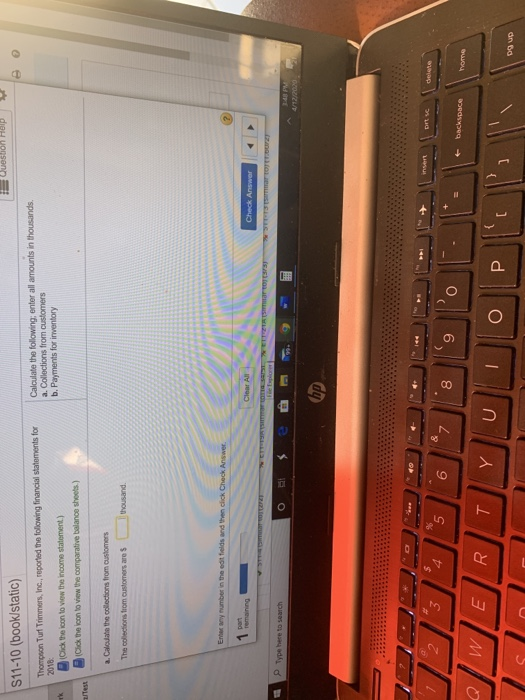

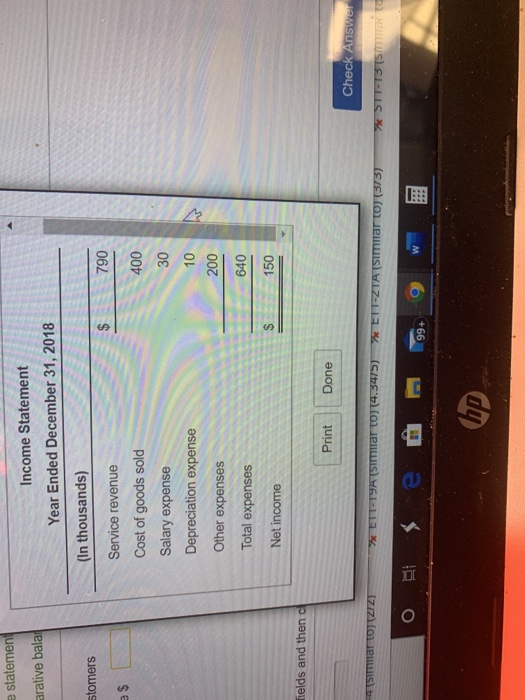

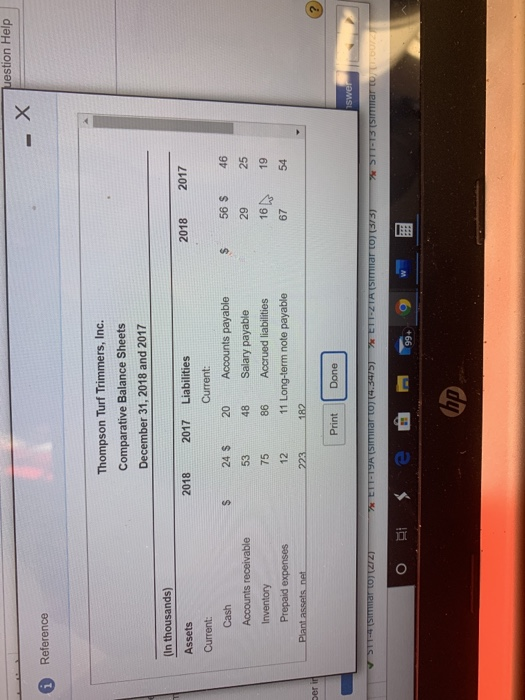

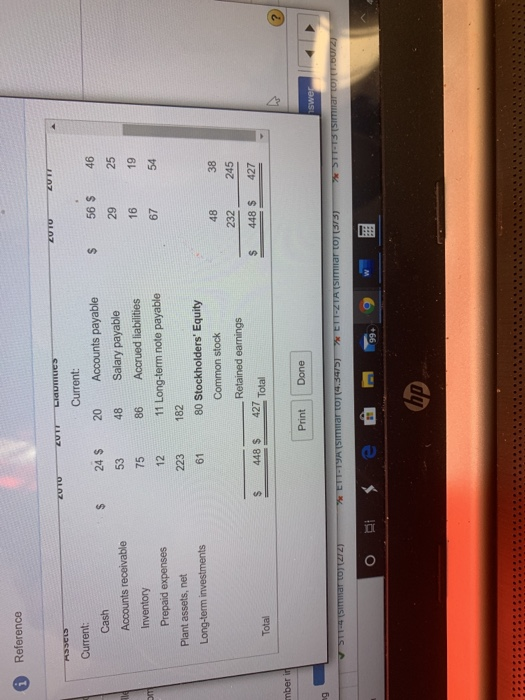

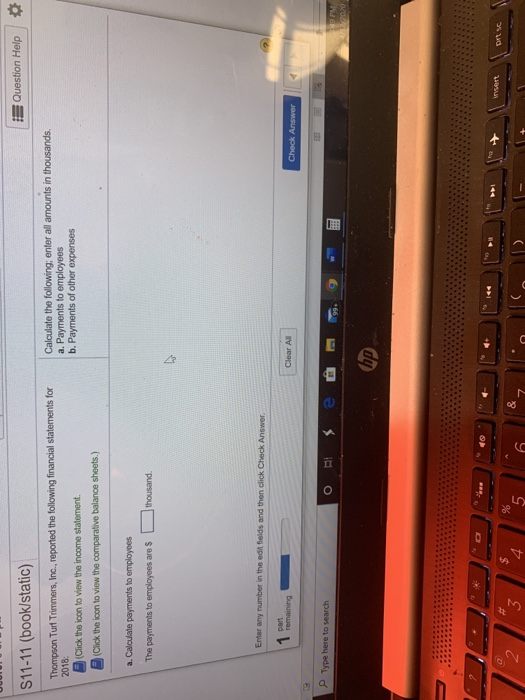

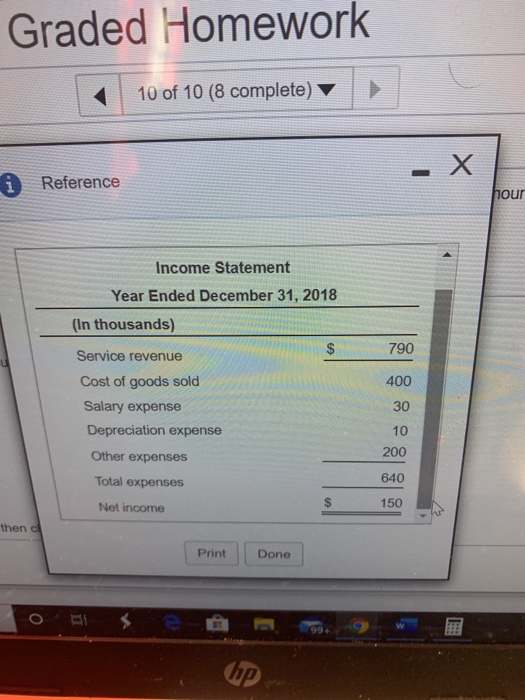

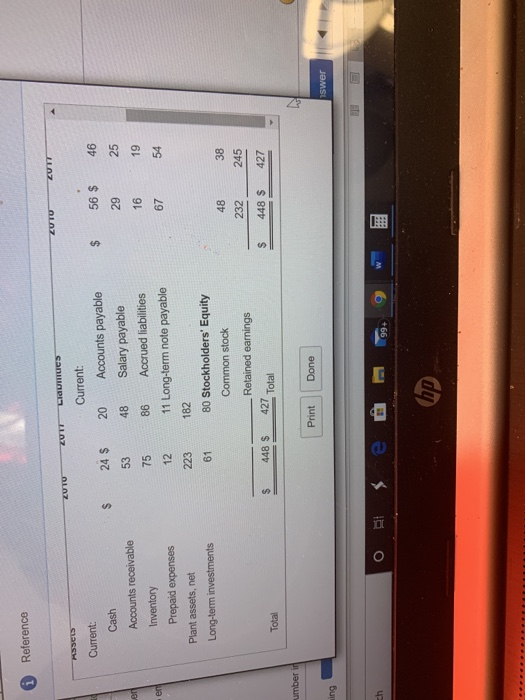

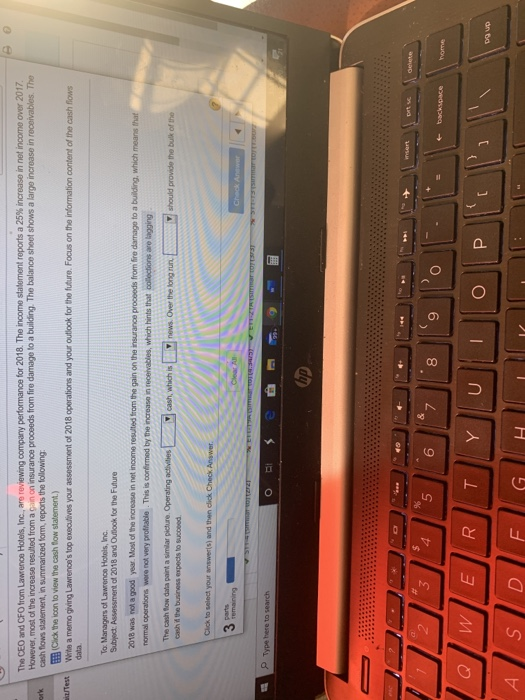

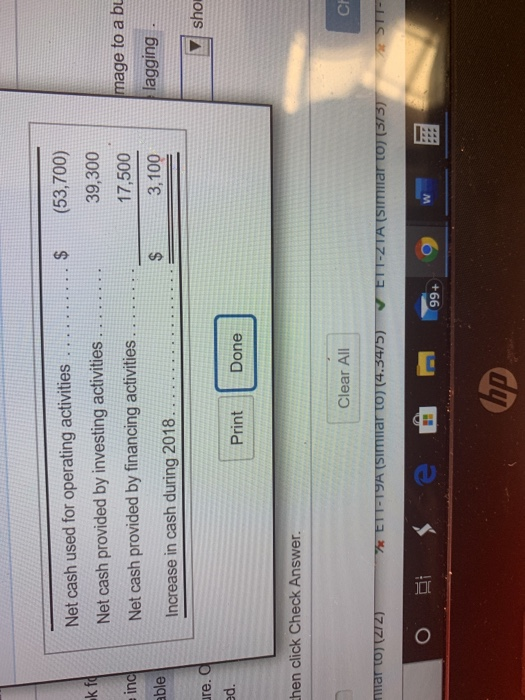

Uuestion Help S11-10 (book/static) Thompson Turf Trimmers, Inc., reported the following financial statements for 2018: Click the icon to view the income statement.) Click the loon to view the comparative balance sheets.) Calculate the following: enter all amounts in thousands a. Collections from customers b. Payments for inventory est a. Calculate the collections from customers The collections from customers are $ thousand. Erhy number in the edities and then click Check Answer romang Check Answer S TOTT Type here to search 4 PM backspace DVD statement ative bala Income Statement Year Ended December 31, 2018 (In thousands) comers 790 Service revenue Cost of goods sold Salary expense Depreciation expense 200 Other expenses Total expenses 640 150 Net income ields and then Print Done Check Answer WETT-19A (SIIar toj (4.5475) WEITZTA (SIIar to (375) STT TS TSITAT SmartOTZIZT ' ois e 99 W Reference Thompson Turf Trimmers, Inc. Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 2018 $ (In thousands) Assets Current: Cash Accounts receivable Inventory Prepaid expenses Plant assets. Det 2017 Liabilities Current: 24 $ 20 Accounts payable 48 Salary payable 75 86 Accrued liabilities 11 Long-term note payable 182 56 $ 46 29 25 1619 67 54 Print Done swer ETT TYSarto4.3475) WEITZTA TSITAT TOTS3 STTT SITT ar to A Reference ZUT ZUTU LIQUITIES HSSES $ 24 $ Current: Cash Accounts receivable Inventory Prepaid expenses Plant assets, net Long-term investments Current: 20 Accounts payable 48 Salary payable 86 Accrued liabilities 11 Long-term note payable 182 80 Stockholders' Equity Common stock _ Retained earnings 427 Total 48 232 448 $ 38 245 427 $ 448 $ $ Total mber Print Done iswe ng STT SITT OZZ E TTTY Iar to 4.3475) ETTZTA TSITAT TOT 373) STT TS TS TOTTIE o B 3 e 1999 W NEXT QUESTION Question Help S11-11 (book/static) Thompson Turf Trimmers, Inc., reported the following financial statements for 2018: (Click the icon to view the income statement (Click the icon to view the comparative balance sheets.) Calculate the following: enter all amounts in thousands. a. Payments to employees b. Payments of other expenses a. Calculate payments to employees The payments to employees are thousand. Enter any number in the edit fields and then click Check Answer. part remaining Clear All Check Answer Type here to search gw 