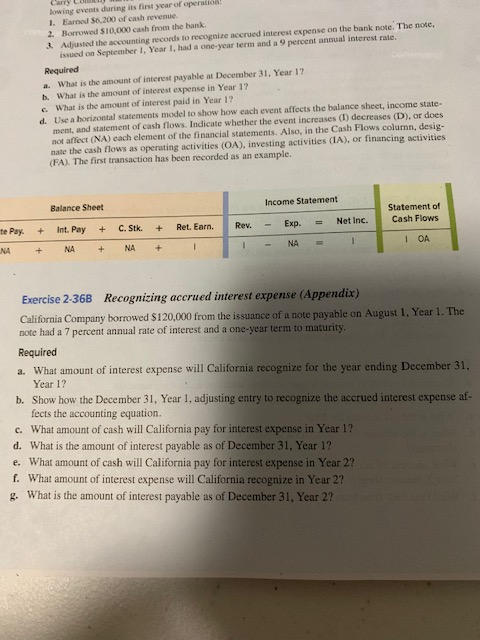

Carry LOL lowing events during its first year of operation! 1. Earned $6.200 of cash revenue. 2. Borrowed $10,000 cash from the bank 2 Adjusted the accounting records to recognize accrued interest expense on the bank note. The note. issued on September I. Year I, had a one-year term and a 9 percent annual interest rate. Required a. What is the amount of interest payable at December 31, Year 1? h. What is the amount of interest expense in Year 1? c. What is the amount of interest paid in Year 1? d. Use a horizontal statements model to show how each event affects the balance sheet, income state- ment, and statement of cash flows. Indicate whether the event increases (1) decreases (D), or does not affect (NA) each element of the financial statements. Also, in the Cash Flows column, desig- nate the cash flows as operating activities (OA). investing activities (IA), or financing activities (FA). The first transaction has been recorded as an example. Income Statement Balance Sheet Statement of Cash Flows Rev. Net Inc. te Pay. NA + + Int. Pay NA + + C. Stk. NA + + Ret. Earn. 1 - - Exp. NA - - IOA Exercise 2-36B Recognizing accrued interest expense (Appendix) California Company borrowed $120.000 from the issuance of a note payable on August 1, Year 1. The note had a 7 percent annual rate of interest and a one-year term to maturity, Required a. What amount of interest expense will California recognize for the year ending December 31. Year 1? b. Show how the December 31, Year 1, adjusting entry to recognize the accrued interest expense af fects the accounting equation. c. What amount of cash will California pay for interest expense in Year 1? d. What is the amount of interest payable as of December 31, Year 1? e. What amount of cash will California pay for interest expense in Year 27 f. What amount of interest expense will California recognize in Year 2? g. What is the amount of interest payable as of December 31, Year 2? W Cv BIN M Fundamental Financial Accounting Concepts, Tenth Editio Account a. Purchased land for cash. b. Acquired cash from the issue of common stock. c. Collected cash from accounts receivable. d. Paid cash for operating expenses. e. Recorded accrued salaries. f. Purchased supplies on account. g. Performed services on account. h. Paid cash in advance for rent on office space. i. Adjusted the books to record supplies used during the period. j. Performed services for cash. k. Paid cash for salaries accrued at the end of a prior period. 1. Paid a cash dividend to the stockholders. m. Adjusted books to reflect the amount of prepaid rent expired during the period, n. Incurred operating expenses on account. o. Paid cash on accounts payable. p. Received cash advance for services to be provided in the future, q. Recognized revenue on account at the end of the accounting period. Exercise 2-32B Ethical conduct An October 31, 2012, news release from Hewlett-Packard Company (HP) included HP recorded a non-cash charge for the impairment of goodwill and intangible assets Carry LOL lowing events during its first year of operation! 1. Earned $6.200 of cash revenue. 2. Borrowed $10,000 cash from the bank 2 Adjusted the accounting records to recognize accrued interest expense on the bank note. The note. issued on September I. Year I, had a one-year term and a 9 percent annual interest rate. Required a. What is the amount of interest payable at December 31, Year 1? h. What is the amount of interest expense in Year 1? c. What is the amount of interest paid in Year 1? d. Use a horizontal statements model to show how each event affects the balance sheet, income state- ment, and statement of cash flows. Indicate whether the event increases (1) decreases (D), or does not affect (NA) each element of the financial statements. Also, in the Cash Flows column, desig- nate the cash flows as operating activities (OA). investing activities (IA), or financing activities (FA). The first transaction has been recorded as an example. Income Statement Balance Sheet Statement of Cash Flows Rev. Net Inc. te Pay. NA + + Int. Pay NA + + C. Stk. NA + + Ret. Earn. 1 - - Exp. NA - - IOA Exercise 2-36B Recognizing accrued interest expense (Appendix) California Company borrowed $120.000 from the issuance of a note payable on August 1, Year 1. The note had a 7 percent annual rate of interest and a one-year term to maturity, Required a. What amount of interest expense will California recognize for the year ending December 31. Year 1? b. Show how the December 31, Year 1, adjusting entry to recognize the accrued interest expense af fects the accounting equation. c. What amount of cash will California pay for interest expense in Year 1? d. What is the amount of interest payable as of December 31, Year 1? e. What amount of cash will California pay for interest expense in Year 27 f. What amount of interest expense will California recognize in Year 2? g. What is the amount of interest payable as of December 31, Year 2? W Cv BIN M Fundamental Financial Accounting Concepts, Tenth Editio Account a. Purchased land for cash. b. Acquired cash from the issue of common stock. c. Collected cash from accounts receivable. d. Paid cash for operating expenses. e. Recorded accrued salaries. f. Purchased supplies on account. g. Performed services on account. h. Paid cash in advance for rent on office space. i. Adjusted the books to record supplies used during the period. j. Performed services for cash. k. Paid cash for salaries accrued at the end of a prior period. 1. Paid a cash dividend to the stockholders. m. Adjusted books to reflect the amount of prepaid rent expired during the period, n. Incurred operating expenses on account. o. Paid cash on accounts payable. p. Received cash advance for services to be provided in the future, q. Recognized revenue on account at the end of the accounting period. Exercise 2-32B Ethical conduct An October 31, 2012, news release from Hewlett-Packard Company (HP) included HP recorded a non-cash charge for the impairment of goodwill and intangible assets