Answered step by step

Verified Expert Solution

Question

1 Approved Answer

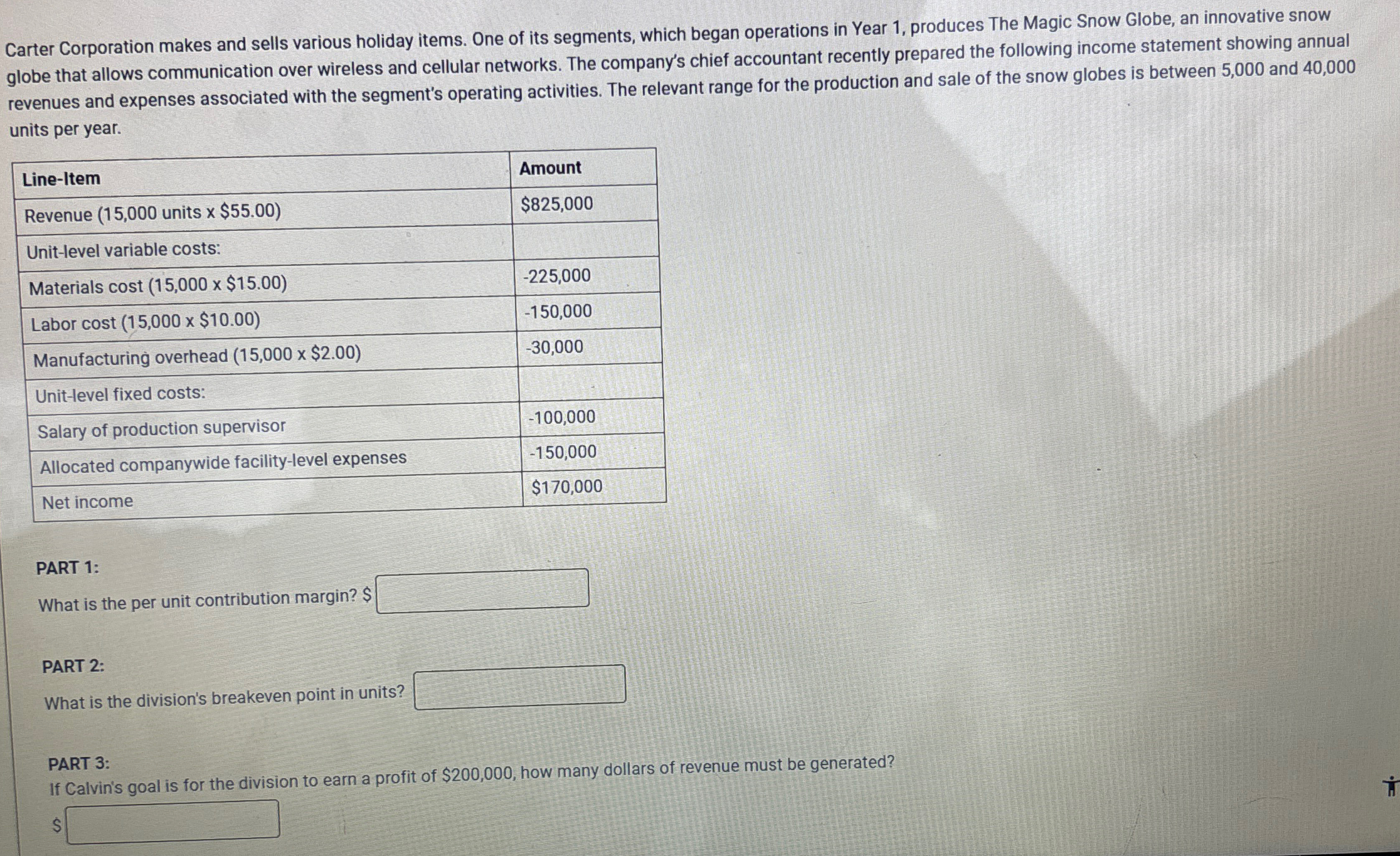

Carter Corporation makes and sells various holiday items. One of its segments, which began operations in Year 1, produces The Magic Snow Globe, an

Carter Corporation makes and sells various holiday items. One of its segments, which began operations in Year 1, produces The Magic Snow Globe, an innovative snow globe that allows communication over wireless and cellular networks. The company's chief accountant recently prepared the following income statement showing annual revenues and expenses associated with the segment's operating activities. The relevant range for the production and sale of the snow globes is between 5,000 and 40,000 units per year. Line-Item Revenue (15,000 units x $55.00) Unit-level variable costs: Amount $825,000 Materials cost (15,000 x $15.00) -225,000 Labor cost (15,000 x $10.00) -150,000 Manufacturing overhead (15,000 x $2.00) -30,000 Unit-level fixed costs: Salary of production supervisor -100,000 Allocated companywide facility-level expenses -150,000 Net income $170,000 PART 1: What is the per unit contribution margin? $ PART 2: What is the division's breakeven point in units? PART 3: If Calvin's goal is for the division to earn a profit of $200,000, how many dollars of revenue must be generated? S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started