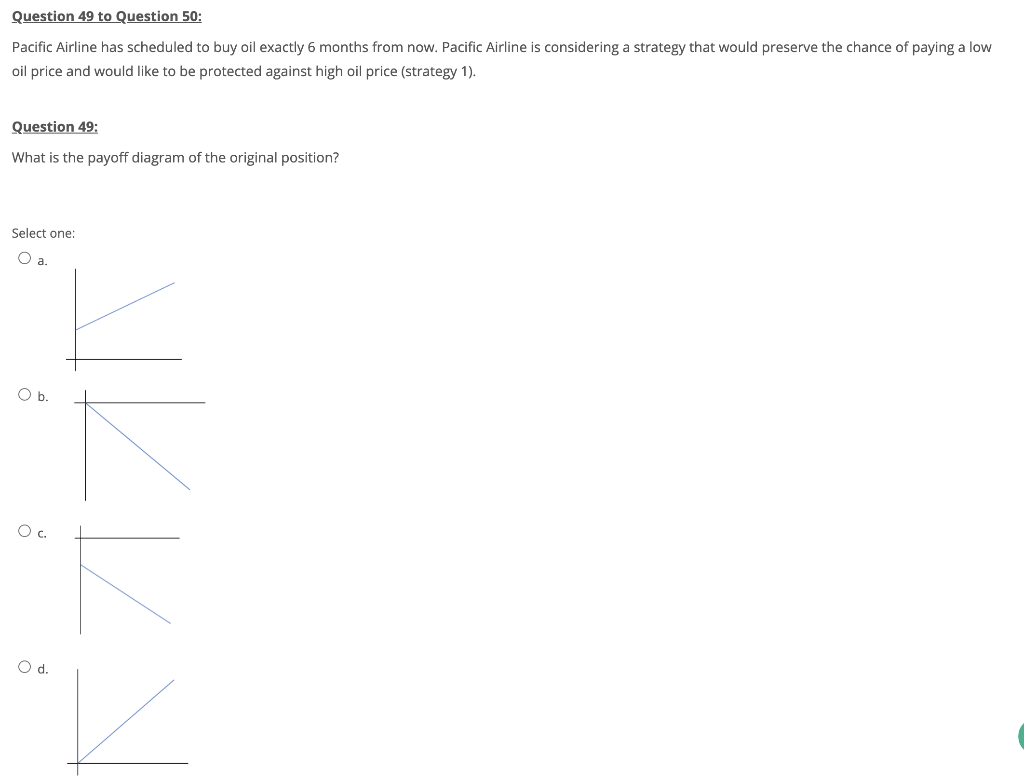

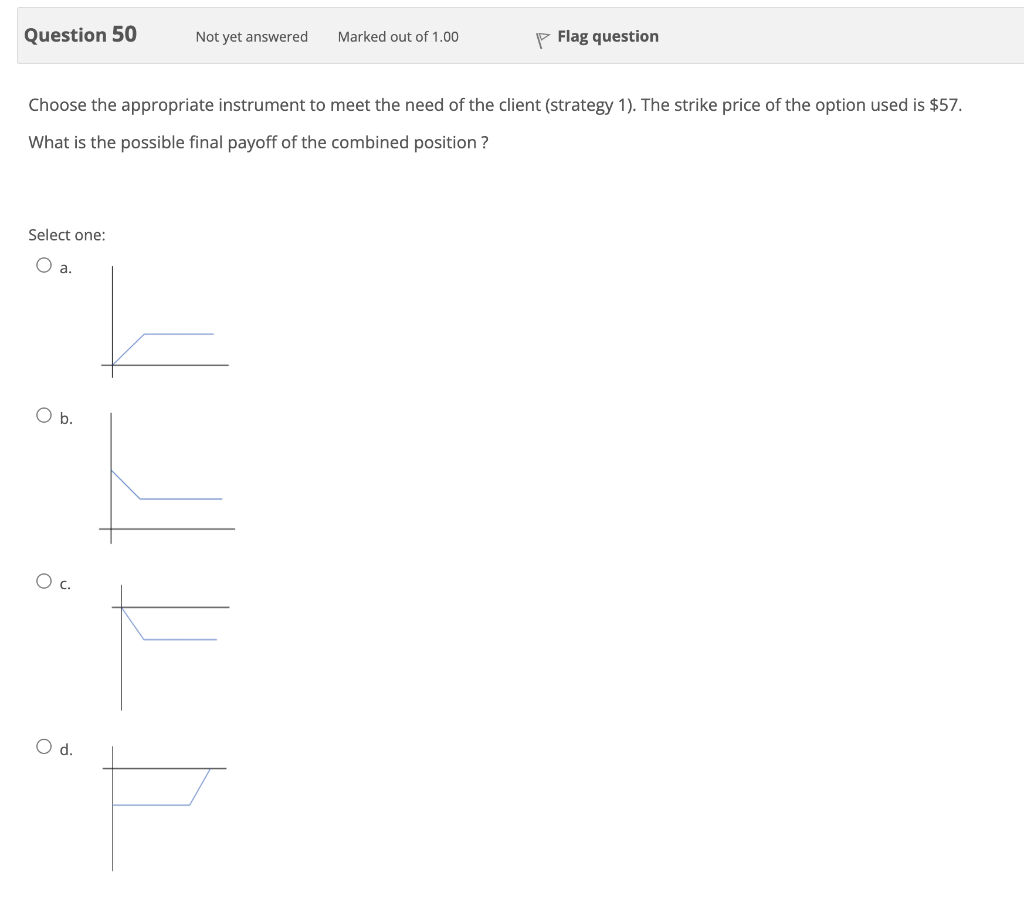

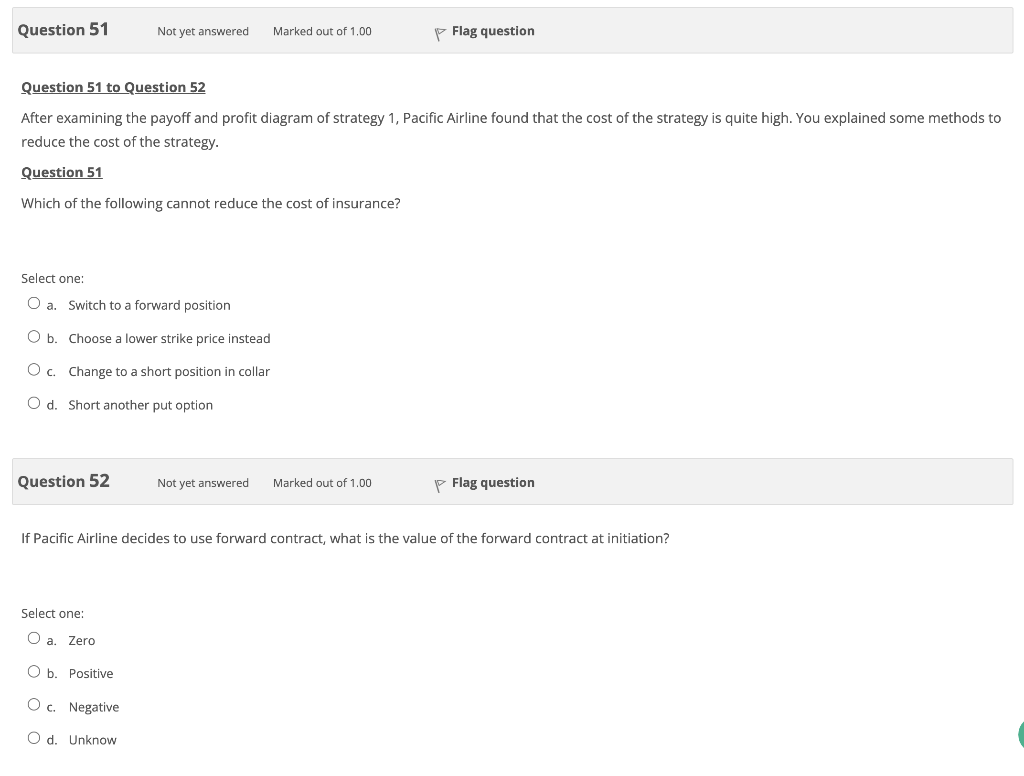

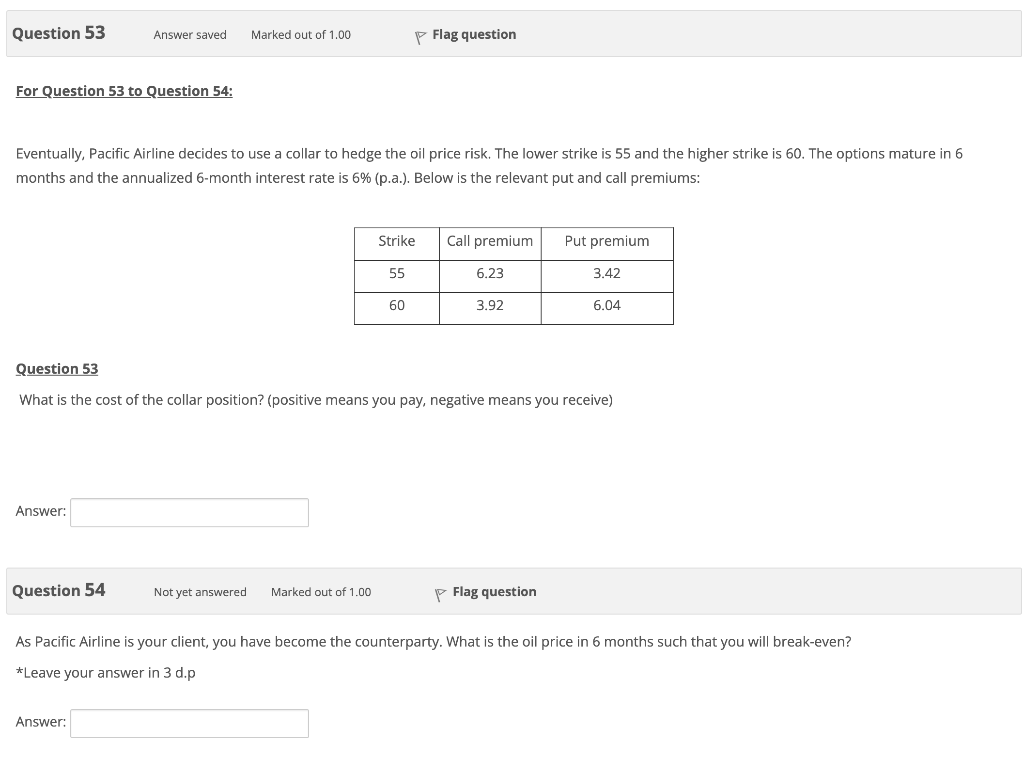

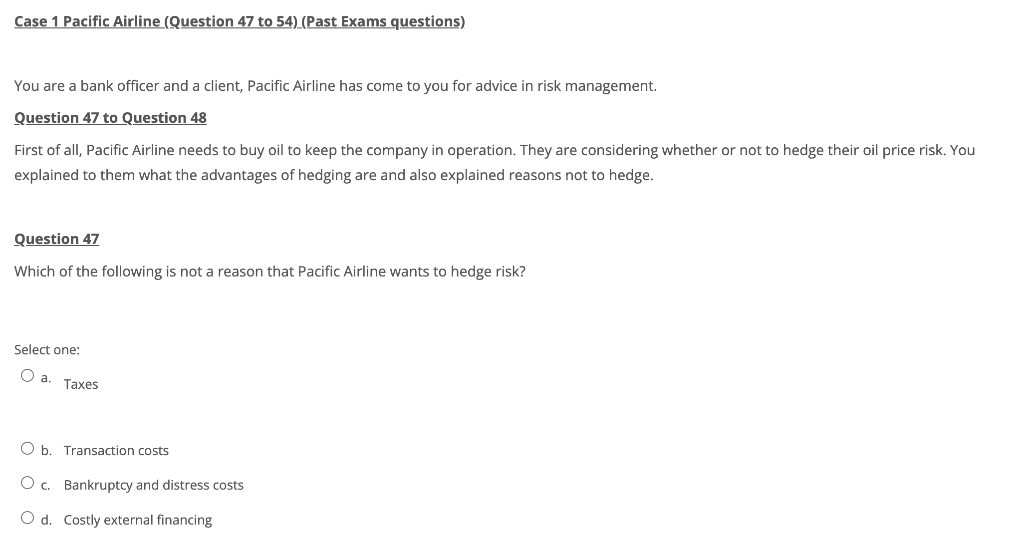

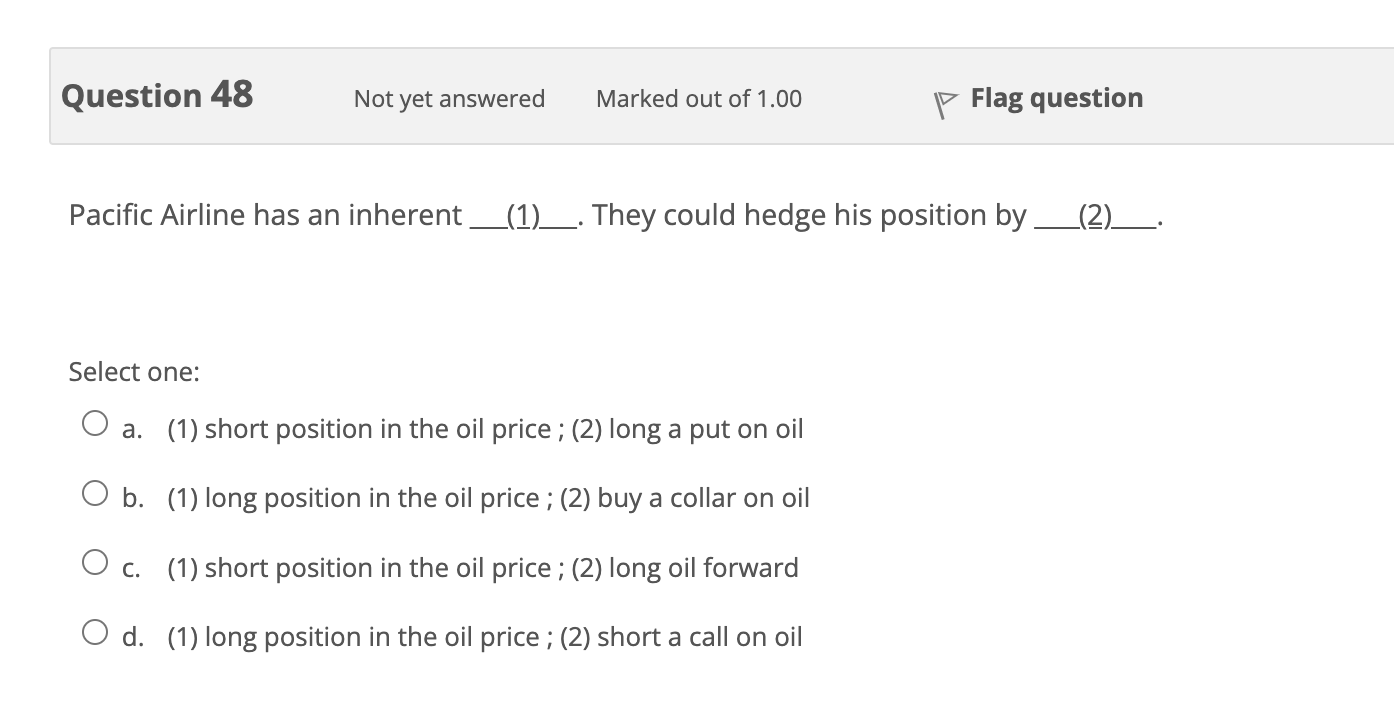

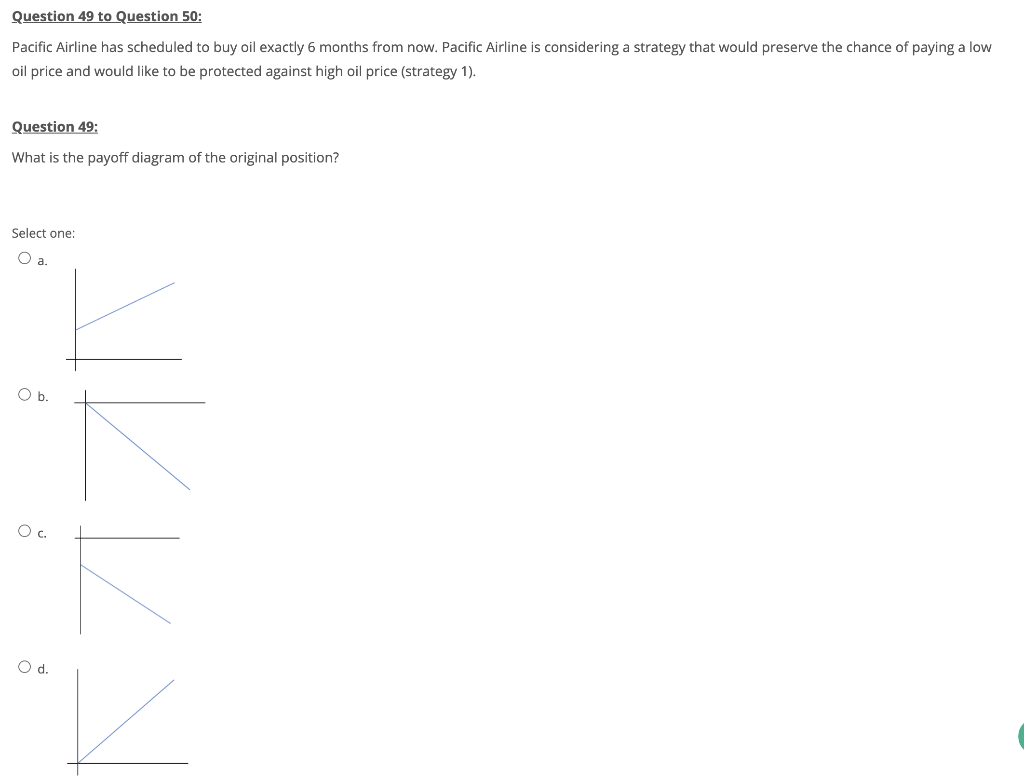

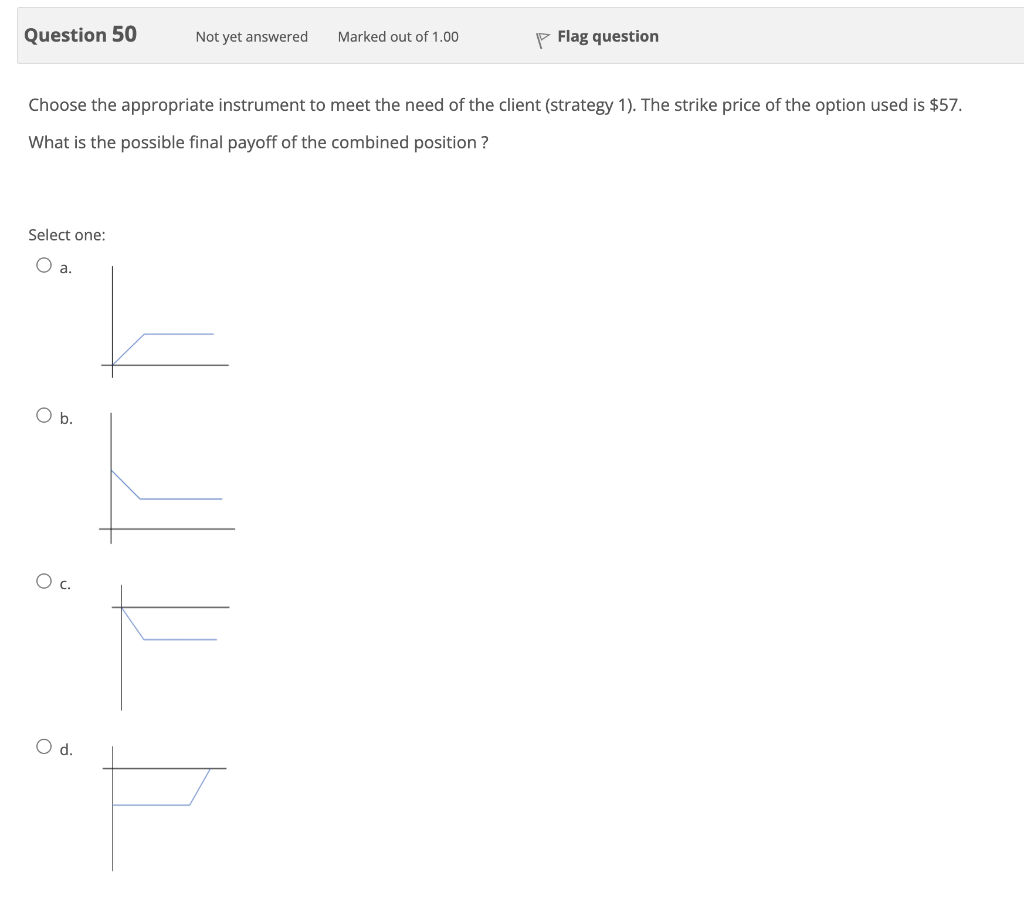

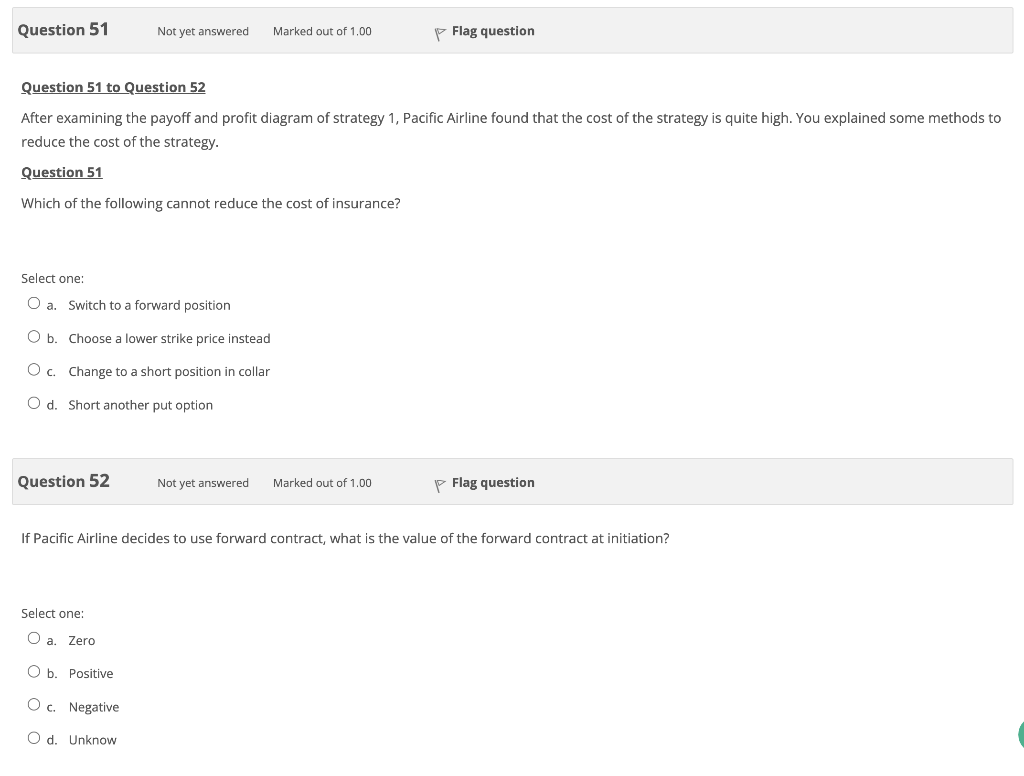

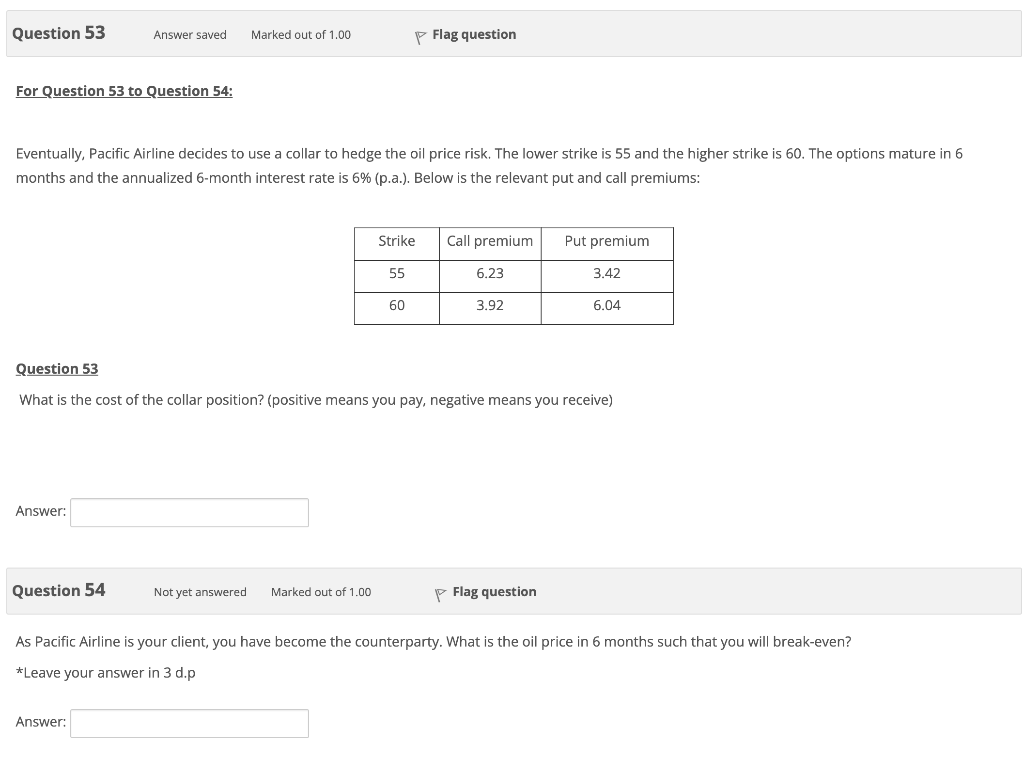

Case 1 Pacific Airline (Question 47 to 54).(Past Exams questions) You are a bank officer and a client, Pacific Airline has come to you for advice in risk management. Question 47 to Question 48 First of all, Pacific Airline needs to buy oil to keep the company in operation. They are considering whether or not to hedge their oil price risk. You explained to them what the advantages of hedging are and also explained reasons not