Question

CASE ANALYSIS MANAGEMENT ACCOUNTING You have just been hired as an accountant by GEK Technologies Inc. GEK Technologies Inc., was setup by Brendan Pierce, an

CASE ANALYSIS MANAGEMENT ACCOUNTING

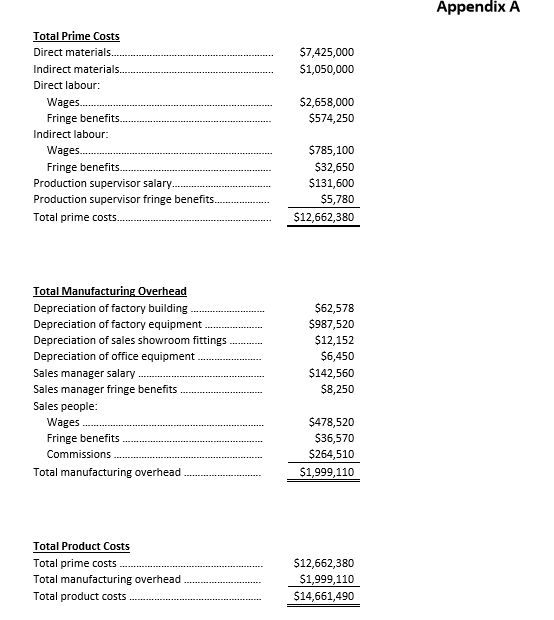

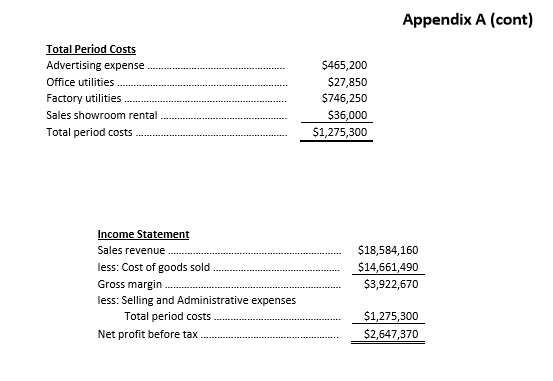

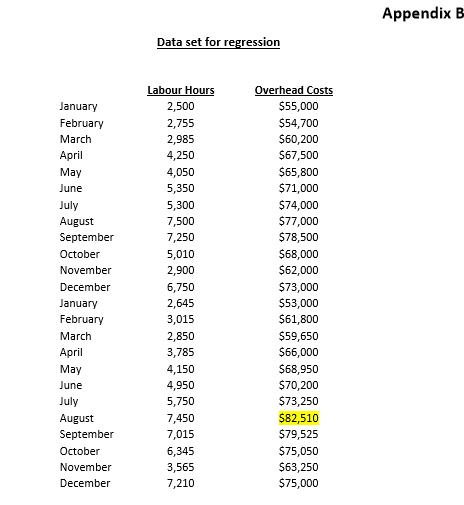

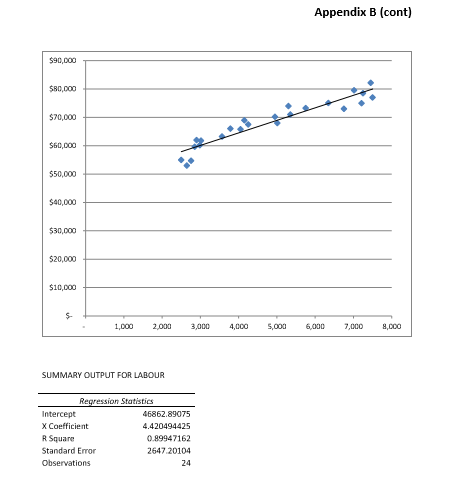

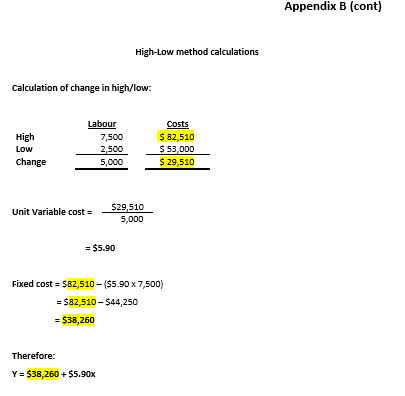

You have just been hired as an accountant by GEK Technologies Inc. GEK Technologies Inc., was setup by Brendan Pierce, an engineer by training, in 2006 and has established a reputation for producing high quality and relatively cheap unmanned aerial vehicles (UAV, or more commonly known as drones) for the public as well as the entertainment industry. In 2007, the companys first product, namely the GEK Eagle Eye, was introduced to the public and was a technological breakthrough in terms of technology and price. It was an affordable drone that had all the capabilities of the more expensive drones in the market. Furthermore, it was the first drone on the market that one could get a real time view of the flight, which was a first in the market. Through the years, more new models were developed and launched, with the latest being the GEK 3Sixty, a drone primarily developed for the entertainment industry, which could film and stream live, with a battery life of 3-hours. The GEK Eagle Eye has retained its standing as the premier drone though, for casual users due to its ease of use and functionalities for the price paid. When you arrived at work for the first time, you learnt that the though the company has been in existence for the last nine years, they have never had an accountant. The accounts were typically prepared by the Jodie Watts, secretary of Brendan Pierce and Tom Nicholson, a part-time accountant who came in once or twice a month. Tom informed Brendan two years ago that he could no longer spare the time to come in and has suggested the need for an accountant on a full time basis. However, none was hired, with Brendan instead relying on interns. However, this year, Brendan was convinced by Jodie to hire an accountant, though he is still sceptical of the need for one. When you were introduced to Brendan by Jodie, he said, Look, I do not know why I need a full-time accountant? At the end of the day, all I need to do is total up my revenues, total up my expenses and the difference is my profit. Do I really need to understand my product costs? What is the purpose of that? Why do I need to know what my product costs