Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 2: Trade orders Margo Salan, a portfolio manager at ADIA Investment Company in Europe, would like to buy 40,000 shares of alpha stock, which

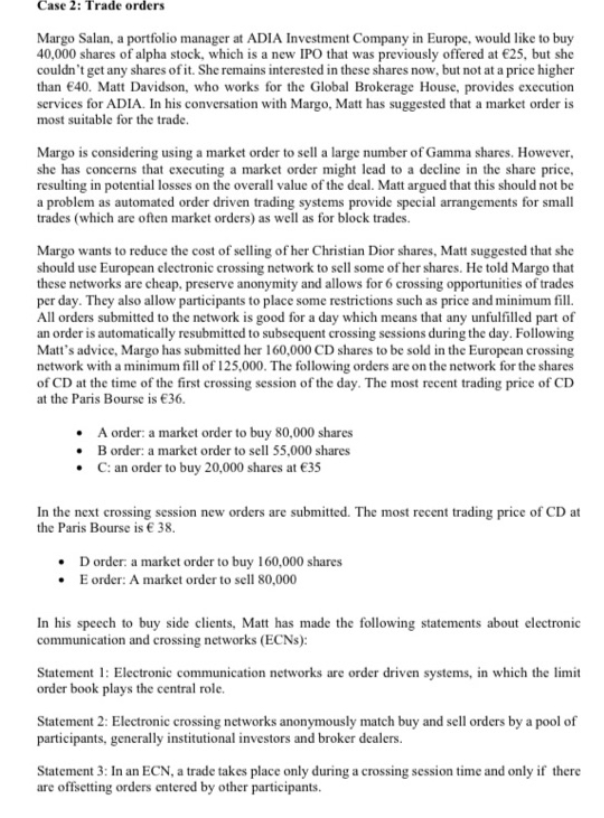

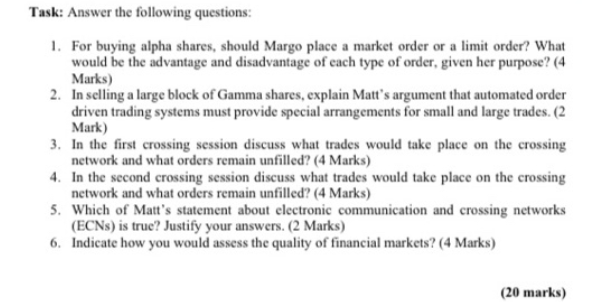

Case 2: Trade orders Margo Salan, a portfolio manager at ADIA Investment Company in Europe, would like to buy 40,000 shares of alpha stock, which is a new IPO that was previously offered at 25, but she couldn't get any shares of it. She remains interested in these shares now, but not at a price higher than 40. Matt Davidson, who works for the Global Brokerage House, provides execution services for ADIA. In his conversation with Margo, Matt has suggested that a market order is most suitable for the trade. Margo is considering using a market order to sell a large number of Gamma shares. However, she has concerns that executing a market order might lead to a decline in the share price, resulting in potential losses on the overall value of the deal. Matt argued that this should not be a problem as automated order driven trading systems provide special arrangements for small trades (which are often market orders) as well as for block trades. Margo wants to reduce the cost of selling of her Christian Dior shares, Matt suggested that she should use European electronic crossing network to sell some of her shares. He told Margo that these networks are cheap, preserve anonymity and allows for 6 crossing opportunities of trades per day. They also allow participants to place some restrictions such as price and minimum fill. All orders submitted to the network is good for a day which means that any unfulfilled part of an order is automatically resubmitted to subsequent crossing sessions during the day. Following Matt's advice, Margo has submitted her 160,000 CD shares to be sold in the European crossing network with a minimum fill of 125,000 . The following orders are on the network for the shares of CD at the time of the first crossing session of the day. The most recent trading price of CD at the Paris Bourse is 36. - A order: a market order to buy 80,000 shares - B order: a market order to sell 55,000 shares - C: an order to buy 20,000 shares at 35 In the next crossing session new orders are submitted. The most recent trading price of CD at the Paris Bourse is 38. - D order: a market order to buy 160,000 shares - E order: A market order to sell 80,000 In his speech to buy side clients, Matt has made the following statements about electronic communication and crossing networks (ECNs): Statement 1: Electronic communication networks are order driven systems, in which the limit order book plays the central role. Statement 2: Electronic crossing networks anonymously match buy and sell orders by a pool of participants, generally institutional investors and broker dealers. Statement 3: In an ECN, a trade takes place only during a crossing session time and only if there are offsetting orders entered by other participants. Task: Answer the following questions: 1. For buying alpha shares, should Margo place a market order or a limit order? What would be the advantage and disadvantage of each type of order, given her purpose? (4 Marks) 2. In selling a large block of Gamma shares, explain Matt's argument that automated order driven trading systems must provide special arrangements for small and large trades. (2 Mark) 3. In the first crossing session discuss what trades would take place on the crossing network and what orders remain unfilled? (4 Marks) 4. In the second crossing session discuss what trades would take place on the crossing network and what orders remain unfilled? (4 Marks) 5. Which of Matt's statement about electronic communication and crossing networks (ECNs) is true? Justify your answers. (2 Marks) 6. Indicate how you would assess the quality of financial markets? (4 Marks)