to hedge. Question 47 Which of the following is not a reason that Pacific Airline wants to hedge risk? Select one: O a. Taxes Ob. Transaction costs Oc. Bankruptcy and distress costs O d. Costly external financing Question 48 Not yet answered Marked out of 1.00 P Flag question Pacific Airline has an inherent (1)__. They could hedge his position by (2). Select one: a. (1) short position in the oil price; (2) long a put on oil O b. (1) long position in the oil price ; (2) buy a collar on oil O c. (1) short position in the oil price ; (2) long oil forward i O d. (1) long position in the oil price ; (2) short a call on oil Question 49 to Question 50: Pacific Airline has scheduled to buy oil exactly 6 months from now. Pacific Airline is considering a strategy that would preserve the chance of paying a low oil price and would like to be protected against high oil price (strategy 1). Question 49: What is the payoff diagram of the original position? Select one: O a. ob. Oc. O d. Question 50 Not yet answered Marked out of 1.00 Flag question Choose the appropriate instrument to meet the need of the client (strategy 1). The strike price of the option used is $57. What is the possible final payoff of the combined position ? Select one: O a. O b. Oc. O d. Question 51 Not yet answered Marked out of 1,00 Flag question Question 51 to Question 52 After examining the payoff and profit diagram of strategy 1, Pacific Airline found that the cost of the strategy is quite high. You explained some methods to reduce the cost of the strategy. Question 51 Which of the following cannot reduce the cost of insurance? Select one: O a. Switch to a forward position O b. Choose a lower strike price instead