Answered step by step

Verified Expert Solution

Question

1 Approved Answer

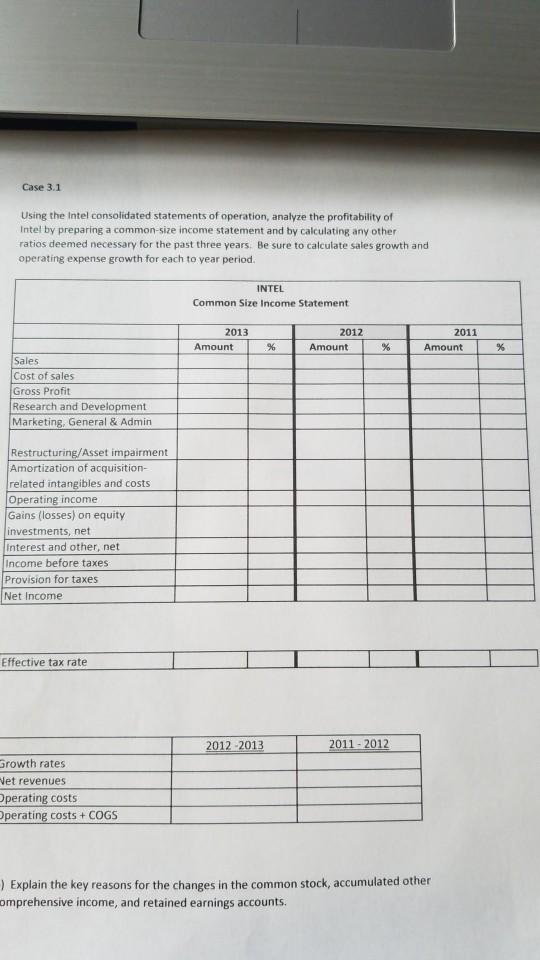

Case 3.1 Using the Intel consolidated statements of operation, analyze the profitability of Intel by preparing a common-size income statement and by calculating any

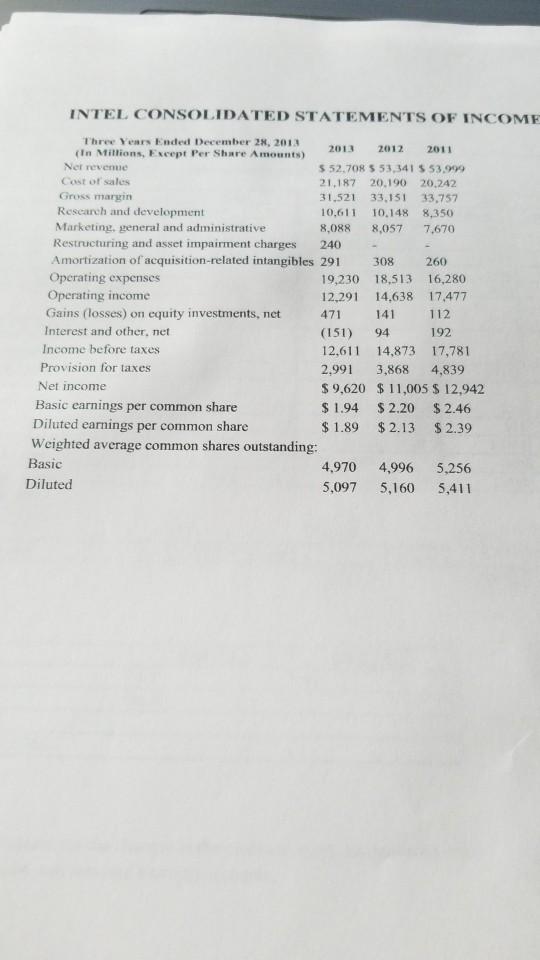

Case 3.1 Using the Intel consolidated statements of operation, analyze the profitability of Intel by preparing a common-size income statement and by calculating any other ratios deemed necessary for the past three years. Be sure to calculate sales growth and operating expense growth for each to year period. Sales Cost of sales Gross Profit Research and Development Marketing, General & Admin Restructuring/Asset impairment Amortization of acquisition- related intangibles and costs Operating income Gains (losses) on equity investments, net Interest and other, net Income before taxes: Provision for taxes Net Income Effective tax rate Growth rates Net revenues Operating costs Operating costs + COGS INTEL Common Size Income Statement. 2013 Amount 2012-2013 % 2012 Amount % 2011-2012 2011 Amount ) Explain the key reasons for the changes in the common stock, accumulated other omprehensive income, and retained earnings accounts. % INTEL CONSOLIDATED STATEMENTS OF INCOME Three Years Ended December 28, 2013 (In Millions, Except Per Share Amounts) Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and asset impairment charges 240 Amortization of acquisition-related intangibles 291 Operating expenses Operating income Gains (losses) on equity investments, net Interest and other, net Income before taxes Provision for taxes 2013 2012 2011 $ 52,708 $ 53,341 $ 53,999 21,187 20.190 20,242 31,521 33,151 33,757 10,611 10,148 8,350 8,088 8,057 7,670 Net income Basic earnings per common share Diluted earnings per common share Weighted average common shares outstanding: Basic Diluted 308 260 19,230 18,513 16,280 12,291 14,638 17,477 112 192 471 141 (151) 94 12,611 14,873 17,781 2,991 3,868 4,839 $9,620 $11,005 $ 12,942 $1.94 $2.20 $2.46 $ 1.89 $2.13 $2.39 4,970 5,097 4,996 5,256 5,160 5,411

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Solution Common Size Income Statement of Intel Year 2013 Column Item Salesx100 2012 2011 Amount Amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started