are? Furthermore, Jodie said that you are a management accountant. What does that even mean? I agreed to hire an accountant, not another manager. You really need to convince me CASE ANALYSIS ACCT2002 Management Accounting Case Analysis Page 2 that I should keep you. You are on probation for three months and if you do nothing for me in these three months, you can start looking for another job. Now go do something as I am busy. Jodie, who has been the secretary cum bookkeeper (of sorts) since the day the company started took you to her office and said: Look, dont worry about him. He sounds tough but hes really a softie. However, you do need to address what he has asked of you, otherwise, I cant protect you. Here are some stuff that was prepared for us by the last intern (Appendix A and B), she said as she handed you some documents. Referring to appendix A, she continued: These are our revenues and expenses from last year and Alex, the last intern, said that this is how we should be classifying our costs. He calls them prime costs, manufacturing overheads and period costs. I have no idea what they mean and neither does Brendan. Like Brendan has said, couldnt we just add up all our expenses and then take that away from our revenues to get our net profit? I am so confused. You need to work this out for us! Referring now to appendix B, Jodie said: Alex (the last intern) also prepared this for us. He said it is used for planning. He mentioned something about regression, but I have no idea as I did regression way back when I was in high school. He also said that there was a quick and dirty method and that he has used this method for us, based on the data sheet (appendix B). He said something about a high or low or something that I cannot remember. But he says he is not 100 percent certain that he has got it right. So could you please check it? Jodie then continued: He has also given us a regression output, whatever that means. He says dont worry about the workings here as it is definitely correct. I certainly hope so. He says that you can also use this for prediction. Predict what? We are not fortune tellers! Can you just tell us what the regression output means? And also, which method is the correct one to use? So many methods, its all just so confusing.

REQUIRED: Prepare a report (no more than 10-pages) for Brendan Pierce that addresses all the issues in the above exchanges between Brendan, Jodie and yourself. Attach an email brief of your report to Jodie by the due date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started