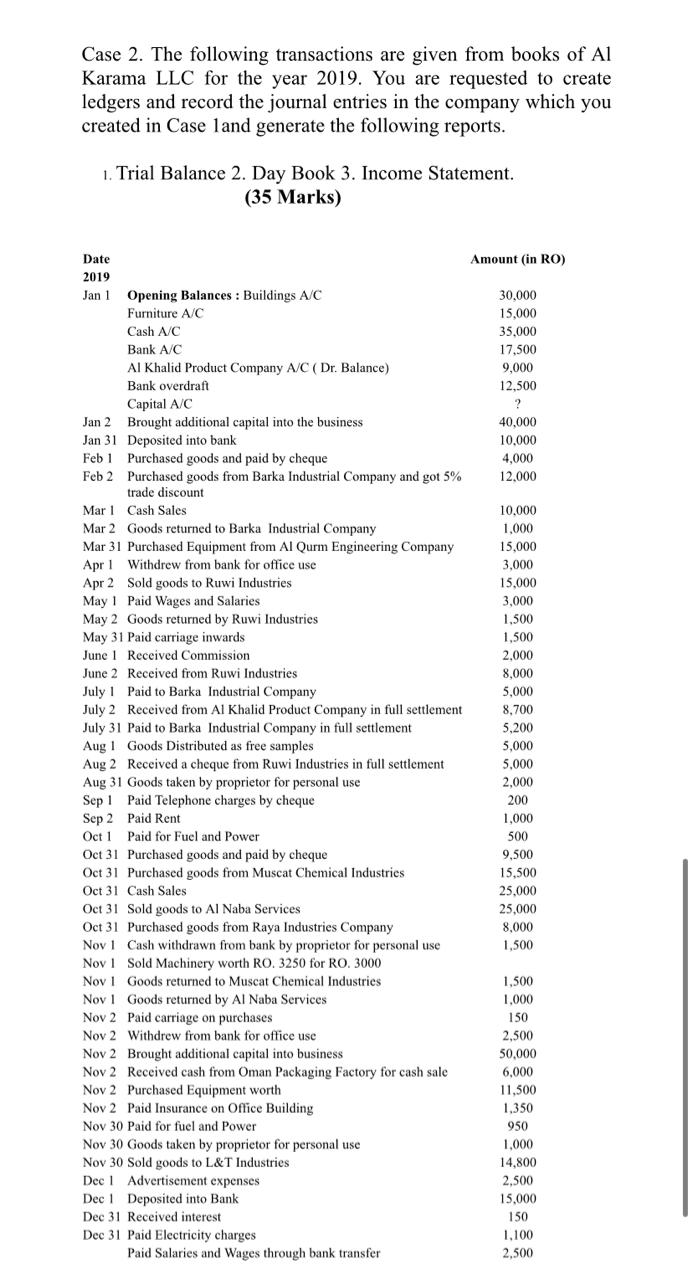

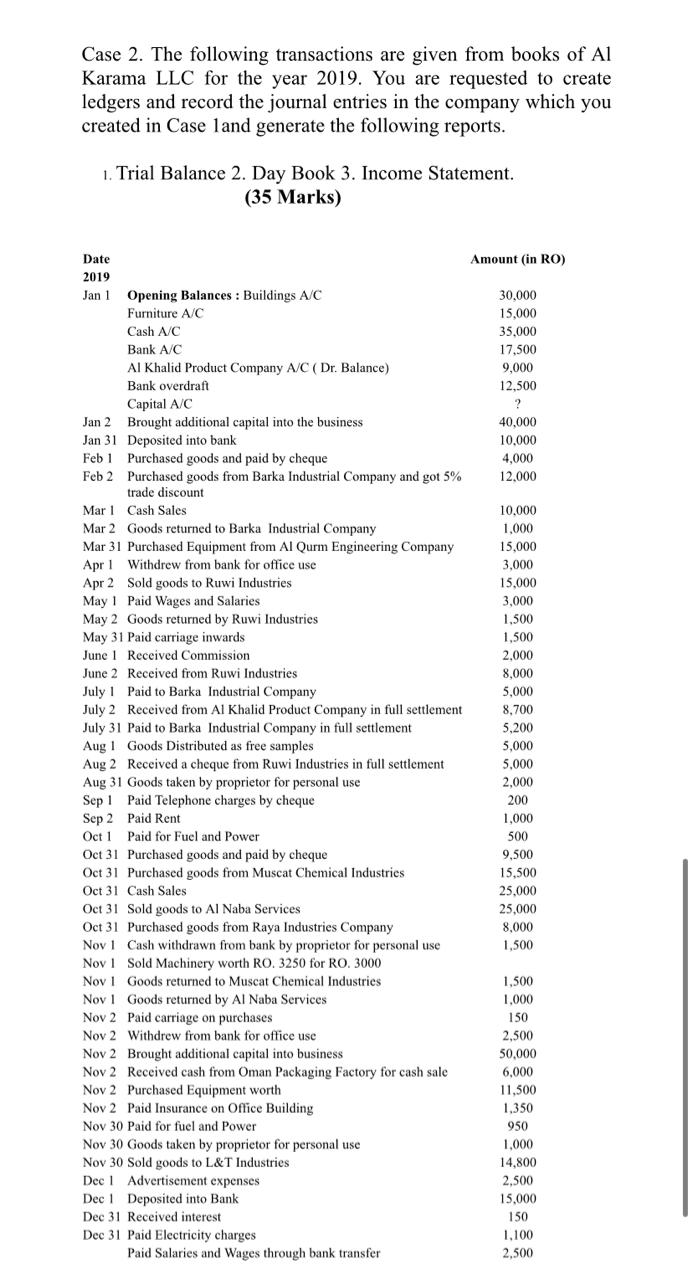

Case 2. The following transactions are given from books of Al Karama LLC for the year 2019. You are requested to create ledgers and record the journal entries in the company which you created in Case land generate the following reports. 1. Trial Balance 2. Day Book 3. Income Statement. (35 Marks) 3,000 Date Amount (in RO) 2019 Jan 1 Opening Balances : Buildings A/C 30,000 Furniture A/C 15,000 Cash A/C 35,000 Bank A/C 17,500 Al Khalid Product Company A/C (Dr. Balance) 9,000 Bank overdraft 12,500 Capital A/C ? Jan 2 Brought additional capital into the business 40,000 Jan 31 Deposited into bank 10.000 Feb 1 Purchased goods and paid by cheque 4,000 Feb 2 Purchased goods from Barka Industrial Company and got 5% 12.000 trade discount Mar 1 Cash Sales 10,000 Mar 2 Goods returned to Barka Industrial Company 1.000 Mar 31 Purchased Equipment from Al Qurm Engineering Company 15.000 Apr ! Withdrew from bank for office use Apr 2 Sold goods to Ruwi Industries 15.000 May 1 Paid Wages and Salaries 3.000 May 2 Goods returned by Ruwi Industries 1,500 May 31 Paid carriage inwards 1,500 June 1 Received Commission 2.000 June 2 Received from Ruwi Industries 8,000 July 1 Paid to Barka Industrial Company 5.000 July 2 Received from Al Khalid Product Company in full settlement 8,700 July 31 Paid to Barka