Answered step by step

Verified Expert Solution

Question

1 Approved Answer

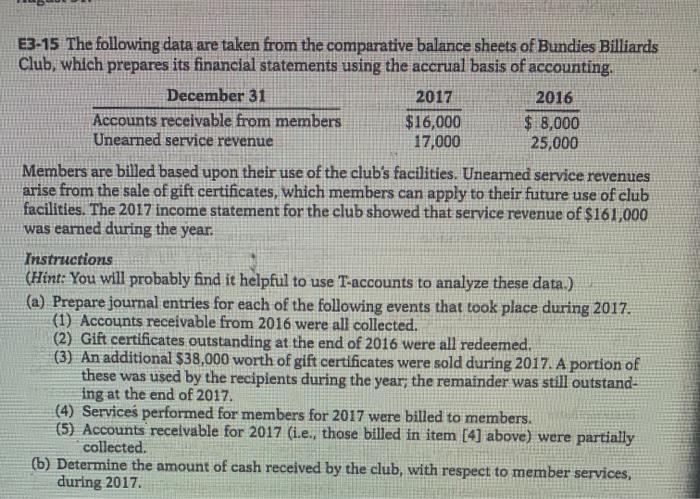

E3-15 The following data are taken from the comparative balance sheets of Bundies Billiards Club, which prepares its financial statements using the accrual basis

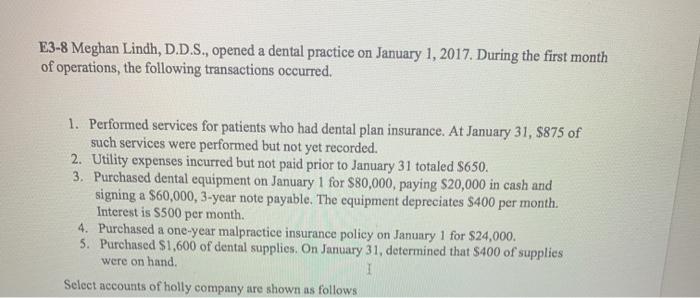

E3-15 The following data are taken from the comparative balance sheets of Bundies Billiards Club, which prepares its financial statements using the accrual basis of accounting. December 31 Accounts receivable from members Unearned service revenue 2017 $16,000 17,000 2016 $8,000 25,000 Members are billed based upon their use of the club's facilities. Unearned service revenues arise from the sale of gift certificates, which members can apply to their future use of club facilities. The 2017 income statement for the club showed that service revenue of $161,000 was earned during the year. Instructions (Hint: You will probably find it helpful to use T-accounts to analyze these data.) (a) Prepare journal entries for each of the following events that took place during 2017. (1) Accounts receivable from 2016 were all collected. (2) Gift certificates outstanding at the end of 2016 were all redeemed. (3) An additional $38,000 worth of gift certificates were sold during 2017. A portion of these was used by the recipients during the year, the remainder was still outstand- ing at the end of 2017. (4) Services performed for members for 2017 were billed to members. (5) Accounts receivable for 2017 (i.e., those billed in item [4] above) were partially collected. (b) Determine the amount of cash received by the club, with respect to member services, during 2017. E3-8 Meghan Lindh, D.D.S., opened a dental practice on January 1, 2017. During the first month of operations, the following transactions occurred. 1. Performed services for patients who had dental plan insurance. At January 31, $875 of such services were performed but not yet recorded. 2. Utility expenses incurred but not paid prior to January 31 totaled $650. 3. Purchased dental equipment on January 1 for $80,000, paying $20,000 in cash and signing a $60,000, 3-year note payable. The equipment depreciates $400 per month. Interest is $500 per month. 4. Purchased a one-year malpractice insurance policy on January 1 for $24,000. 5. Purchased $1,600 of dental supplies. On January 31, determined that $400 of supplies were on hand. I Select accounts of holly company are shown as follows

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer E31...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started