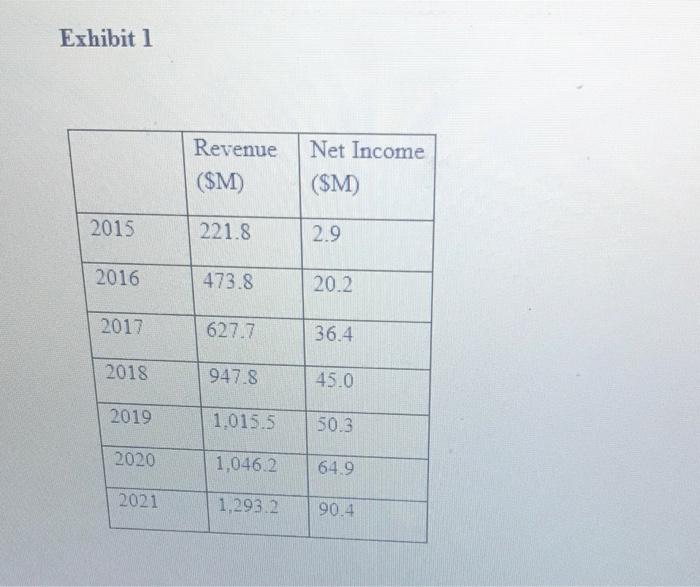

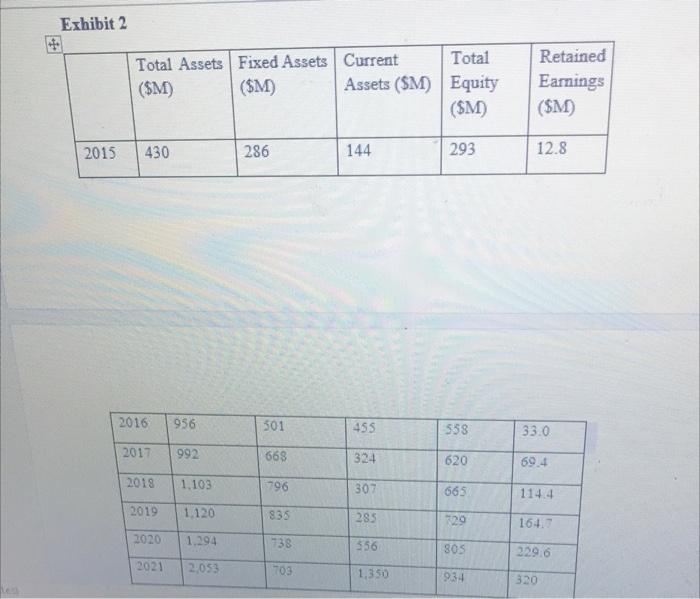

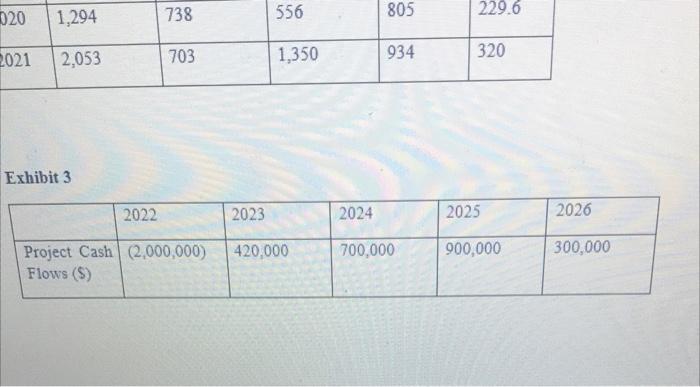

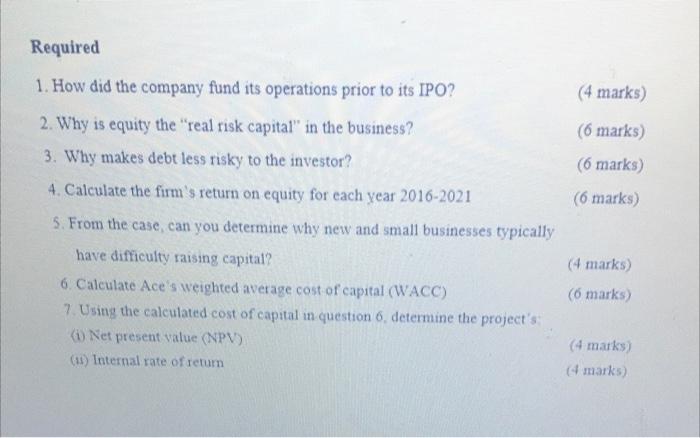

Case A Introduction Mr. Merrick Simms, Chief Executive Officer of Northcon Ltd. was satisfied as he looked back. over the previous 5 years of Northcon's operations. He recalled his search for growth opportunities and the efforts to raise the necessary financing. He was forced to accept back in 2016, that it would have been impossible to raise the needed financing without making significant changes to how the company operated. Now, in 2021, despite the downturn in the economy due to the corona virus epidemic, the company is doing well enough as a wholesaler and retailer of lighting, electrical, and solar solutions, but in 2016 it wasn't so. The difference between now and then was Northcon's transformation from a sole proprietorship, to a well- organized corporate entity Background Northcon Ltd was incorporated in 2001 when it started selling electrical materials. As a sole proprietorship. Northcon struggled to adequately fund ongoing operations and expansion. Such financing as it could source came mostly from retained earnings and bank loans. Northcon had difficulty attracting equity investors, as they required audited accounts which, as far as Mr. Simms was concerned, were an unnecessary expense. He was quite aware of his company's finances, and didn't need audited accounts when he was having problems just financing ongoing operations. Besides, he didn't wish to sell shares in his company to anyone else for fear of losing control of it. As long as his bank would lend him money in those days, he could Unit 4 Notes fear of losing control of it. As long as his bank would lend him money in those days, he could survive. The absence of audited accounts was problematic for the banks too, and because of this, wouldn't lend any more money to Nortcon. Mr. Simms got around that by borrowing in his personal capacity, putting up his home and other personal assets as collateral. He signed those loan agreements not as CEO on behalf of Northcon, but as a private customer Merrick Simms. Those arrangements were enough to keep Ace going, but Mr. Simms had growth on his mind and that called for large amounts of affordable financing. What next? He explored the idea of raising equity finance by listing on the Junior Stock Market. If that was successful, it would increase Northcon's ability to raise debt capital as well. The conditions for listing required major changes to Northcon's culture and practice, to bring them into conformity with Junior Market rules Mr Simms eventually "bit the bullet" and invested a great deal of time and money in overhauling Northcon's accounting processes to bring them into compliance with tax legislation and financial reporting requirements. He also appointed advisers an auditor, a Board and Mentor as required by the Stock Exchange, a broker, and an attorney. By 2018. Northcon's transformation was complete and it made its initial public offering (IPO). The cost in time and money was considerable, but it paid off handsomely as the IPO was well received, and Northcon raised the equity finance it sought Banks were now interested in doing business with the firm as a stock market listing signaled that its financials and corporate structure were in good order. Small firms like Northcon otherwise had little chance of attracting equity investors because equity was the real risk capital in a business Without proper financial and governance controls in place, equity investors would be unwilling to put up money, viewing such investments as too risky. They knew that equity's claims