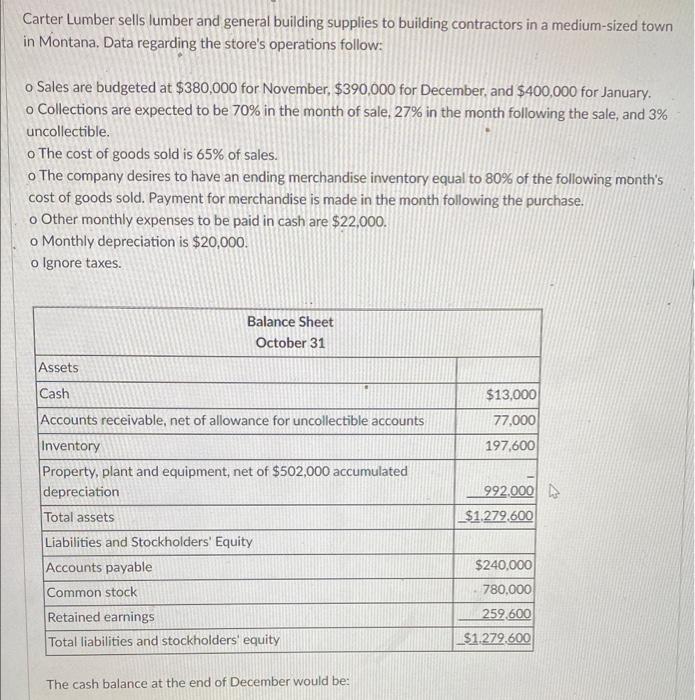

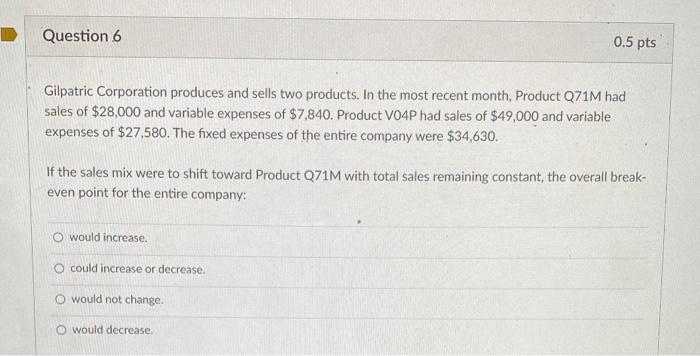

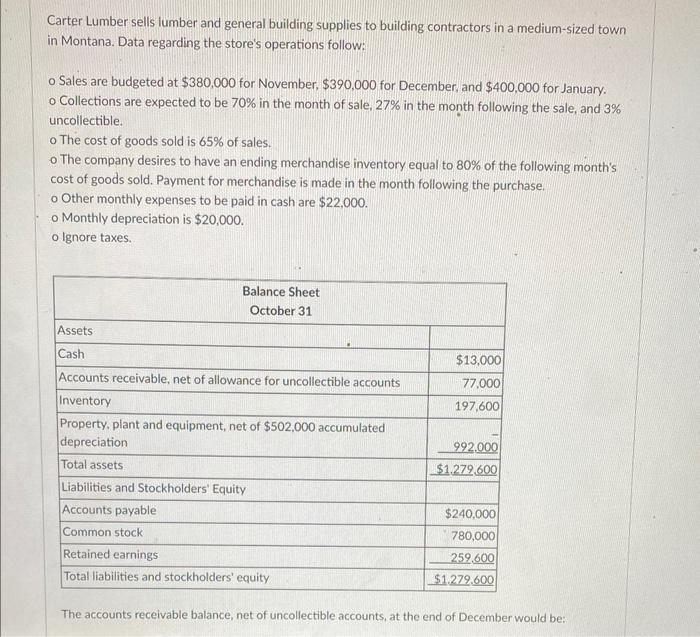

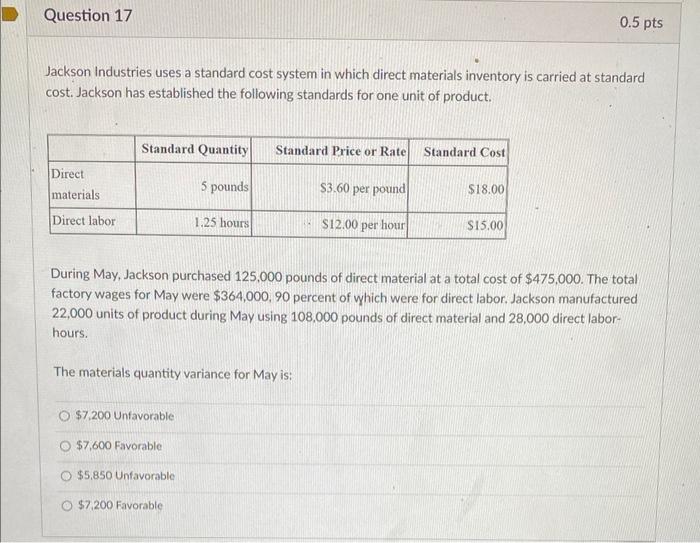

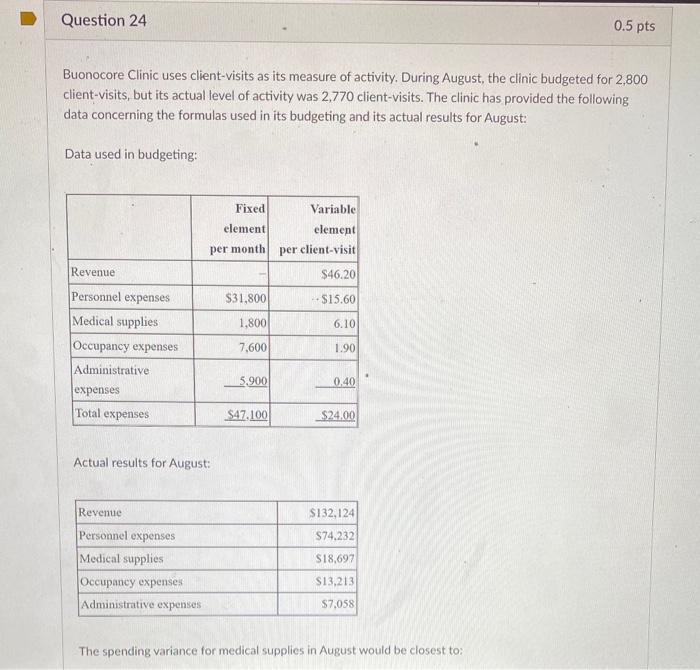

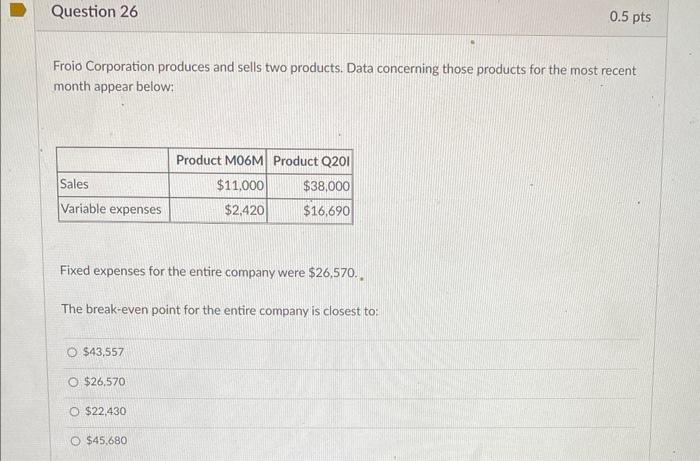

Carter Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow: - Sales are budgeted at $380,000 for November, $390,000 for December, and $400,000 for January. - Collections are expected to be 70% in the month of sale. 27% in the month following the sale, and 3% uncollectible. o The cost of goods sold is 65% of sales. o The company desires to have an ending merchandise inventory equal to 80% of the following month's cost of goods sold. Payment for merchandise is made in the month following the purchase. - Other monthly expenses to be paid in cash are $22,000. o Monthly depreciation is $20,000. o Ignore taxes. The cash balance at the end of December would be: Gilpatric Corporation produces and sells two products. In the most recent month, Product Q71M had sales of $28,000 and variable expenses of $7,840. Product V04P had sales of $49,000 and variable expenses of $27,580. The fixed expenses of the entire company were $34,630. If the sales mix were to shift toward Product Q71M with total sales remaining constant, the overall breakeven point for the entire company: would increase. could increase or decrease. would not change. would decrease. Carter Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow: - Sales are budgeted at $380,000 for November, $390,000 for December, and $400,000 for January. - Collections are expected to be 70% in the month of sale, 27% in the month following the sale, and 