case check numbers

unasjusted trial balance tools: 97,115

adjusted trial balance tools: 98,440

net income: 16,282

year-end retained earnings: 11,192

year-end total assets: 22,947

post-closing trial balance: 20,072

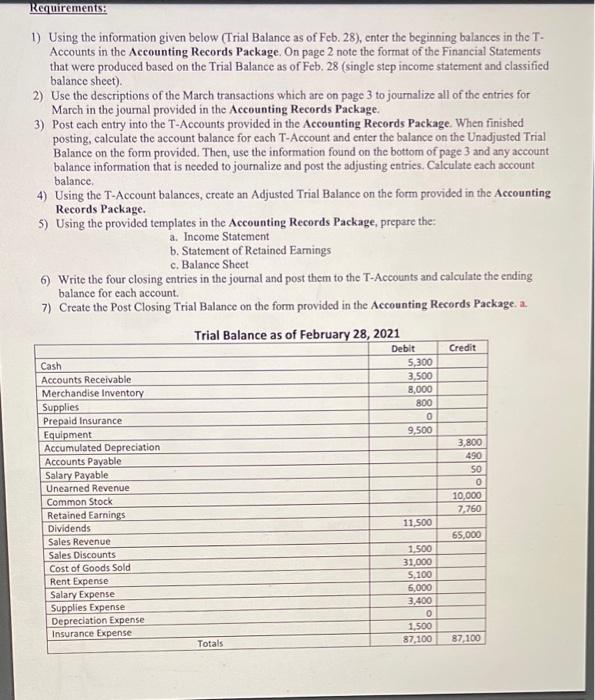

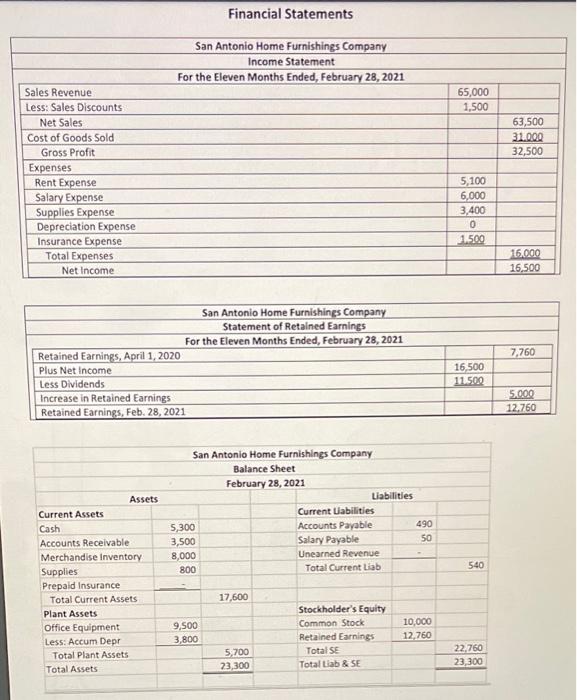

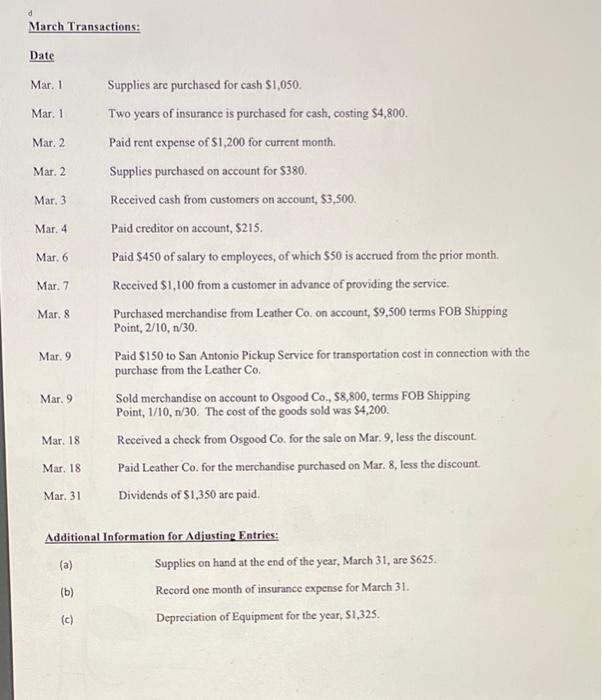

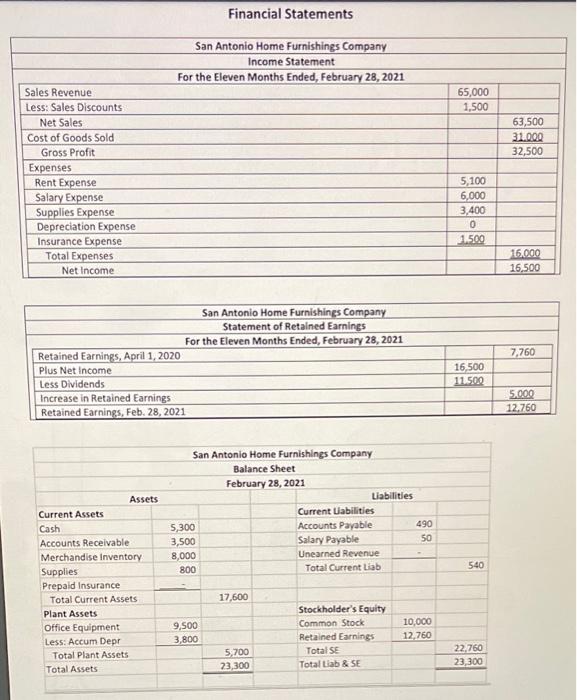

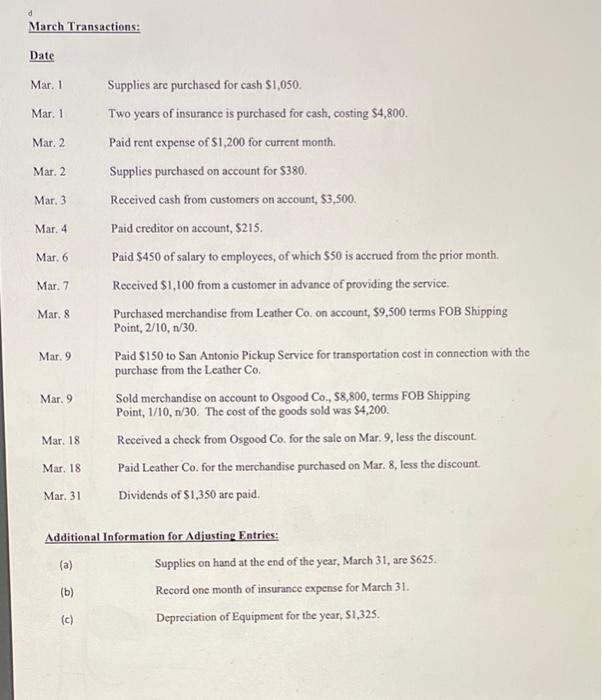

1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the TAccounts in the Accounting Records Package. On page 2 note the format of the Financial Statements that were produced based on the Trial Balance as of Feb. 28 (single step income statement and classified balance sheet). 2) Use the descriptions of the March transactions which are on page 3 to journalize all of the entries for March in the joumal provided in the Accounting Records Package. 3) Post each entry into the T-Accounts provided in the Accounting Records Package. When finished posting, calculate the account balance for each T-Account and enter the balance on the Unadjusted Trial Balance on the form provided. Then, use the information found on the bottom of page 3 and any account balance information that is needed to journalize and post the adjusting entries. Calculate each account balance, 4) Using the T-Account balances, create an Adjusted Trial Balance on the form provided in the Accounting Records Package. 5) Using the provided templates in the Accounting Records Package, prepare the: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet 6) Write the four closing entries in the journal and post them to the T-Accounts and calculate the ending balance for each account. 