on the firm's cash flows and assets were residual, only being addressed, if anything remained after lenders and preferred stock holders claims had been satisfied. Listing transformed Northcon's fortunes as affordable financing became available for the firm's growth plans. Three years after listing in 2021, Northcon was a much larger and more profitable company because of those moves. Mr. Simms was contemplating further expansion to start very soon. The project would be financed by a mix of 60% debt and 40% equity and the company's tax rate was 25%. He was confident that the firm could raise debt at 11% and equity at 14%. The projects expected 5-year cash flows are set out in Exhibit 3. Exhibit 1 Exhibit 1 Revenue ($M) Net Income ($M) 2015 221.8 2.9 2016 473.8 20.2 2017 627.7 36.4 2018 947.8 45.0 2019 1,015.5 50.3 2020 1,046.2 64.9 2021 1,293 2 90.4 Exhibit 2 Total Assets Fixed Assets Current Total ($M) ($M) Assets (SM) Equity (SM) Retained Earnings (SM) 2015 430 286 144 293 12.8 2016 956 501 455 358 33.0 2017 992 668 324 620 694 2018 1.103 796 307 665 114.4 2019 1.120 835 285 129 16:47 2020 1.294 738 356 305 2296 2021 2,053 703 1,350 934 320 020 738 805 1,294 229.6 556 2021 703 934 1,350 2,053 320 Exhibit 3 2022 2023 2024 2025 2026 420,000 700,000 900,000 300,000 Project Cash 2,000,000) Flows (S) (4 marks) Required 1. How did the company fund its operations prior to its IPO? 2. Why is equity the "real risk capital" in the business? 3. Why makes debt less risky to the investor? 4. Calculate the firm's return on equity for each year 2016-2021 5. From the case, can you determine why new and small businesses typically have difficulty raising capital? 6. Calculate Ace's weighted average cost of capital (WACC) 7. Using the calculated cost of capital in question 6. determine the project's Net present value (NPV) (11) Internal rate of retum (6 marks) (6 marks) (6 marks) (4 marks) (6 marks) (4 marks) (4 marks) Case A Introduction Mr. Merrick Simms, Chief Executive Officer of Northcon Ltd. was satisfied as he looked back. over the previous 5 years of Northcon's operations. He recalled his search for growth opportunities and the efforts to raise the necessary financing. He was forced to accept back in 2016, that it would have been impossible to raise the needed financing without making significant changes to how the company operated. Now, in 2021, despite the downturn in the economy due to the corona virus epidemic, the company is doing well enough as a wholesaler and retailer of lighting, electrical, and solar solutions, but in 2016 it wasn't so. The difference between now and then was Northcon's transformation from a sole proprietorship, to a well- organized corporate entity Background Northcon Ltd was incorporated in 2001 when it started selling electrical materials. As a sole proprietorship. Northcon struggled to adequately fund ongoing operations and expansion. Such financing as it could source came mostly from retained earnings and bank loans. Northcon had difficulty attracting equity investors, as they required audited accounts which, as far as Mr. Simms was concerned, were an unnecessary expense. He was quite aware of his company's finances, and didn't need audited accounts when he was having problems just financing ongoing operations. Besides, he didn't wish to sell shares in his company to anyone else for fear of losing control of it. As long as his bank would lend him money in those days, he could Unit 4 Notes fear of losing control of it. As long as his bank would lend him money in those days, he could survive. The absence of audited accounts was problematic for the banks too, and because of this, wouldn't lend any more money to