Answered step by step

Verified Expert Solution

Question

1 Approved Answer

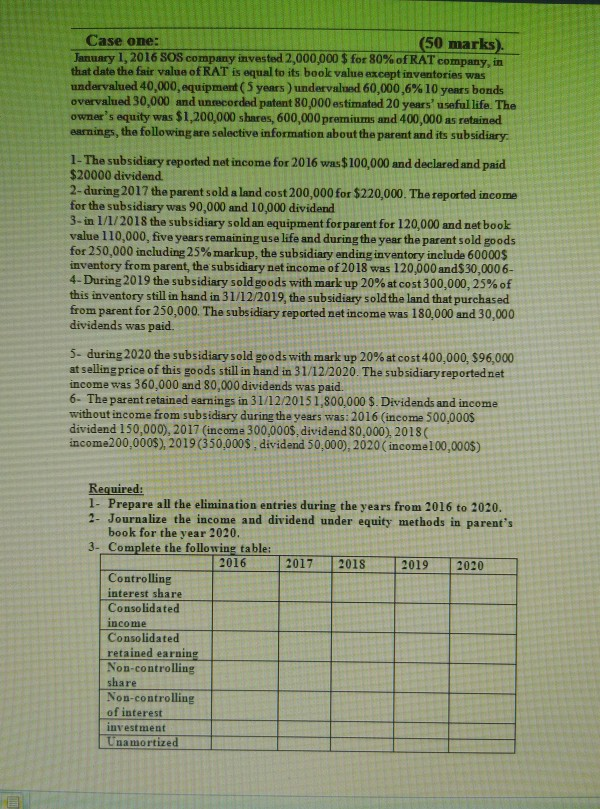

Case one: (50 marks). January 1, 2016 SOS company invested 2,000,000 $ for 80% of RAT company, in that date the fair value of RAT

Case one: (50 marks). January 1, 2016 SOS company invested 2,000,000 $ for 80% of RAT company, in that date the fair value of RAT is equal to its book value except inventories was undervalued 40,000, equipment (5 years) undervalued 60,000,6% 10 years bonds overvalued 30,000 and unrecorded patent 80,000 estimated 20 years' useful life. The owner's equity was $1,200,000 shares, 600,000 premiums and 400,000 as retained earnings, the following are selective information about the parent and its subsidiary. 1- The subsidiary reported net income for 2016 was $100,000 and declared and paid $20000 dividend 2-during 2017 the parent sold a land cost 200,000 for $220,000. The reported income for the subsidiary was 90,000 and 10,000 dividend 3-in 1/1/2018 the subsidiary sold an equipment for parent for 120,000 and netbook value 110,000, five years remaining use life and during the year the parent sold goods for 250,000 including 25% markup, the subsidiary ending inventory include 60000$ inventory from parent, the subsidiary net income of 2018 was 120,000 and $30,0006- 4-During 2019 the subsidiary sold goods with mark up 20% at cost 300,000, 25% of this inventory still in hand in 31/12/2019, the subsidiary sold the land that purchased from parent for 250,000. The subsidiary reported net income was 180,000 and 30,000 dividends was paid 5- during 2020 the subsidiary sold goods with mark up 20% at cost 400,000, $96,000 at selling price of this goods still in hand in 31/12/2020. The subsidiary reported net income was 360,000 and 80,000 dividends was paid. 6- The parent retained earnings in 31/12/20151,800,000 $. Dividends and income without income from subsidiary during the years was: 2016 (income 500,000$ dividend 150,000), 2017 (income 300,000$, dividend 80,000), 2018 income200,000$). 2019 (350,000$, dividend 50,000), 2020 income100,000$) Required: 1- Prepare all the elimination entries during the years from 2016 to 2020. 2 - Journalize the income and dividend under equity methods in parent's book for the year 2020. 3- Complete the following table: 2016 2017 2018 2019 2020 Controlling interest share Consolidated income Consolidated retained earning Non-controlling share Non-controlling of interest investment Unamortized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started