Answered step by step

Verified Expert Solution

Question

1 Approved Answer

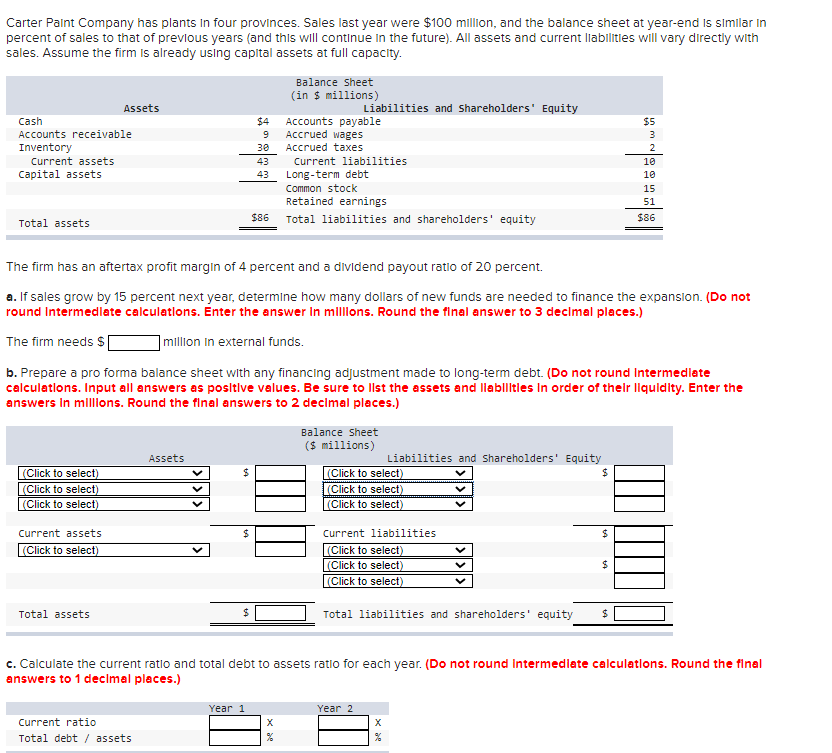

Carter Paint Company has plants in four provinces. Sales last year were $ 1 0 0 million, and the balance sheet at year - end

Carter Paint Company has plants in four provinces. Sales last year were $ million, and the balance sheet at yearend is similar in

percent of sales to that of previous years and this will continue in the future All assets and current llabilitles will vary directly with

sales. Assume the firm is already using capital assets at full capacity.

The firm has an aftertax profit margin of percent and a dividend payout ratio of percent.

a If sales grow by percent next year, determine how many dollars of new funds are needed to finance the expansion. Do not

round Intermedlate calculatlons. Enter the answer In millions. Round the final answer to decimal places.

The firm needs $ million In external funds.

b Prepare a pro forma balance sheet with any financing adjustment made to longterm debt. Do not round Intermedlate

calculations. Input all answers as positive values. Be sure to list the assets and llablities In order of thelr llquidity. Enter the

answers in millions. Round the final answers to decimal places.

c Calculate the current ratio and total debt to assets ratio for each year. Do not round Intermedlate calculatlons. Round the final

answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started