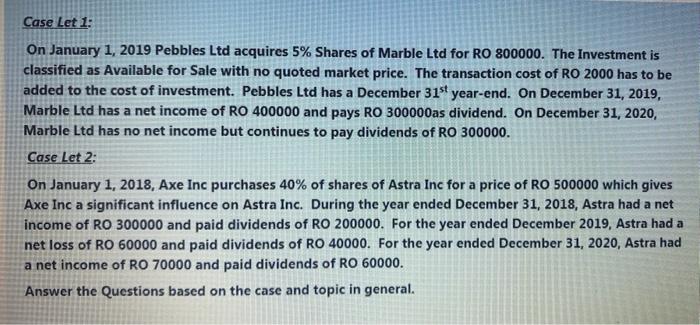

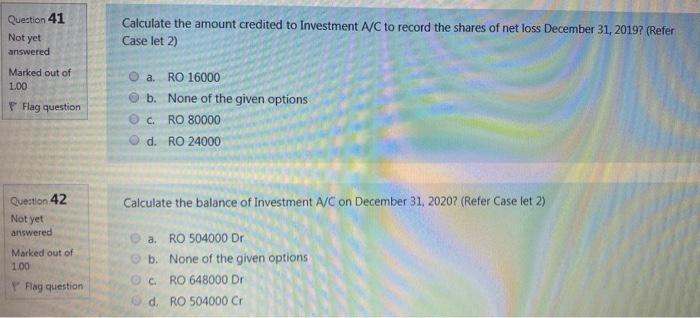

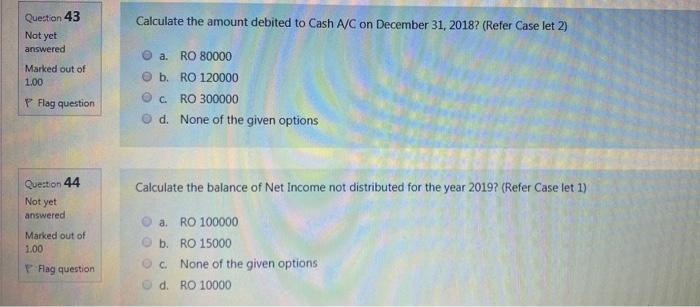

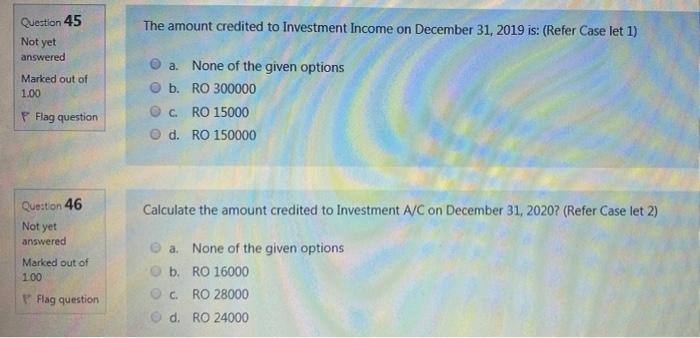

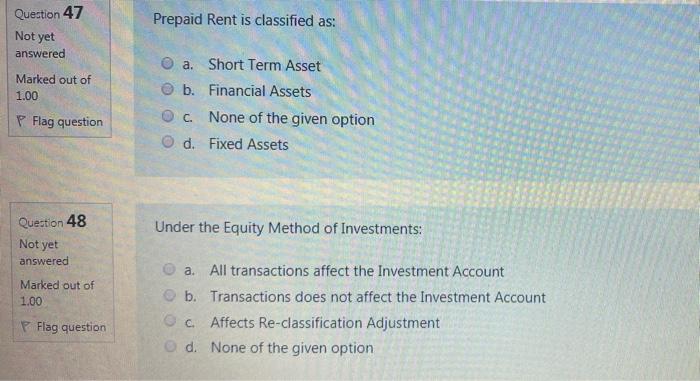

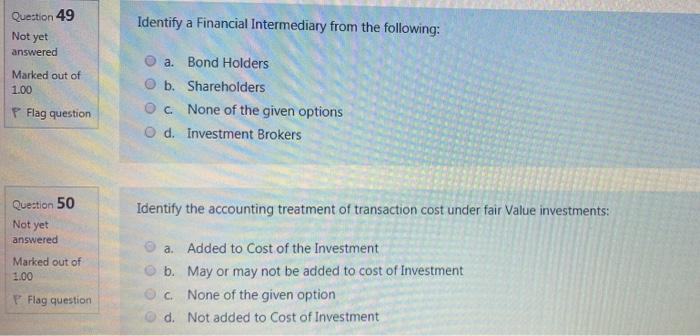

Case Let 1: On January 1, 2019 Pebbles Ltd acquires 5% Shares of Marble Ltd for RO 800000. The Investment is classified as Available for Sale with no quoted market price. The transaction cost of RO 2000 has to be added to the cost of investment. Pebbles Ltd has a December 31st year-end. On December 31, 2019, Marble Ltd has a net income of RO 400000 and pays RO 300000as dividend. On December 31, 2020, Marble Ltd has no net income but continues to pay dividends of RO 300000. Case Let 2: On January 1, 2018, Axe Inc purchases 40% of shares of Astra Inc for a price of RO 500000 which gives Axe Inc a significant influence on Astra Inc. During the year ended December 31, 2018, Astra had a net income of RO 300000 and paid dividends of RO 200000. For the year ended December 2019, Astra had a net loss of RO 60000 and paid dividends of RO 40000. For the year ended December 31, 2020, Astra had a net income of RO 70000 and paid dividends of RO 60000. Answer the Questions based on the case and topic in general. Question 41 Calculate the amount credited to Investment A/C to record the shares of net loss December 31, 20197 (Refer Case let 2) Not yet answered Marked out of 1.00 P Flag question a. RO 16000 b. None of the given options CRO 80000 d.RO 24000 Question 42 Calculate the balance of Investment A/C on December 31, 2020? (Refer Case let 2) Not yet answered Marked out of 1.00 Flag question a. RO 504000 DE b. None of the given options c RO 648000 Dr d. RO 504000 Cr Question 43 Calculate the amount debited to Cash A/C on December 31, 2018? (Refer Case let 2) Not yet answered Marked out of 1.00 a. RO 80000 b. RO 120000 RO 300000 d. None of the given options C. Flag question Question 44 Not yet answered Marked out of 1.00 Calculate the balance of Net Income not distributed for the year 2019? (Refer Case let 1) a RO 100000 b. RO 15000 OC. None of the given options d. RO 10000 Flag question Question 45 The amount credited to Investment Income on December 31, 2019 is: (Refer Case let 1) Not yet answered Marked out of 1.00 a. None of the given options b. RO 300000 OC RO 15000 d. RO 150000 F Flag question Question 46 Calculate the amount credited to Investment A/C on December 31, 2020? (Refer Case let 2) Not yet answered Marked out of 100 a. None of the given options b. RO 16000 C.RO 28000 d.RO 24000 Flag question Question 47 Prepaid Rent is classified as: Not yet answered Marked out of 1.00 a. Short Term Asset b. Financial Assets c None of the given option d. Fixed Assets P Flag question Under the Equity Method of Investments: Question 48 Not yet answered Marked out of 1.00 a. All transactions affect the Investment Account b. Transactions does not affect the Investment Account OcAffects Re-classification Adjustment d. None of the given option Flag question Question 49 Identify a Financial Intermediary from the following: Not yet answered Marked out of 1.00 a. Bond Holders O b. Shareholders OC None of the given options Od. Investment Brokers P Flag question Question 50 Identify the accounting treatment of transaction cost under fair Value investments: Not yet answered Marked out of 1.00 a. Added to Cost of the Investment