Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carter Company manufactures two products, Deluxe and Regular, and allocates indirect resources to the products using two cost pools, one for each production department. Each

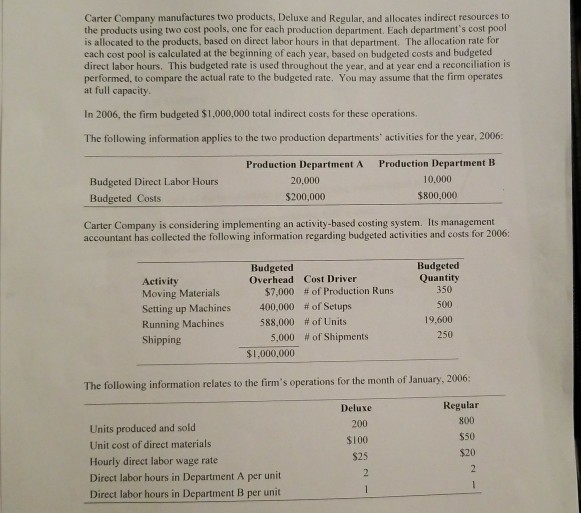

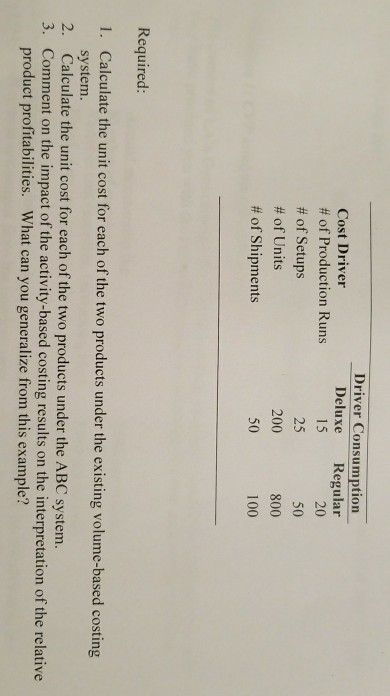

Carter Company manufactures two products, Deluxe and Regular, and allocates indirect resources to the products using two cost pools, one for each production department. Each department's cost pool is allocated to the products, based on direct labor hours in that department. The allocation rate for each cost pool is calculated at the beginning of each year, based on budgeted costs and budgeted direct labor hours. This budgeted rate is used throughout the year, and at year end a reconciliation is performed, to compare the actual rate to the budgeted rate. You may assume that the firm operates at full capacity In 2006, the firm budgeted $1,000,000 total indirect costs for these operations The following information applies to the two production departments' activities for the year, 2006: Budgeted Direct Labor Hours Budgeted Costs Production Department A 20,000 $200,000 Production Department B 10,000 $800,000 Carter Company is considering implementing an activity-based costing system. Its management Budgeted Quantity Budgeted Overhead Cost Driver Activity Moving Materials Setting up Machines Running Machines Shipping $7,000 400,000 588,000 5,000 $1,000,000 #of Production Runs # of Setups #of Units # of Shipments 350 500 19,600 250 06: The following information relates to the firm's operations for the month of January, 20 Regular Deluxe 200 $100 $25 800 $50 $20 Units produced and sold Unit cost of direct materials Hourly direct labor wage rate Direct labor hours in Department A per unit Direct labor hours in Department B per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started