Case Assignment: Kasvataan Cookies Kasvataan Cookie....

| Prepare the 2019 Statement of Cash Flows using both the direct and indirect method. |

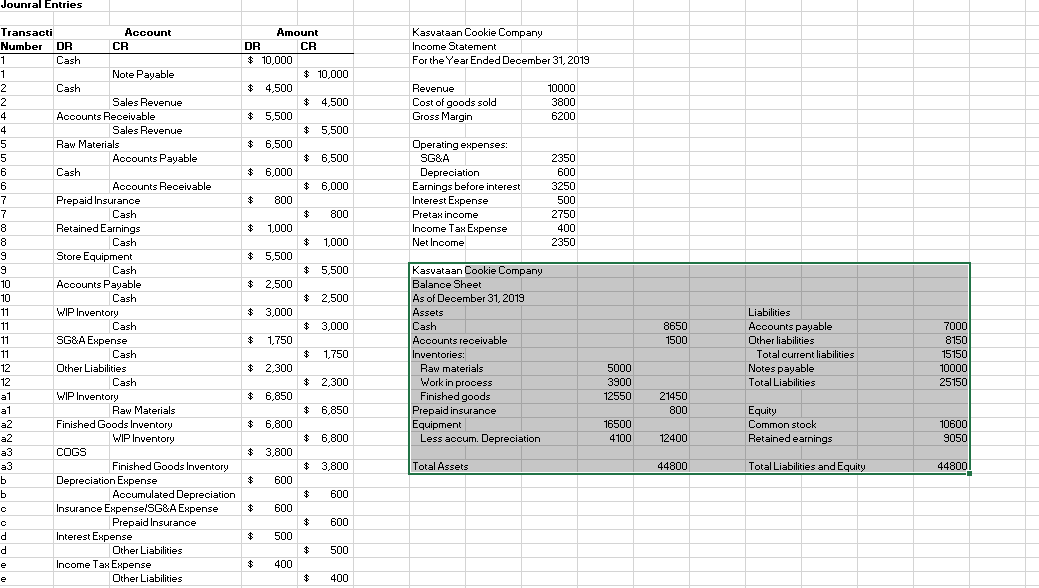

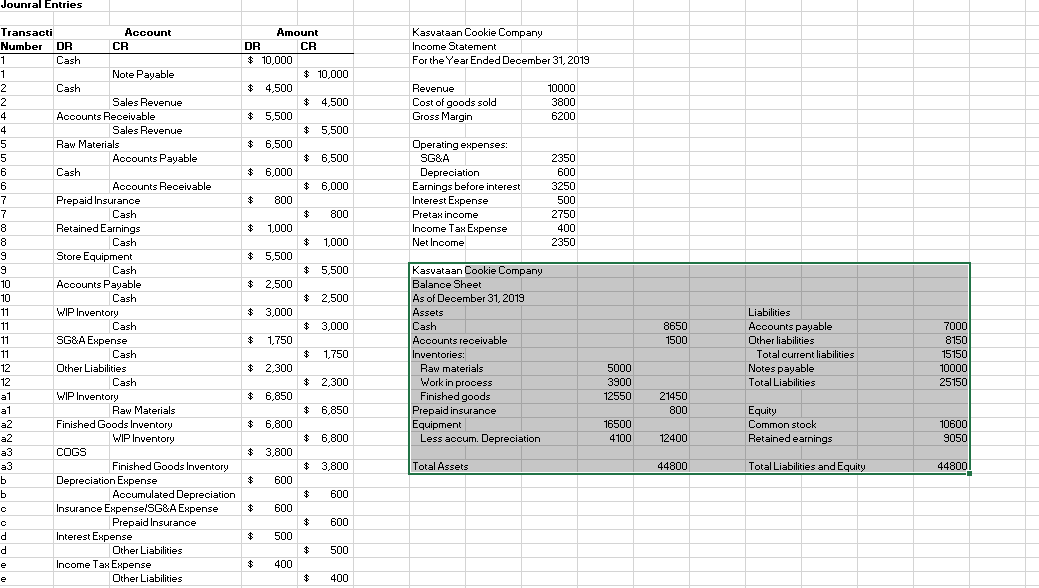

Jounral Entries Kasvataan Cookie Company Income Statement For the Year Ended December 31, 2019 Revenue Cost of goods sold Gross Margin 10000 3800 6200 Operating expenses: SG&A Depreciation Earnings before interest Interest Expense Pretax income Income Tax Expense Net Income 2350 600 3250 500 2750 400 2350 Transacti Account Number DR CR D 1 Cash Note Payable Cash Sales Revenue Accounts Receivable Sales Revenue Raw Materials Accounts Payable Cash Accounts Receivable Prepaid Insurance Cash Retained Earnings Cash Store Equipment Cash Accounts Payable Cash WIP Inventory Cash SG&A Expense Cash Other Liabilities Cash WIP Inventory Raw Materials Finished Goods Inventory WIP Inventory COGS Finished Goods Inventory Depreciation Expense Accumulated Depreciation Insurance Expense/SG&A Expense Prepaid Insurance Interest Expense Other Liabilities Income Tax Expense Other Liabilities 8650 1500 Amount R CR $ 10,000 $ 10,000 $ 4,500 $ 4,500 $ 5,500 $5,500 $ 6,500 $ 6,500 $ 6,000 $ 6,000 $ 800 $ 800 $ 1,000 $ 1,000 $ 5,500 $ 5,500 $ 2,500 $ 2,500 $ 3,000 $ 3,000 $ 1,750 $ 1,750 $ 2,300 $ 2,300 $ 6,850 $ 6,850 $ 6,800 $ 6,800 $ 3,800 $ 3,800 $ 600 $ 600 $ 600 $ 600 $ 500 $ 500 $ 400 $ 400 Kasvataan Cookie Company Balance Sheet As of December 31, 2019 Assets Cash Accounts receivable Inventories: Raw materials Work in process Finished goods Prepaid insurance Equipment Less accum. Depreciation Liabilities Accounts payable Other liabilities Total current liabilities Notes payable Total Liabilities 7000 8150 15150 10000 25150 5000 3900 12550 200CM KWN===== 21450 800 16500 