Question

Case - Bell Inc. Bell Inc. Corporation (Bell Corp. CC) is involved in the production, distribution and marketing of consumer products that encompass a broad

Case - Bell Inc.

Bell Inc. Corporation (Bell Corp. CC) is involved in the production, distribution and marketing of consumer products that encompass a broad range of items, from hair care products, to cosmetics and perfume, to vitamins and supplements. Bell CC has been hard hit by the recent economic downturn, during which consumer spending has been curtailed. The financial results of the current year, 20X3, are critical for all stakeholders and will reflect on the viability of the existing strategic model. The executive team will receive a healthy return to profitability bonus if 20X3 earnings are positive, after two years of losses.

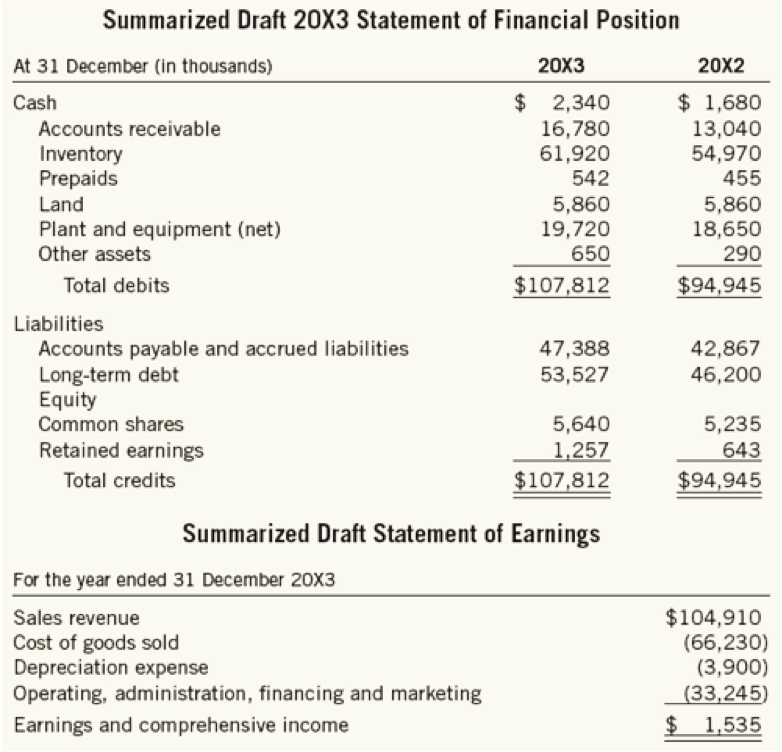

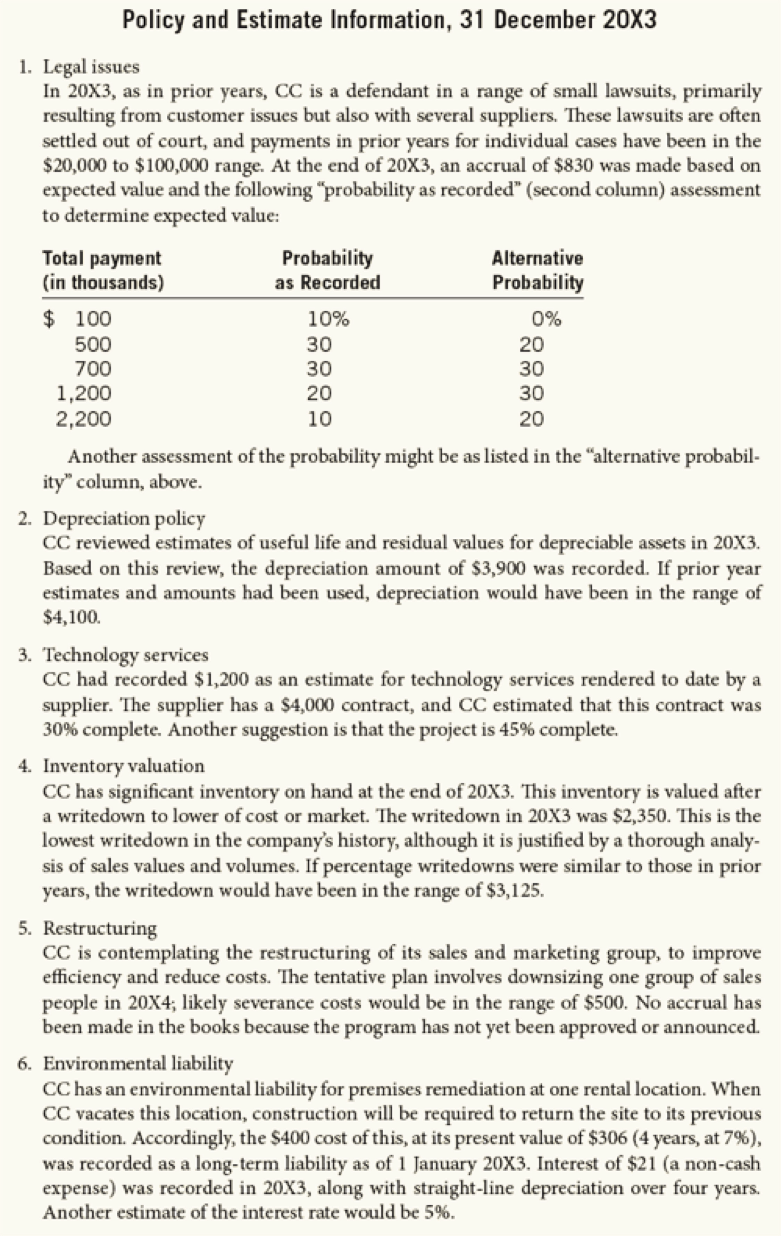

You are a member of the Board of Directors of Bell CC and sit on the Audit Committee. You have a fair understanding of financial statements and take some pride in your technical proficiency. You have just left an Audit Committee meeting, where a 20X3 summarized draft SFP and a summarized draft statement of earnings has been presented (Exhibit 1). Earnings are positive. However, you are concerned that no SCF has yet been prepared. You also are concerned that some of the estimates and policy decisions made might have been affected by management's desire to show positive 20X3 earnings (Exhibit 2).

Therefore, you have completed your independent analysis which includes:

Calculating cash flow from Operating activities from the draft set of financial statements

Adjusting the financial statements estimates and policies that may be aggressive using sensitivity analysis and considering the impact

Recalculating cash flow from operations based on your revised financial statements

An exclusion of income tax considerations

Write a report around the analysis that you may refer to the chair of the Audit committee for discussion at the next meeting.

Require: Prepare the analysis and report. Make any necessary assumptions regarding dividend payments.

Bell CC- Exhibit #1

EXHIBIT 2-Bell CC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started