2202 op Graded Homework 10 of 10 (8 complete) Reference pour Income Statement Year Ended December 31, 2018 (In thousands) 790 400 Service revenue Cost of goods sold Salary expense Depreciation expense Other expenses 30 10 200 Total expenses 640 Net income 150 then c Print Done of 3 e a Thompson Turf Trimmers, Inc. Comparative Balance Sheets December 31, 2018 and 2017 (In thousands) Assets Current: 2018 2018 2017 Cash $ 56 $ 46 Accounts receivable 2017 Liabilities Current: 20 Accounts payable 48 Salary payable 86 Accrued liabilities 11 Long-term note payable 182 Inventory Prepaid expenses Plant assets net 67 54 mber Print Done iswer i Reference ZUTU ZUTT LIQUITIES RSS $ 24 $ 53 Current: Cash Accounts receivable Inventory Prepaid expenses Plant assets, net Long-term investments Current: 20 Accounts payable 48 Salary payable 86 Accrued liabilities 11 Long-term note payable 182 80 Stockholders' Equity Common stock 223 38 232 245 Retained earnings 427 Total $ 448 $ $ 448 $ 427 Total umber i Print Done 1swer ing o te hp NEXT QUESTION The CEO and CFO from Lawrence Hotels, Inc., are reviewing company performance for 2018. The income statement reports a 25% increase in net income over 2017 However, most of the increase resulted from again on insurance proceeds from fire damage to a building. The balance sheet shows a large increase in receivables. The cash flows statement, in summarized form, reports the following: Click the icon to view the cash flow statement.) Wite a memo giving Lawrence's top executives your assessment of 2018 operations and your outlook for the future. Focus on the information content of the cash flows data Ten To: Managers of Lawrence Hotels, Inc. Subject: Assessment of 2018 and Outlook for the Future 2018 was not a good year. Most of the increase in net income resulted from the gain on the insurance proceeds from fire damage to a building, which means that normal operations were not very profitable. This is confirmed by the increase in receivables, which hints that collections are lagging The cash flow dalis paint a similar picture. Operating activities cash in the business expects to succeed cash, which is news. Over the long run should provide the bulk of the Click to select your answers) and then click Check Answer 3 porte Chock Anawer Type here to search OPIS /a/ WER Truliol DOUD k to Net cash used for operating activities.. Net cash provided by investing activities Net cash provided by financing activities (53,700) 39,300 17,500 3,100 mage to a bu inc able lagging. Increase in cash during 2018.. ure. shol Print Done then click Check Answer. Clear All nutar to) (ZIZ) * ETT-TYA (Simar to) (4.3475) VETT-ZTA (SIIar toJ (373) SIT- o s e M 99+ 9 w E hp