Question

Case 8: Georgia Atlantic Company: Directed QUESTIONS 1. For each of the years listed in Table 2, what is Georgia Atlantic's annual earnings per growth

Case 8: Georgia Atlantic Company: Directed QUESTIONS 1. For each of the years listed in Table 2, what is Georgia Atlantic's annual earnings per growth rate, its P/E ratio, and its market/book ratio? Compare your answers with the indust averages shown in Table 2. What can be inferred about Georgia Atlantic's dividend policy share from these data?

2. Do you think it is better for firms in general, and for Georgia Atlantic in particular, to have an announced dividend policy?

3. In general, how is a firm's growth rate in earnings affected by its dividend policy? What does this imply about Georgia Atlantic's historical rate of return on investment vis-à-vis that of the average lumber company? (Hint: Consider the retention growth model, g br, where g = growth rate in EPS, b = retention ratio, and r = return on equity.)

4. Evaluate the family's argument that higher-priced stocks are more attractive to investors because the percentage transactions costs on such issues are lower. Is this a valid argument? Do you think Georgia Atlantic's current per-share price is "optimal" in the sense that the value of the shares to investors is maximized?

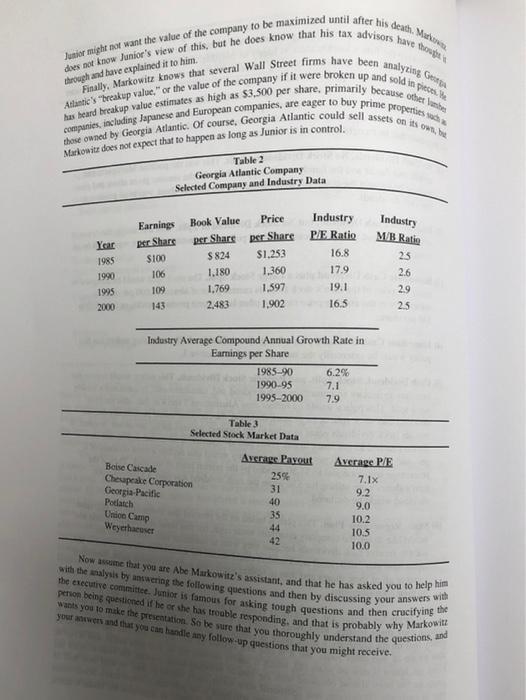

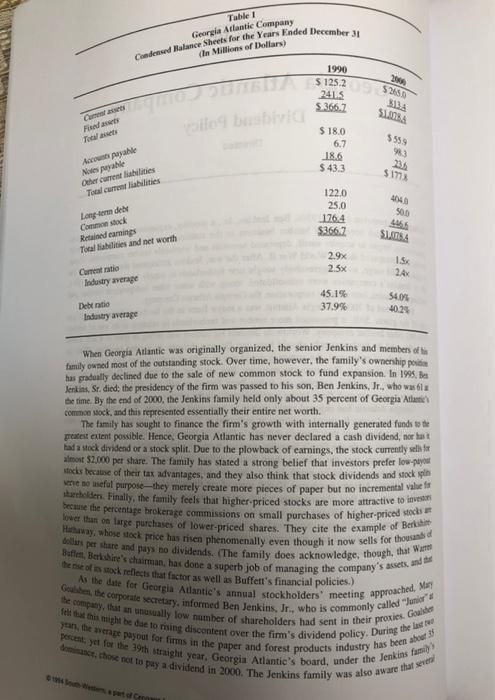

through and have explained it to him. Junior might not want the value of the company to be maximized until after his death. Markow does not know Junior's view of this, but he does know that his tax advisors have thought Atlantic's "breakup value," or the value of the company if it were broken up and sold in pieces. He Finally, Markowitz knows that several Wall Street firms have been analyzing Georg companies, including Japanese and European companies, are eager to buy prime properties such has heard breakup value estimates as high as $3,500 per share, primarily because other lune those owned by Georgia Atlantic. Of course, Georgia Atlantic could sell assets on its own, be Markowitz does not expect that to happen as long as Junior is in control. Year 1985 1990 1995 2000 Earnings per Share $100 106 109 143 Table 2 Georgia Atlantic Company Selected Company and Industry Data Book Value per Share $ 824 Podatch Union Camp Weyerhaeuser 1,180 1,769 2,483 Boise Cascade Chesapeake Corporation Georgia-Pacific Price per Share $1,253 1,360 1,597 1,902 Industry Average Compound Annual Growth Rate int Earnings per Share 1985-90 1990-95 1995-2000 Table 3 Selected Stock Market Data Industry P/E Ratio 16.8 17.9 19.1 16.5 Average Payout 25% 31 40 35 44 42 6.2% 7.1 7.9 Industry M/B Ratio 25 26 Average P/E 7.1x 9.2 9.0 10.2 10.5 10.0 2.9 2.5 with the analysis by answering the following questions and then by discussing your answers with Now assume that you are Abe Markowitz's assistant, and that he has asked you to help him person being questioned if he or she has trouble responding, and that is probably why Markowitz the executive committee. Junior is famous for asking tough questions and then crucifying the wants you to make the presentation. So be sure that you thoroughly understand the questions, and your answers and that you can handle any follow-up questions that you might receive.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Detailed Explanation 1 Lets figure out each years marketbook ratio PE ratio and annual profits per growth rate For the year 1985 Earnings per Share Growth Rate 106100100100 6 PE Ratio 1253100 1253 MB ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started