7) Create the Post Closing Trial Balance on the form provided in the Accounting Records Package. a. Financial Statements March Transactions: Date Mar. 1 Supplies are purchased for cash \$1,050. Mar. 1 Two years of insurance is purchased for cash, costing $4,800. Mar. 2 Paid rent expense of $1,200 for current month. Mar. 2 Supplies purchased on account for $380. Mar. 3 Received cash from customers on account, $3,500. Mar, 4 Paid creditor on account, \$215. Mar. 6 Paid $450 of salary to employees, of which $50 is acerued from the prior month. Mar. 7 Reccived $1,100 from a customer in advance of providing the service. Mar. 8 Purchased merchandise from Leather Co. on account, 59,500 terms FOB Shipping Point, 2/10,n/30. Mar. 9 Paid S150 to San Antonio Pickup Service for transportation cost in connection with the purchase from the Leather Co. Mar. 9 Sold merchandise on account to Osgood Co., 58,800 , terms FOB Shipping Point, 1/10,n/30. The cost of the goods sold was $4,200. Mar. 18 Received a check from Osgood Co. for the sale on Mar. 9, less the discount. Mar. 18 Paid Leather Co. for the merchandise purchased on Mar. 8, less the discount. Mar. 31 Dividends of $1,350 are paid. Additional Information for Adjusting Entries: (a) Supplies on hand at the end of the year, March 31, are 5625. (b) Record one month of insurance expense for March 31. (c) Depreciation of Equipment for the year, \$1,325. 1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the TAccounts in the Accounting Records Package. On page 2 note the format of the Financial Statements that were produced based on the Trial Balance as of Feb. 28 (single step income statement and classified balance sheet). 2) Use the descriptions of the March transactions which are on page 3 to journalize all of the entries for March in the joumal provided in the Accounting Records Package. 3) Post each entry into the T-Accounts provided in the Accounting Records Package. When finished posting, calculate the account balance for each T-Account and enter the balance on the Unadjusted Trial Balance on the form provided. Then, use the information found on the bottom of page 3 and any account balance information that is needed to journalize and post the adjusting entries. Calculate each account balance, 4) Using the T-Account balances, create an Adjusted Trial Balance on the form provided in the Accounting Records Package. 