4100 Equity Common stock Retained earnings 10600 9050 12400 Total Assets 44800 Total Liabilities and Equity 448001 Jounral Entries Kasvataan Cookie Company Income Statement For the Year Ended December 31, 2019 Revenue Cost of goods sold Gross Margin 10000 3800 6200 Operating expenses: SG&A Depreciation Earnings before interest Interest Expense Pretax income Income Tax Expense Net Income 2350 600 3250 500 2750 400 2350 Transacti Account Number DR CR D 1 Cash Note Payable Cash Sales Revenue Accounts Receivable Sales Revenue Raw Materials Accounts Payable Cash Accounts Receivable Prepaid Insurance Cash Retained Earnings Cash Store Equipment Cash Accounts Payable Cash WIP Inventory Cash SG&A Expense Cash Other Liabilities Cash WIP Inventory Raw Materials Finished Goods Inventory WIP Inventory COGS Finished Goods Inventory Depreciation Expense Accumulated Depreciation Insurance Expense/SG&A Expense Prepaid Insurance Interest Expense Other Liabilities Income Tax Expense Other Liabilities 8650 1500 Amount R CR $ 10,000 $ 10,000 $ 4,500 $ 4,500 $ 5,500 $5,500 $ 6,500 $ 6,500 $ 6,000 $ 6,000 $ 800 $ 800 $ 1,000 $ 1,000 $ 5,500 $ 5,500 $ 2,500 $ 2,500 $ 3,000 $ 3,000 $ 1,750 $ 1,750 $ 2,300 $ 2,300 $ 6,850 $ 6,850 $ 6,800 $ 6,800 $ 3,800 $ 3,800 $ 600 $ 600 $ 600 $ 600 $ 500 $ 500 $ 400 $ 400 Kasvataan Cookie Company Balance Sheet As of December 31, 2019 Assets Cash Accounts receivable Inventories: Raw materials Work in process Finished goods Prepaid insurance Equipment Less accum. Depreciation Liabilities Accounts payable Other liabilities Total current liabilities Notes payable Total Liabilities 7000 8150 15150 10000 25150 5000 3900 12550 200CM KWN===== 21450 800 16500 4100 Equity Common stock Retained earnings 10600 9050 12400 Total Assets 44800 Total Liabilities and Equity 448001