Oc Change to a short position in collar O d. Short another put option Question 52 Not yet answered Marked out of 1.00 P Flag question If Pacific Airline decides to use forward contract, what is the value of the forward contract at initiation? Select one: O a. Zero O b. Positive Oc. Negative O d. Unknow Question 53 Answer saved Marked out of 1.00 Flag question For Question 53 to Question 54: Eventually, Pacific Airline decides to use a collar to hedge the oil price risk. The lower strike is 55 and the higher strike is 60. The options mature in 6 months and the annualized 6-month interest rate is 6% (p.a.). Below is the relevant put and call premiums: Strike Call premium Put premium 55 6.23 3.42 60 3.92 6.04 Question 53 What is the cost of the collar position? (positive means you pay, negative means you receive) Answer: Question 54 Not yet answered Marked out of 1.00 p Flag question As Pacific Airline is your client, you have become the counterparty. What is the oil price in 6 months such that you will break-even? *Leave your answer in 3 d.p Answer: Case 1 Pacific Airline (Question 47 to 54).(Past Exams questions) You are a bank officer and a client, Pacific Airline has come to you for advice in risk management. Question 47 to Question 48 First of all, Pacific Airline needs to buy oil to keep the company in operation. They are considering whether or not to hedge their oil price risk. You explained to them what the advantages of hedging are and also explained reasons not to hedge. Question 47 Which of the following is not a reason that Pacific Airline wants to hedge risk? Select one: O a. Taxes Ob. Transaction costs Oc. Bankruptcy and distress costs O d. Costly external