Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Facts: Keith Santangelo contacted Comcast Corporation through its online customer service chat function and requested Internet service for his new apartment. During the

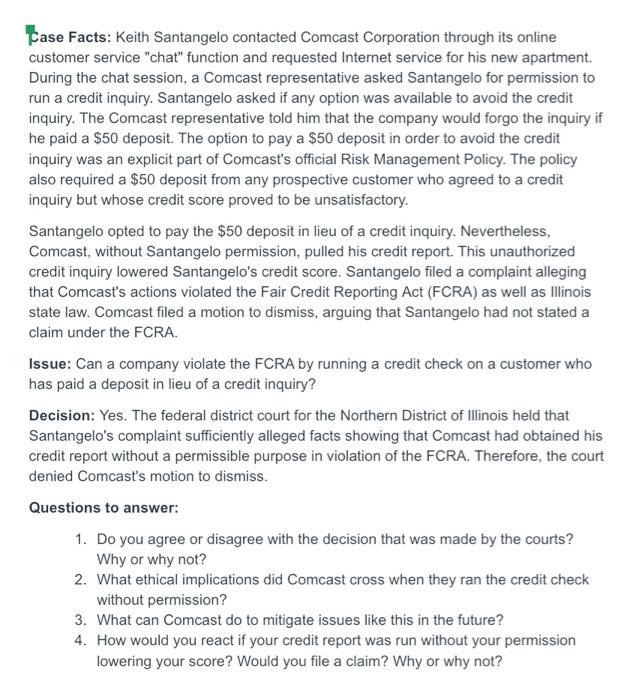

Case Facts: Keith Santangelo contacted Comcast Corporation through its online customer service "chat" function and requested Internet service for his new apartment. During the chat session, a Comcast representative asked Santangelo for permission to run a credit inquiry. Santangelo asked if any option was available to avoid the credit inquiry. The Comcast representative told him that the company would forgo the inquiry if he paid a $50 deposit. The option to pay a $50 deposit in order to avoid the credit inquiry was an explicit part of Comcast's official Risk Management Policy. The policy also required a $50 deposit from any prospective customer who agreed to a credit inquiry but whose credit score proved to be unsatisfactory. Santangelo opted to pay the $50 deposit in lieu of a credit inquiry. Nevertheless, Comcast, without Santangelo permission, pulled his credit report. This unauthorized credit inquiry lowered Santangelo's credit score. Santangelo filed a complaint alleging that Comcast's actions violated the Fair Credit Reporting Act (FCRA) as well as Illinois state law. Comcast filed a motion to dismiss, arguing that Santangelo had not stated a claim under the FCRA. Issue: Can a company violate the FCRA by running a credit check on a customer who has paid a deposit in lieu of a credit inquiry? Decision: Yes. The federal district court for the Northern District of Illinois held that Santangelo's complaint sufficiently alleged facts showing that Comcast had obtained his credit report without a permissible purpose in violation of the FCRA. Therefore, the court denied Comcast's motion to dismiss. Questions to answer: 1. Do you agree or disagree with the decision that was made by the courts? Why or why not? 2. What ethical implications did Comcast cross when they ran the credit check without permission? 3. What can Comcast do to mitigate issues like this in the future? 4. How would you react if your credit report was run without your permission lowering your score? Would you file a claim? Why or why not?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Yes I totally agree with the decision of court as Fair Credit Report Act FCRA was formed with the initiative to protect the consumer legally in limiting the access to their credit reports Moreover t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started