Case 2: Trade orders Margo Salan, a portfolio manager at ADIA Investment Company in Europe, would like to buy 40,000 shares of alpha stock, which is a new IPO that was previously offered at 25, but she couldn't get any shares of it. She remains interested in these shares now, but not at a price higher than 40. Matt Davidson, who works for the Global Brokerage House, provides execution services for ADIA. In his conversation with Margo, Matt has suggested that a market order is most suitable for the trade. Margo is considering using a market order to sell a large number of Gamma shares. However, she has concerns that executing a market order might lead to a decline in the share price, resulting in potential losses on the overall value of the deal. Matt argued that this should not be a problem as automated order driven trading systems provide special arrangements for small trades (which are often market orders) as well as for block trades. Margo wants to reduce the cost of selling of her Christian Dior shares, Matt suggested that she should use European electronic crossing network to sell some of her shares. He told Margo that these networks are cheap, preserve anonymity and allows for 6 crossing opportunities of trades per day. They also allow participants to place some restrictions such as price and minimum fill. All orders submitted to the network is good for a day which means that any unfulfilled part of an order is automatically resubmitted to subsequent crossing sessions during the day. Following Matt's advice, Margo has submitted her 160,000 CD shares to be sold in the European crossing network with a minimum fill of 125,000 . The following orders are on the network for the shares of CD at the time of the first crossing session of the day. The most recent trading price of CD at the Paris Bourse is 36. - A order: a market order to buy 80,000 shares - B order: a market order to sell 55,000 shares - C: an order to buy 20,000 shares at 35 In the next crossing session new orders are submitted. The most recent trading price of CD at the Paris Bourse is 38. - D order: a market order to buy 160,000 shares - E order: A market order to sell 80,000 In his speech to buy side clients, Matt has made the following statements about electronic communication and crossing networks (ECNs): Statement 1: Electronic communication networks are order driven systems, in which the limit order book plays the central role. Statement 2: Electronic crossing networks anonymously match buy and sell orders by a pool of participants, generally institutional investors and broker dealers. Statement 3: In an ECN, a trade takes place only during a crossing session time and only if there are offsetting orders entered by other participants. Task: Answer the following questions: 1. For buying alpha shares, should Margo place a market order or a limit order? What would be the advantage and disadvantage of each type of order, given her purpose? (4 Marks) 2. In selling a large block of Gamma shares, explain Matt's argument that automated order driven trading systems must provide special arrangements for small and large trades. (2 Mark) 3. In the first crossing session discuss what trades would take place on the crossing network and what orders remain unfilled? (4 Marks) 4. In the second crossing session discuss what trades would take place on the crossing network and what orders remain unfilled? (4 Marks) 5. Which of Matt's statement about electronic communication and crossing networks (ECNs) is true? Justify your answers. (2 Marks) 6. Indicate how you would assess the quality of financial markets? (4 Marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started