Answered step by step

Verified Expert Solution

Question

1 Approved Answer

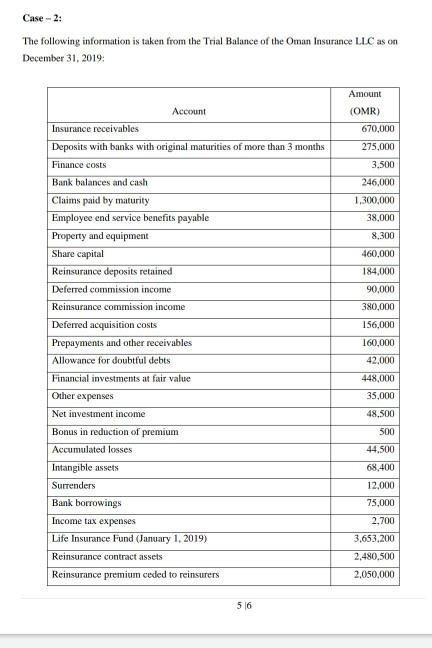

Case -2: The following information is taken from the Trial Balance of the Oman Insurance LLC as on December 31, 2019: Amount Account (OMR) 670,000

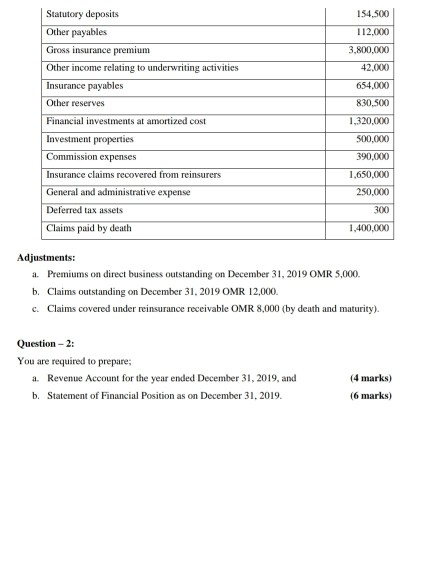

Case -2: The following information is taken from the Trial Balance of the Oman Insurance LLC as on December 31, 2019: Amount Account (OMR) 670,000 275,000 3.500 246,000 1,300,000 38,000 8,300 460,000 184,000 90,000 380,000 156,000 Insurance receivables Deposits with banks with original maturities of more than 3 months Finance costs Bank balances and cash Claims paid by maturity Employee end service benefits payable Property and equipment Share capital Reinsurance deposits retained Deferred commission income Reinsurance commission income Deferred acquisition costs Prepayments and other receivables Allowance for doubtful debts Financial investments at fair value Other expenses Net investment income Bonus in reduction of premium Accumulated losses Intangible assets Surrenders Bank borrowings Income tax expenses Life Insurance Fund (January 1, 2019) Reinsurance contract assets Reinsurance premium ceded to reinsurers 160,000 42,000 448,000 35,000 48,500 500 44,500 68,400 12,000 75,000 2,700 3.653,200 2,480,500 2,050,000 516 154.500 112.000 3,800.000 42.000 654,0XX) Statutory deposits Other payables Gross insurance premium Other income relating to underwriting activities Insurance payables Other reserves Financial investments at amortized cost Investment properties Commission expenses Insurance claims recovered from reinsurers General and administrative expense Deferred tax assets Claims paid by death 830.500 1,320,000 500.000 390.0XXO 1.650.000 250.000 300 1,400,000 Adjustments: a. Premiums on direct business outstanding on December 31, 2019 OMR 5,000. b. Claims outstanding on December 31, 2019 OMR 12,000 c. Claims covered under reinsurance receivable OMR 8,000 (by death and maturity). Question - 2: You are required to prepare a. Revenue Account for the year ended December 31, 2019, and b. Statement of Financial Position as on December 31, 2019. (4 marks) (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started