Nortcon. Mr. Simms got around that by borrowing in his personal capacity, putting up his home and other personal assets as collateral. He signed those loan agreements not as CEO on behalf of Northcon, but as a private customer Merrick Simms. Those arrangements were enough to keep Ace going, but Mr. Simms had growth on his mind and that called for large amounts of affordable financing. What next? He explored the idea of raising equity finance by listing on the Junior Stock Market. If that was successful, it would increase Northcon's ability to raise debt capital as well. The conditions for listing required major changes to Northcon's culture and practice, to bring them into conformity with Junior Market rules Mr Simms eventually "bit the bullet" and invested a great deal of time and money in overhauling Northcon's accounting processes to bring them into compliance with tax legislation and financial reporting requirements. He also appointed advisers an auditor, a Board and Mentor as required by the Stock Exchange, a broker, and an attorney. By 2018. Northcon's transformation was complete and it made its initial public offering (IPO). The cost in time and money was considerable, but it paid off handsomely as the IPO was well received, and Northcon raised the equity finance it sought Banks were now interested in doing business with the firm as a stock market listing signaled that its financials and corporate structure were in good order. Small firms like Northcon otherwise had little chance of attracting equity investors because equity was the real risk capital in a business Without proper financial and governance controls in place, equity investors would be unwilling to put up money, viewing such investments as too risky. They knew that equity's claims on the firm's cash flows and assets were residual, only being addressed, if anything remained after lenders and preferred stock holders claims had been satisfied. Listing transformed Northcon's fortunes as affordable financing became available for the firm's growth plans. Three years after listing in 2021, Northcon was a much larger and more profitable company because of those moves. Mr. Simms was contemplating further expansion to start very soon. The project would be financed by a mix of 60% debt and 40% equity and the company's tax rate was 25%. He was confident that the firm could raise debt at 11% and equity at 14%. The projects expected 5-year cash flows are set out in Exhibit 3. Exhibit 1 Exhibit 1 Revenue ($M) Net Income ($M) 2015 221.8 2.9 2016 473.8 20.2 2017 627.7 36.4 2018 947.8 45.0 2019 1,015.5 50.3 2020 1,046.2 64.9 2021 1,293 2 90.4 Exhibit 2 Total Assets Fixed Assets Current Total ($M) ($M) Assets (SM) Equity (SM) Retained Earnings (SM) 2015 430 286 144 293 12.8 2016 956 501 455 358 33.0 2017 992 668 324 620 694 2018 1.103 796 307 665 114.4 2019 1.120 835 285 129 16:47 2020 1.294 738 356 305 2296 2021 2,053 703 1,350 934 320 020 738 805 1,294 229.6 556 2021 703 934 1,350 2,053 320 Exhibit 3 2022 2023 2024 2025 2026 420,000 700,000 900,000 300,000 Project Cash 2,000,000) Flows (S) (4 marks) Required 1. How did the company fund its operations prior to its IPO? 2. Why is equity the "real risk capital" in the business? 3. Why makes debt less risky to the investor? 4. Calculate the firm's return on equity for each year 2016-2021 5. From the case, can you determine why new and small businesses typically have difficulty raising capital? 6. Calculate Ace's weighted average cost of capital (WACC) 7. Using the calculated cost of capital in question 6. determine the project's Net present value (NPV) (11) Internal rate of retum (6 marks) (6 marks) (6 marks) (4 marks) (6 marks) (4 marks) (4 marks)