Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE #3: VALUING OFFICE BUILDING You will be valuing an office building located at 815 Second Avenue in New York City. The operating details

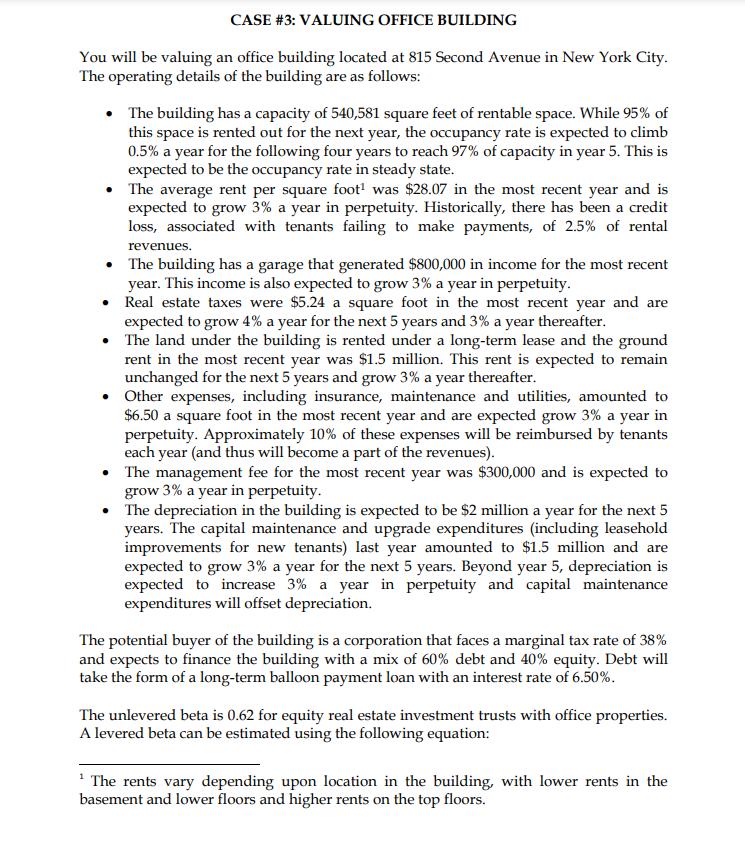

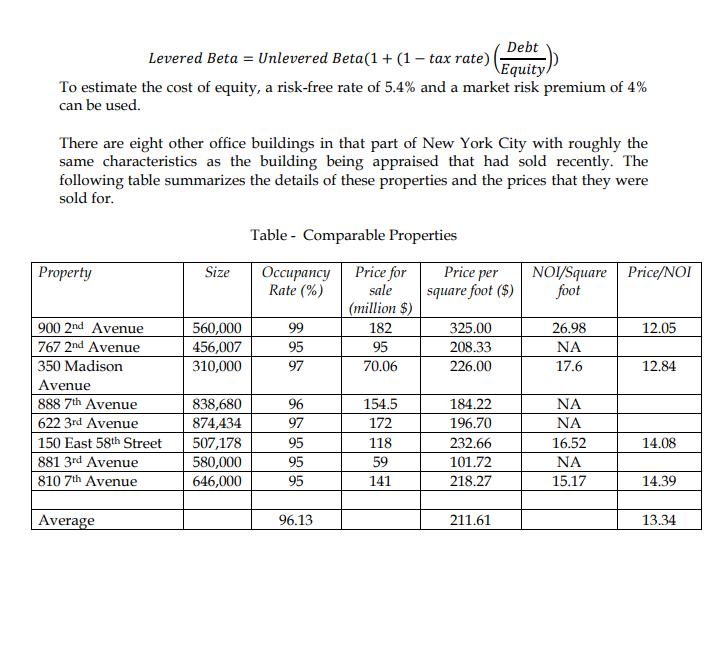

CASE #3: VALUING OFFICE BUILDING You will be valuing an office building located at 815 Second Avenue in New York City. The operating details of the building are as follows: The building has a capacity of 540,581 square feet of rentable space. While 95% of this space is rented out for the next year, the occupancy rate is expected to climb 0.5% a year for the following four years to reach 97% of capacity in year 5. This is expected to be the occupancy rate in steady state. The average rent per square foot was $28.07 in the most recent year and is expected to grow 3% a year in perpetuity. Historically, there has been a credit loss, associated with tenants failing to make payments, of 2.5% of rental revenues. The building has a garage that generated $800,000 in income for the most recent year. This income is also expected to grow 3% a year in perpetuity. Real estate taxes were $5.24 a square foot in the most recent year and are expected to grow 4% a year for the next 5 years and 3% a year thereafter. The land under the building is rented under a long-term lease and the ground rent in the most recent year was $1.5 million. This rent is expected to remain unchanged for the next 5 years and grow 3% a year thereafter. Other expenses, including insurance, maintenance and utilities, amounted to $6.50 a square foot in the most recent year and are expected grow 3% a year in perpetuity. Approximately 10% of these expenses will be reimbursed by tenants each year (and thus will become a part of the revenues). The management fee for the most recent year was $300,000 and is expected to grow 3% a year in perpetuity. The depreciation in the building is expected to be $2 million a year for the next 5 years. The capital maintenance and upgrade expenditures (including leasehold improvements for new tenants) last year amounted to $1.5 million and are expected to grow 3% a year for the next 5 years. Beyond year 5, depreciation is expected to increase 3% a year in perpetuity and capital maintenance expenditures will offset depreciation. The potential buyer of the building is a corporation that faces a marginal tax rate of 38% and expects to finance the building with a mix of 60% debt and 40% equity. Debt will take the form of a long-term balloon payment loan with an interest rate of 6.50%. The unlevered beta is 0.62 for equity real estate investment trusts with office properties. A levered beta can be estimated using the following equation: The rents vary depending upon location in the building, with lower rents in the basement and lower floors and higher rents on the top floors. Debt Levered Beta Unlevered Beta(1 + (1 - tax rate) | Equity) To estimate the cost of equity, a risk-free rate of 5.4% and a market risk premium of 4% can be used. There are eight other office buildings in that part of New York City with roughly the same characteristics as the building being appraised that had sold recently. The following table summarizes the details of these properties and the prices that they were sold for. Property 900 2nd Avenue 767 2nd Avenue 350 Madison Avenue 888 7th Avenue 622 3rd Avenue 150 East 58th Street 881 3rd Avenue 810 7th Avenue Average Size 560,000 456,007 310,000 838,680 874,434 507,178 580,000 646,000 Table Comparable Properties Occupancy | Price for Rate (%) sale (million $) 182 95 70.06 99 95 97 96 97 95 95 95 96.13 154.5 172 118 59 141 Price per square foot ($) 325.00 208.33 226.00 184.22 196.70 232.66 101.72 218.27 211.61 NOI/Square Price/NOI foot 26.98 17.6 16.52 15.17 12.05 12.84 14.08 14.39 13.34

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

STEP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started