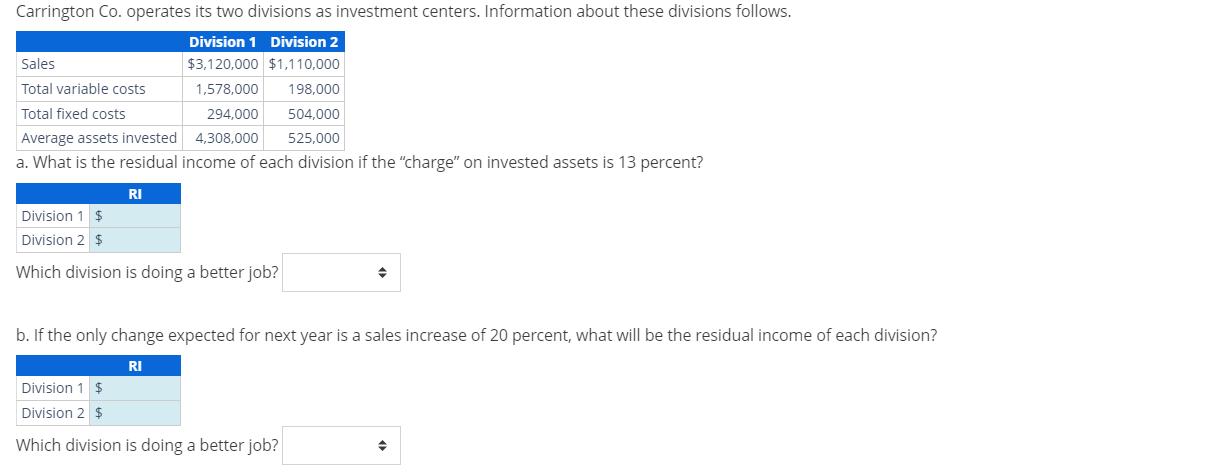

Carrington Co. operates its two divisions as investment centers. Information about these divisions follows. Division 1 Division 2 Sales $3,120,000 $1,110,000 Total variable costs

Carrington Co. operates its two divisions as investment centers. Information about these divisions follows. Division 1 Division 2 Sales $3,120,000 $1,110,000 Total variable costs 1,578,000 198,000 294,000 504,000 4,308,000 525,000 Total fixed costs Average assets invested a. What is the residual income of each division if the "charge" on invested assets is 13 percent? RI Division 1 $ Division 2 $ Which division is doing a better job? b. If the only change expected for next year is a sales increase of 20 percent, what will be the residual income of each division? Division 1 $ Division 2 $ RI Which division is doing a better job?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Residual Income for Each Division To calculate the residual income RI well follow these steps Calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting Foundations and Evolutions

Authors: Michael R. Kinney, Cecily A. Raiborn

9th edition

9781285401072, 1111971722, 1285401077, 978-1111971724

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App