Answered step by step

Verified Expert Solution

Question

1 Approved Answer

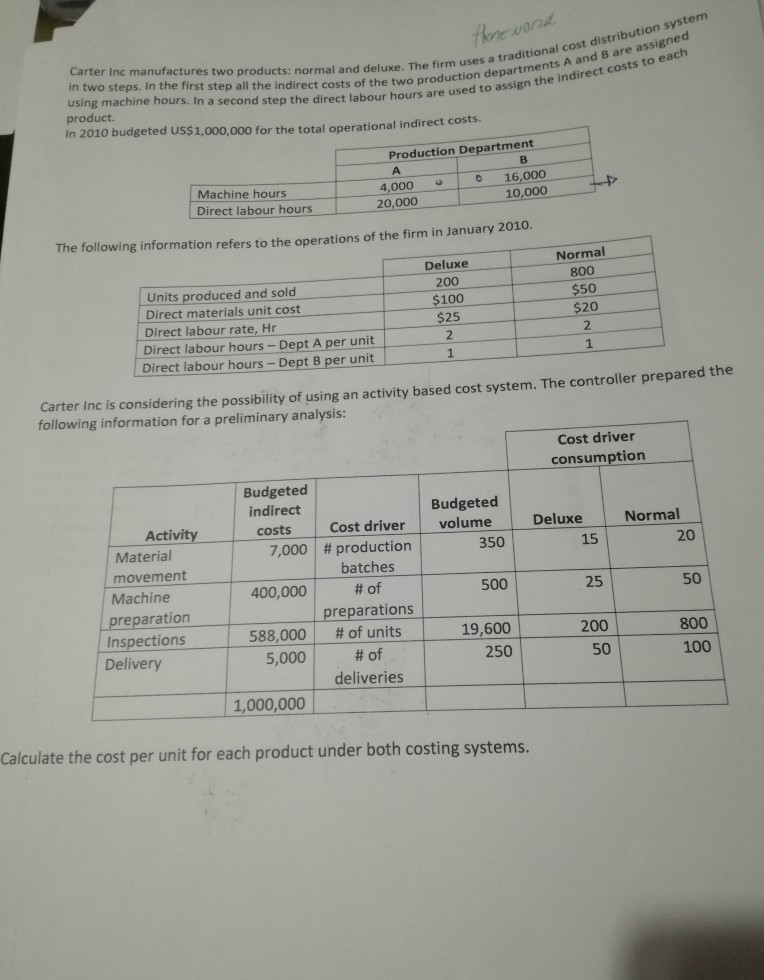

Carter Inc manufactures two products: normal and deluxe. fi in two steps. In the first step all the indirect costs of the two p using

Carter Inc manufactures two products: normal and deluxe. fi in two steps. In the first step all the indirect costs of the two p using machine hours. In a second step the direct labour hours are used to assign product. In 2010 budgeted US$1,000,000 for the total operational indir production departments A and B are assigned the indirect costs to each rm uses a roduction departments A an n direct costs of thete. The firm uses a traditional cost distribution system ect costs. Production Department 4,000 20,000 o 16,000 10,000 Machine hours Direct labour hours The following information refers to the operations of the firm in January 2010. Normal Units produced and sold Direct materials unit cost Direct labour rate, Hr Direct labour hours-Dept A per unit Direct labour hours-Dept B per unit Deluxe 200 $100 $25 2 1 $50 $20 Carter Inc is considering the possibility of using an activity based cost system. The controller prepared the following information for a preliminary analysis Cost driver consumption Budgeted indirect costs Budgeted Activity Cost driver volume Deluxe Normal Material movement Machine preparation Inspections | 7,000 | # production 350 15 20 batches 400,000 | #of 588,000 | # of units 5,000 | #of 500 25 50 preparations 19,600 250 2001 50 800 100 Delivery deliveries 1,000,000 Calculate the cost per unit for each product under both costing systems

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started