Answered step by step

Verified Expert Solution

Question

1 Approved Answer

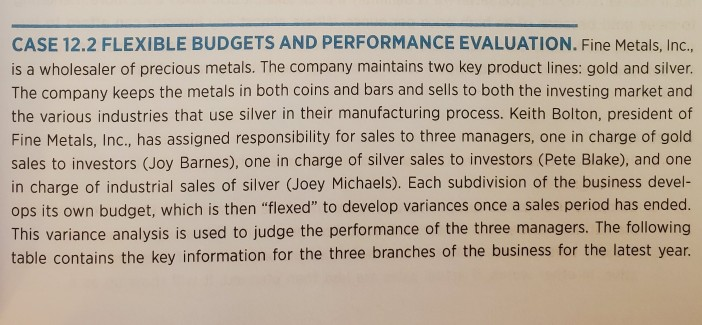

CASE 12.2 FLEXIBLE BUDGETS AND PERFORMANCE EVALUATION. Fine Metals, Inc., is a wholesaler of precious metals. The company maintains two key product lines: gold and

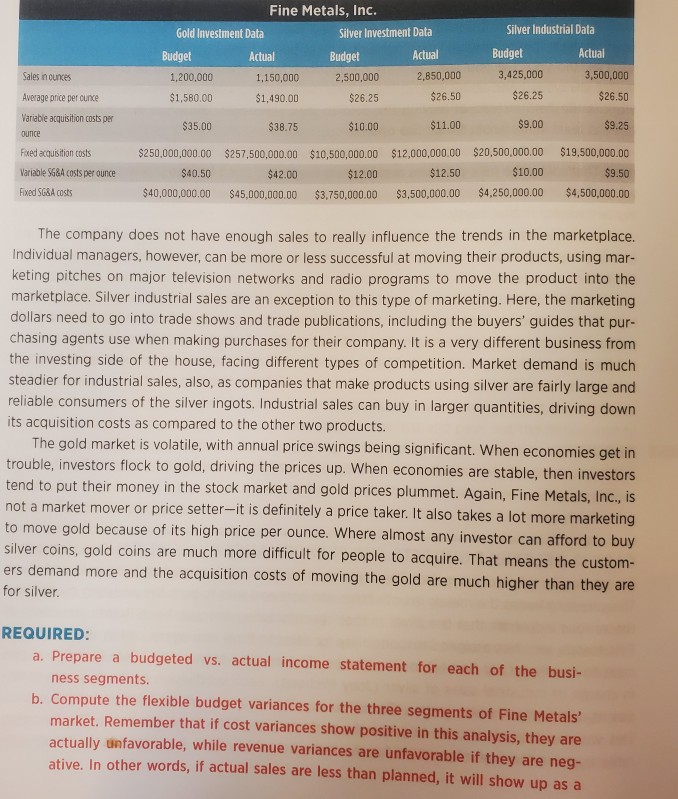

CASE 12.2 FLEXIBLE BUDGETS AND PERFORMANCE EVALUATION. Fine Metals, Inc., is a wholesaler of precious metals. The company maintains two key product lines: gold and silver. The company keeps the metals in both coins and bars and sells to both the investing market and the various industries that use silver in their manufacturing process. Keith Bolton, president of Fine Metals, Inc., has assigned responsibility for sales to three managers, one in charge of gold sales to investors (Joy Barnes), one in charge of silver sales to investors (Pete Blake), and one in charge of industrial sales of silver (Joey Michaels). Each subdivision of the business devel- ops its own budget, which is then "flexed" to develop variances once a sales period has ended. This variance analysis is used to judge the performance of the three managers. The following table contains the key information for the three branches of the business for the latest year. Fine Metals, Inc. Gold Investment Data Silver Investment Data Budget A ctual Budget Actual 1,200,000 1,150,000 2,500,000 2,850,000 $1,500.00 $1,490.00 $26.25 $26.50 Silver Industrial Data Budget Actual 3,425,000 3,500,000 $26.25 $26.50 Sales in ounces $35.00 $38.75 $10.00 $11.00 $9.00 $9.25 Average price per cunce Variable acquisition costs per ounce Fixed acquisition costs Variable SG&A costs per ounce $250,000,000.00 $40.50 $40,000,000.00 $257,500,000.00 $42.00 $45,000,000.00 $10,500,000.00 $12.00 $3,750,000.00 $12,000,000.00 $20,500,000.00 $12.50 $10.00 $3,500,000.00 $4,250,000.00 $19,500,000.00 $9.50 $4,500,000.00 Fixed SG&A costs The company does not have enough sales to really influence the trends in the marketplace. Individual managers, however, can be more or less successful at moving their products, using mar- keting pitches on major television networks and radio programs to move the product into the marketplace. Silver industrial sales are an exception to this type of marketing. Here, the marketing dollars need to go into trade shows and trade publications, including the buyers' guides that pur- chasing agents use when making purchases for their company. It is a very different business from the investing side of the house, facing different types of competition. Market demand is much steadier for industrial sales, also, as companies that make products using silver are fairly large and reliable consumers of the silver ingots. Industrial sales can buy in larger quantities, driving down its acquisition costs as compared to the other two products. The gold market is volatile, with annual price swings being significant. When economies get in trouble, investors flock to gold, driving the prices up. When economies are stable, then investors tend to put their money in the stock market and gold prices plummet. Again, Fine Metals, Inc., is not a market mover or price setter-it is definitely a price taker. It also takes a lot more marketing to move gold because of its high price per ounce. Where almost any investor can afford to buy silver coins, gold coins are much more difficult for people to acquire. That means the custom- ers demand more and the acquisition costs of moving the gold are much higher than they are for silver. REQUIRED: a. Prepare a budgeted vs. actual income statement for each of the busi- ness segments. b. Compute the flexible budget variances for the three segments of Fine Metals market. Remember that if cost variances show positive in this analysis, they are actually unfavorable, while revenue variances are unfavorable if they are neg- ative. In other words, if actual sales are less than planned, it will show up as a negative which makes sense as less sales is not good (unfavorable). If actual costs are lower than plan, this will also show up as a negative, but is actually a favorable outcome. C. Which set of numbers do you feel is a better indicator of segment performance? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started