Industrial Company in full settlement 5.200 Aug 1 Goods Distributed as free samples 5,000 Aug 2 Received a cheque from Ruwi Industries in full settlement 5.000 Aug 31 Goods taken by proprietor for personal use 2,000 Sep 1 Paid Telephone charges by cheque 200 Sep 2 Paid Rent 1.000 Oct 1 Paid for Fuel and Power 500 Oct 31 Purchased goods and paid by cheque 9,500 Oct 31 Purchased goods from Muscat Chemical Industries 15,500 Oct 31 Cash Sales 25.000 Oct 31 Sold goods to Al Naba Services 25,000 Oct 31 Purchased goods from Raya Industries Company 8,000 Nov 1 Cash withdrawn from bank by proprietor for personal use Nov 1 Sold Machinery worth RO. 3250 for RO. 3000 Nov 1 Goods returned to Muscat Chemical Industries 1,500 Nov 1 Goods returned by Al Naba Services 1.000 Nov 2 Paid carriage on purchases 150 Nov 2 Withdrew from bank for office use 2,500 Nov 2 Brought additional capital into business 50.000 Nov 2 Received cash from Oman Packaging Factory for cash sale 6,000 Nov 2 Purchased Equipment worth 11,500 Nov 2 Paid Insurance on Office Building 1.350 Nov 30 Paid for fuel and Power 950 Nov 30 Goods taken by proprietor for personal use 1.000 Nov 30 Sold goods to L&T Industries 14,800 Dec ! Advertisement expenses 2.500 Dec 1 Deposited into Bank 15.000 Dec 31 Received interest 150 Dec 31 Paid Electricity charges 1.100 Paid Salaries and Wages through bank transfer 2,500 1,500