3% uncollectible. o The cost of goods sold is 65% of sales. o The company desires to have an ending merchandise inventory equal to 80% of the following month's cost of goods sold. Payment for merchandise is made in the month following the purchase. - Other monthly expenses to be paid in cash are $22,000. - Monthly depreciation is $20,000. o Ignore taxes. The accounts receivable balance, net of uncollectible accounts, at the end of December would be: Jackson Industries uses a standard cost system in which direct materials inventory is carried at standard cost. Jackson has established the following standards for one unit of product. During May, Jackson purchased 125,000 pounds of direct material at a total cost of $475,000. The total factory wages for May were $364,000,90 percent of which were for direct labor. Jackson manufactured 22,000 units of product during May using 108,000 pounds of direct material and 28,000 direct laborhours. The materials quantity variance for May is: $7,200 Unfavorable $7,600 Favorable $5,850 Unfavorable $7,200 Favorable Buonocore Clinic uses client-visits as its measure of activity. During August, the clinic budgeted for 2,800 client-visits, but its actual level of activity was 2,770 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for August: Data used in budgeting: Actual results for August: The spending variance for medical supplies in August would be closest to: Froio Corporation produces and sells two products. Data concerning those products for the most recent month appear below: Fixed expenses for the entire company were $26,570. The break-even point for the entire company is closest to: $43,557 $26,570 $22,430 $45,680