5) Using the provided templates in the Accounting Records Package, prepare the: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet 6) Write the four closing entries in the journal and post them to the T-Accounts and calculate the ending balance for each account. 7) Create the Post Closing Trial Balance on the form provided in the Accounting Records Package. a. Financial Statements March Transactions: Date Mar. 1 Supplies are purchased for cash \$1,050. Mar. 1 Two years of insurance is purchased for cash, costing $4,800. Mar. 2 Paid rent expense of $1,200 for current month. Mar. 2 Supplies purchased on account for $380. Mar. 3 Received cash from customers on account, $3,500. Mar, 4 Paid creditor on account, \$215. Mar. 6 Paid $450 of salary to employees, of which $50 is acerued from the prior month. Mar. 7 Reccived $1,100 from a customer in advance of providing the service. Mar. 8 Purchased merchandise from Leather Co. on account, 59,500 terms FOB Shipping Point, 2/10,n/30. Mar. 9 Paid S150 to San Antonio Pickup Service for transportation cost in connection with the purchase from the Leather Co. Mar. 9 Sold merchandise on account to Osgood Co., 58,800 , terms FOB Shipping Point, 1/10,n/30. The cost of the goods sold was $4,200. Mar. 18 Received a check from Osgood Co. for the sale on Mar. 9, less the discount. Mar. 18 Paid Leather Co. for the merchandise purchased on Mar. 8, less the discount. Mar. 31 Dividends of $1,350 are paid. Additional Information for Adjusting Entries: (a) Supplies on hand at the end of the year, March 31, are 5625. (b) Record one month of insurance expense for March 31. (c) Depreciation of Equipment for the year, \$1,325