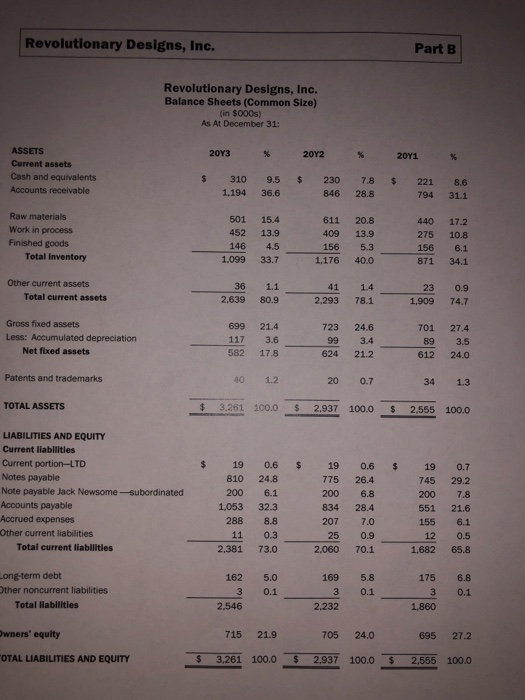

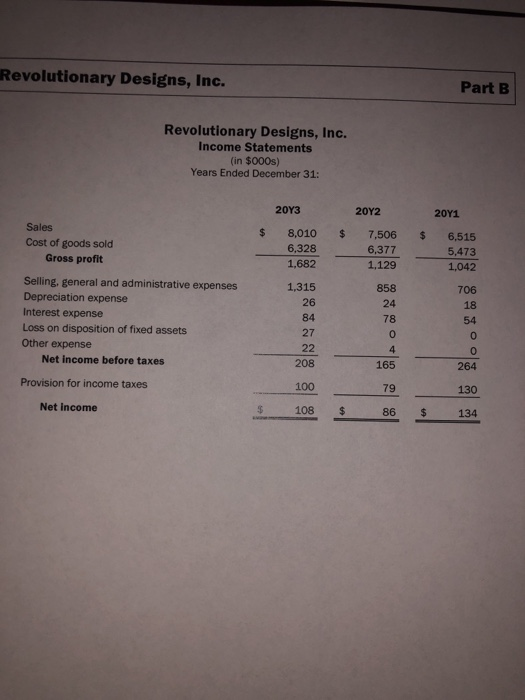

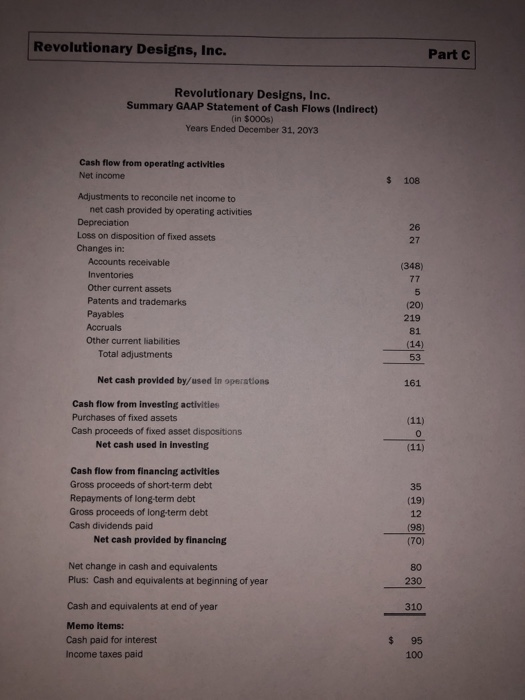

Case Link Question (4) Directions: Click the case link above and use the information provided in the financial statements and narrative of Revolutionary Designs, Part A, to answer this question: Which of the following contributed to Revolutionary Designs' improved gross profit margin in the most recent year? O Cheaper raw materials Better efficiencies OHigher unemployment in the region OHigher selling prices Revolutionary Designs, Inc. Part B Revolutionary Designs, Inc. Balance Sheets (Common Size) (in $000s) As At December 31: ASSETS 20Y3 % 20Y2 % 20Y1 % Current assets Cash and equivalents $ 310 9.5 230 7.8 221 8.6 Accounts receivable 1,194 36.6 846 28.8 794 31.1 Raw materials 501 15.4 611 20.8 440 17.2 Work in process Finished goods 452 13.9 409 13.9 275 10.8 146 4.5 156 5.3 156 6.1 Total Inventory 1,099 33.7 1,176 40.0 871 34.1 Other current assets 36 1.1 41 1.4 23 0.9 Total current assets 2,639 80.9 2.293 78.1 1,909 74.7 Gross fixed assets 699 21.4 723 24.6 701 27.4 Less: Accumulated depreciation 117 3.6 99 3.4 89 3.5 Net fixed assets 582 17.8 624 21.2 612 24.0 Patents and trademarks 40 1.2 20 0.7 34 1.3 TOTAL ASSETSS 3,261 100.0 2,937 100.0 2,555 100.0 LIABILITIES AND EQUITY Current liablities Current portion-LTD $ 19 0.6 $ 19 0.6 $ 19 0.7 Notes payable 810 24.8 775 26.4 745 29.2 Note payable Jack Newsome--subordinated 200 6.1 200 6.8 200 7.8 Accounts payable Accrued expenses Other current liabilities 1,053 32.3 834 28.4 551 21.6 288 8.8 207 7,0 155 6.1 11 0.3 25 0.9 12 0.5 Total current liabilities 2,381 73.0 2,060 70.1 1,682 65.8 Long-term debt 162 5.0 169 5.8 175 6.8 Other noncurrent liabilities 3 0.1 3 0.1 3 0.1 Total liabilities 2.546 2,232 1,860 Owners' equity 24.0 715 21.9 705 695 27.2 OTAL LIABILITIES AND EQUITY 2,937 100.0 2,555 100.0 3,261 100.0 8 % Revolutionary Designs, Inc. Part B Revolutionary Designs, Inc. Income Statements (in $000s) Years Ended December 31: 20Y3 20Y2 20Y1 Sales $ 8,010 $ 7,506 $ 6,515 Cost of goods sold Gross profit 6,328 6,377 5,473 1,682 1,129 1,042 Selling, general and administrative expenses Depreciation expense Interest expense 1,315 858 706 26 24 18 84 78 54 Loss on disposition of fixed assets Other expense 27 C 22 4 Net income before taxes 208 165 264 Provision for income taxes 100 79 130 Net income 108 $ 86 $ 134 Revolutionary Designs, Inc. Part C Revolutionary Designs, Inc. Summary GAAP Statement of Cash Flows (Indirect) (in $000s) Years Ended December 31, 20Y3 Cash flow from operating activities Net income 108 Adjustments to reconcile net income to net cash provided by operating activities Depreciation Loss on disposition of fixed assets 26 27 Changes in: Accounts receivable (348) Inventories 77 Other current assets Patents and trademarks (20) Payables 219 Accruals 81 Other current liabilities (14) Total adjustments 53 Net cash provided by/used In operations 161 Cash flow from investing activities Purchases of fixed assets (11) Cash proceeds of fixed asset dispositions Net cash used in investing (11) Cash flow from financing activities Gross proceeds of short-term debt Repayments of long-term debt Gross proceeds of long-term debt Cash dividends paid 35 (19) 12 (98) Net cash provided by financing (70) Net change in cash and equivalents 80 Plus: Cash and equivalents at beginning of year 230 Cash and equivalents at end of year 310 Memo items: Cash paid for interest $ 95 Income taxes paid 100