financing Question 48 Not yet answered Marked out of 1.00 P Flag question Pacific Airline has an inherent (1)__. They could hedge his position by (2). Select one: a. (1) short position in the oil price; (2) long a put on oil O b. (1) long position in the oil price ; (2) buy a collar on oil O c. (1) short position in the oil price ; (2) long oil forward i O d. (1) long position in the oil price ; (2) short a call on oil Question 49 to Question 50: Pacific Airline has scheduled to buy oil exactly 6 months from now. Pacific Airline is considering a strategy that would preserve the chance of paying a low oil price and would like to be protected against high oil price (strategy 1). Question 49: What is the payoff diagram of the original position? Select one: O a. ob. Oc. O d. Question 50 Not yet answered Marked out of 1.00 Flag question Choose the appropriate instrument to meet the need of the client (strategy 1). The strike price of the option used is $57. What is the possible final payoff of the combined position ? Select one: O a. O b. Oc. O d. Question 51 Not yet answered Marked out of 1,00 Flag question Question 51 to Question 52 After examining the payoff and profit diagram of strategy 1, Pacific Airline found that the cost of the strategy is quite high. You explained some methods to reduce the cost of the strategy. Question 51 Which of the following cannot reduce the cost of insurance? Select one: O a. Switch to a forward position O b. Choose a lower strike price instead Oc Change to a short position in collar O d. Short another put option Question 52 Not yet answered Marked out of 1.00 P Flag question If Pacific Airline decides to use forward contract, what is the value of the forward contract at initiation? Select one: O a. Zero O b. Positive Oc. Negative O d. Unknow Question 53 Answer saved Marked out of 1.00 Flag question For Question 53 to Question 54: Eventually, Pacific Airline decides to use a collar to hedge the oil price risk. The lower strike is 55 and the higher strike is 60. The options mature in 6 months and the annualized 6-month interest rate is 6% (p.a.). Below is the relevant put and call premiums: Strike Call premium Put premium 55 6.23 3.42 60 3.92 6.04 Question 53 What is the cost of the collar position? (positive means you pay, negative means you receive) Answer: Question 54 Not yet answered Marked out of 1.00 p Flag question As Pacific Airline is your client, you have become the counterparty. What is the oil price in 6 months such that you will break-even? *Leave your answer in 3 d.p