Question

CASE 1: Background Information Hillsburgh Hardware Company is a medium-sized corporation, with its headquarters located in Detroit, Michigan. The company is made up of three

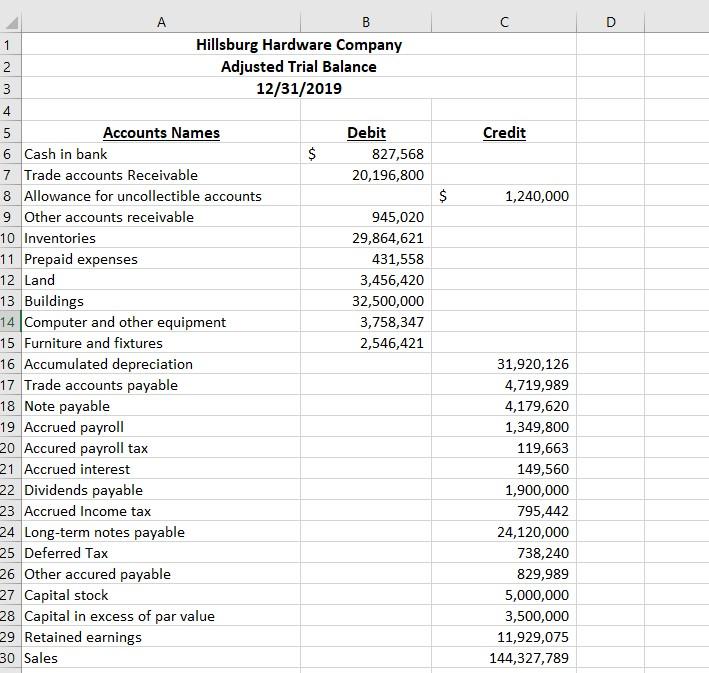

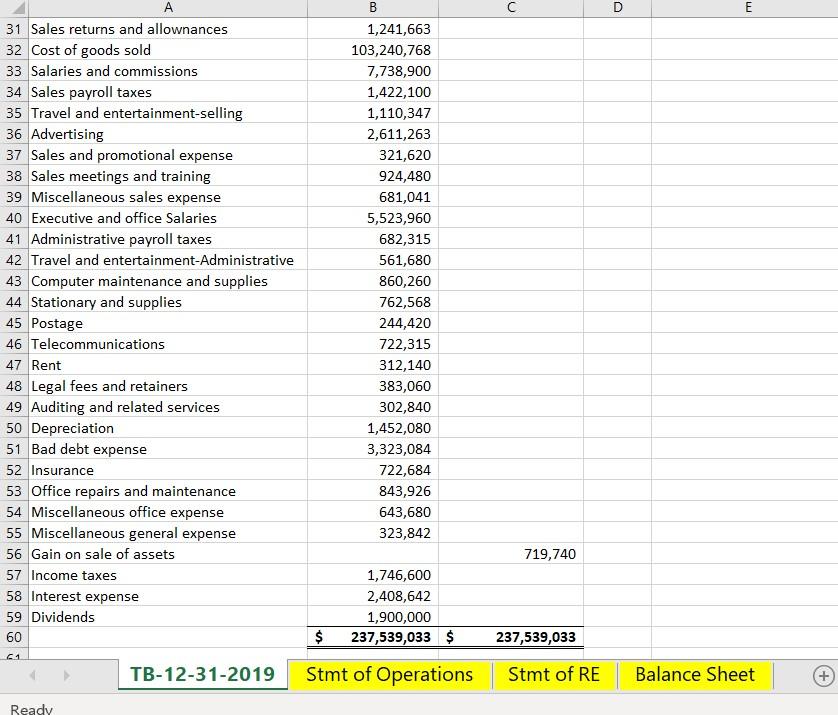

CASE 1: Background Information Hillsburgh Hardware Company is a medium-sized corporation, with its headquarters located in Detroit, Michigan. The company is made up of three divisions. In the attached excel file, the adjusted trial balance for Hillsburgh Hardware as of December 31, 2019, is listed. Based upon the adjusted trial balance provided here, generate the Multiple-Step Income Statment, Statement of Retained Earnings, and Balance Sheet for the year ended December 31, 2019. Notes: 1. The given retained earning account in the trial balance only represents the beginning balance of the year. 2. Create your Statement in the separate tab of the excel file, and upload the completed work to the submission dropbox.

(PLEASE REFER BELOW EXCEL IMAGES AND TABS ARE BLANK BUT NEED TO BE FILLED)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started