b. May or may not be added to cost of Investment c. None of the given option d. Not added to Cost of Investment Flag question Case Let 1: On January 1, 2019 Pebbles Ltd acquires 5% Shares of Marble Ltd for RO 800000. The Investment is classified as Available for Sale with no quoted market price. The transaction cost of RO 2000 has to be added to the cost of investment. Pebbles Ltd has a December 31st year-end. On December 31, 2019, Marble Ltd has a net income of RO 400000 and pays RO 300000as dividend. On December 31, 2020, Marble Ltd has no net income but continues to pay dividends of RO 300000. Case Let 2: On January 1, 2018, Axe Inc purchases 40% of shares of Astra Inc for a price of RO 500000 which gives Axe Inc a significant influence on Astra Inc. During the year ended December 31, 2018, Astra had a net income of RO 300000 and paid dividends of RO 200000. For the year ended December 2019, Astra had a net loss of RO 60000 and paid dividends of RO 40000. For the year ended December 31, 2020, Astra had a net income of RO 70000 and paid dividends of RO 60000. Answer the Questions based on the case and topic in general. Question 41 Calculate the amount credited to Investment A/C to record the shares of net loss December 31, 20197 (Refer Case let 2) Not yet answered Marked out of 1.00 P Flag question a. RO 16000 b. None of the given options CRO 80000 d.RO 24000 Question 42 Calculate the balance of Investment A/C on December 31, 2020? (Refer Case let 2) Not yet answered Marked out of 1.00 Flag question a. RO 504000 DE b. None of the given options c RO 648000 Dr d. RO 504000 Cr Question 43 Calculate the amount debited to Cash A/C on December 31, 2018? (Refer Case let 2) Not yet answered Marked out of 1.00 a. RO 80000 b. RO 120000 RO 300000 d. None of the given options C. Flag question Question 44 Not yet answered Marked out of 1.00 Calculate the balance of Net Income not distributed for the year 2019? (Refer Case let 1) a RO 100000 b. RO 15000 OC. None of the given options d. RO 10000 Flag question Question 45 The amount credited to Investment Income on December 31, 2019 is: (Refer Case let 1) Not yet answered Marked out of 1.00 a. None of the given options b. RO 300000 OC RO 15000 d. RO 150000 F Flag question Question 46 Calculate the amount credited to Investment A/C on December 31, 2020? (Refer Case let 2) Not yet answered Marked out of 100 a. None of the given options b. RO 16000 C.RO 28000 d.RO 24000 Flag question Question 47 Prepaid Rent is classified as: Not yet answered Marked out of 1.00 a. Short Term Asset b. Financial Assets c None of the given option d. Fixed Assets P Flag question Under the Equity Method of Investments: Question 48 Not yet answered Marked out of 1.00 a. All transactions affect the Investment Account b. Transactions does not affect the Investment Account OcAffects Re-classification Adjustment d. None of the given option Flag question Question 49 Identify a Financial Intermediary from the following: Not yet answered Marked out of 1.00 a. Bond Holders O b. Shareholders OC None of the given options Od. Investment Brokers P Flag question Question 50 Identify the accounting treatment of transaction cost under fair Value investments: Not yet answered Marked out of 1.00 a. Added to Cost of the Investment b. May or may not be added to cost of Investment c. None of the given option d. Not added to Cost of Investment Flag