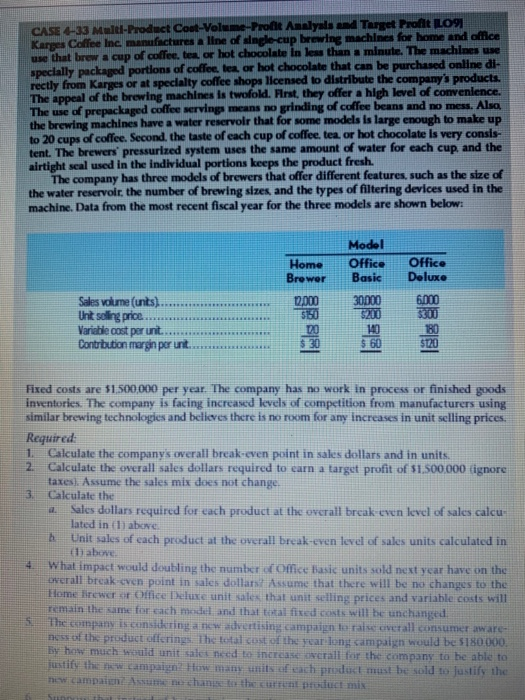

CASE 4-33 Multi-Product Cout-Volume-Profit Aanlyals and Target Profit 109 Karpes Coffee Inc. manufactures a line of single-cup brewing machines for home and office use that brew a cup of coffee, tea or hot chocolate in less than a minute. The machines use specially packaged portions of coffee, tea or hot chocolate that can be purchased online di- rectly from Karges or at specialty coffee shops licensed to distribute the company's products. The appeal of the brewing machines is twofold. First, they offer a high level of convenience. The use of prepackaged coffee servings means no grinding of coffee beans and no mess. Also, the brewing machines have a water reservoir that for some models is large enough to make up to 20 cups of coffee. Second, the taste of each cup of coffee, tea or hot chocolate is very consis- tent. The brewers pressurized system uses the same amount of water for each cup, and the airtight scal used in the individual portions keeps the product fresh. The company has three models of brewers that offer different features, such as the size of the water reservoir, the number of brewing sizes, and the types of filtering devices used in the machine. Data from the most recent fiscal year for the three models are shown below: Home Brewer Model Office Basic Office Deluxe Sales volume (unts) Unt selling price Variable cost per unt Contribution margin por unt. 12000 5:50 10 $ 30 30000 5200 140 $ 60 6.000 3300 180 $120 RE Fixed costs are $1,500,000 per year. The company has no work in process or finished goods inventories. The company is facing increased levels of competition from manufacturers using similar brewing technologies and believes there is no room for any increases in unit selling prices. Required: 1 Calculate the company's overall break-even point in sales dollars and in units. 2 Calculate the overall sales dollars required to earn a target profit of $1.500.000 (ignore taxes. Assume the sales mix does not change. 3. Calculate the Sales dollars required for each product at the overall break even level of sales calcu. lated in labore th Unit sales of each product at the overall break-even level of sales units calculated in chabowe 4 What impact would doubling the number of office basic units sold next year have on the overall break-even point in sales dollars Assume that there will be no changes to the Home liewer or Office Deluxe unit sales that unit selling prices and variable costs will Temain the same for each model and that total fixed costs will be unchanged The company is considering a new advertising campaign to raise overall consumer aware- ness of the product offerings. The total cost of the year-long campaign would be $180.000, By how much would unit salet need to increase overall for the company to be able to justify the campaign? How many units of each product must be sold to justify the SI 6. Suppose that instead of being designed to increase total sales volume, the new $180,000 advertising campaign will focus on getting customers who would have purchased the Office Basic model to buy the Office Deluxe model instead. To justify the cost of the new advertising, how many customers must purchase the Deluxe model instead of the Basic model? Assume that the new advertising campaign will have no impact on sales of the Home Brewer model. 7. The company is considering adding a new product to its line of brewers targeted at the office-use market. The new brewer, the Office Plus, would sell for $250 per unit and would have variable unit costs of $160. Introducing the new model would increase fixed costs by $102,000 annually and would reduce annual unit sales of the Office Basic and Office Deluxe models by 10% each. Assuming no change to the sales of the Home Brewer model, how many units of the Office Plus model would need to be sold to justify its addition to the product line next year