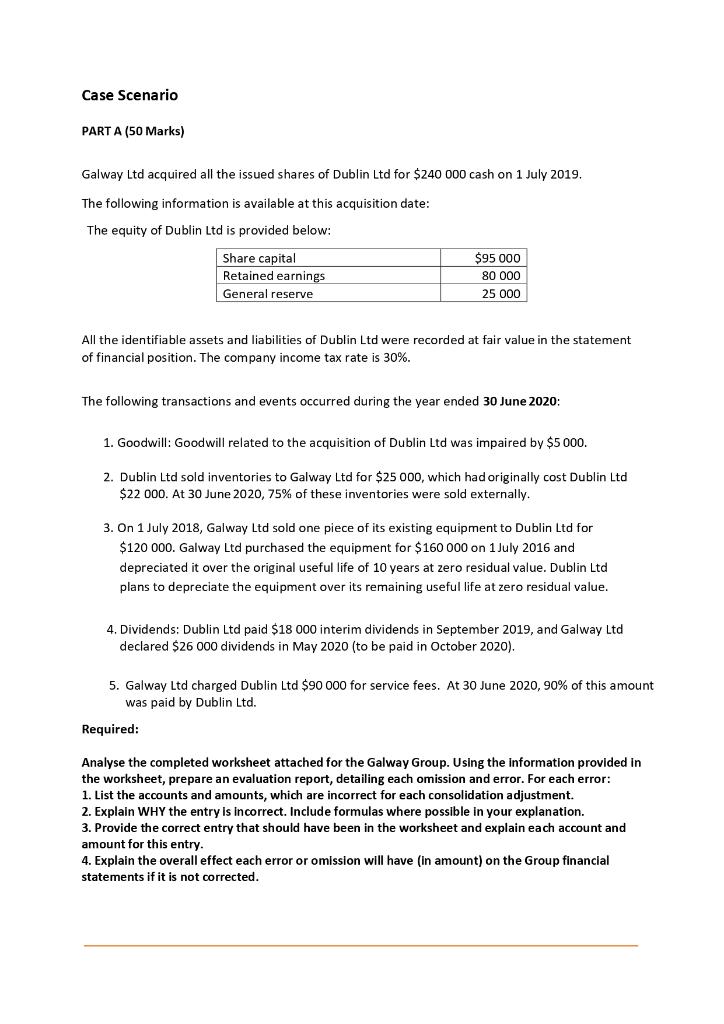

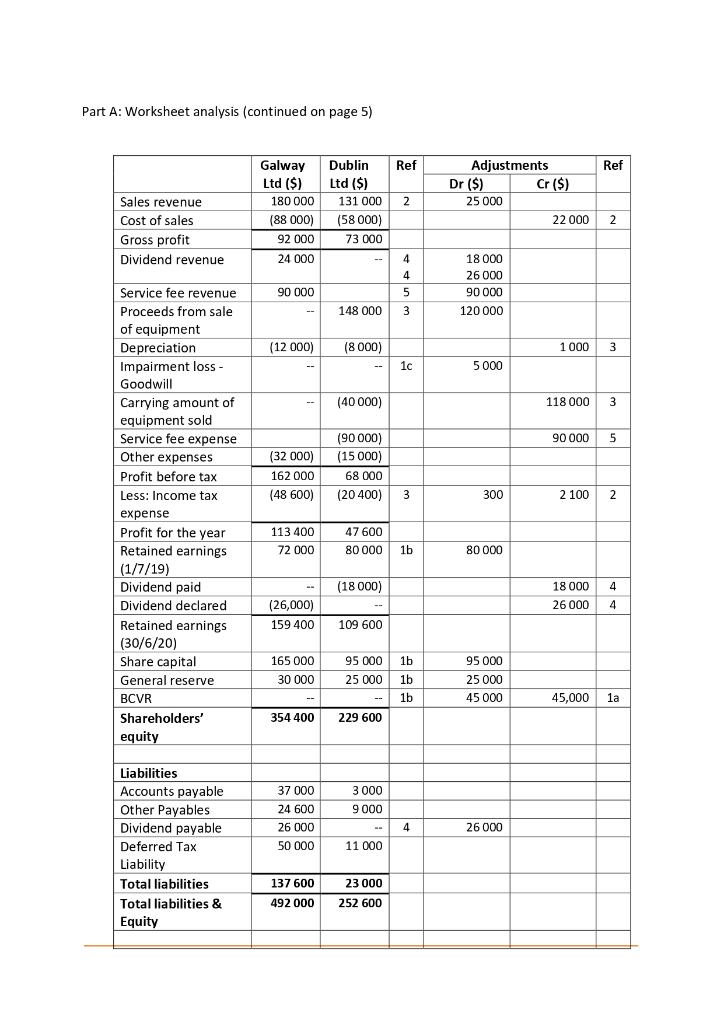

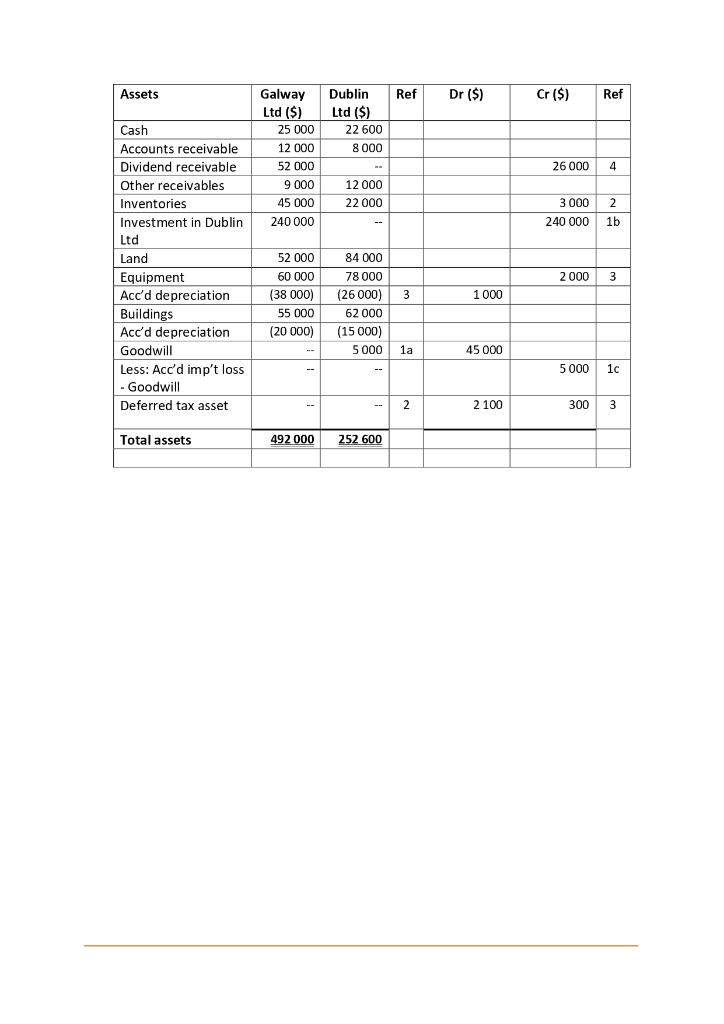

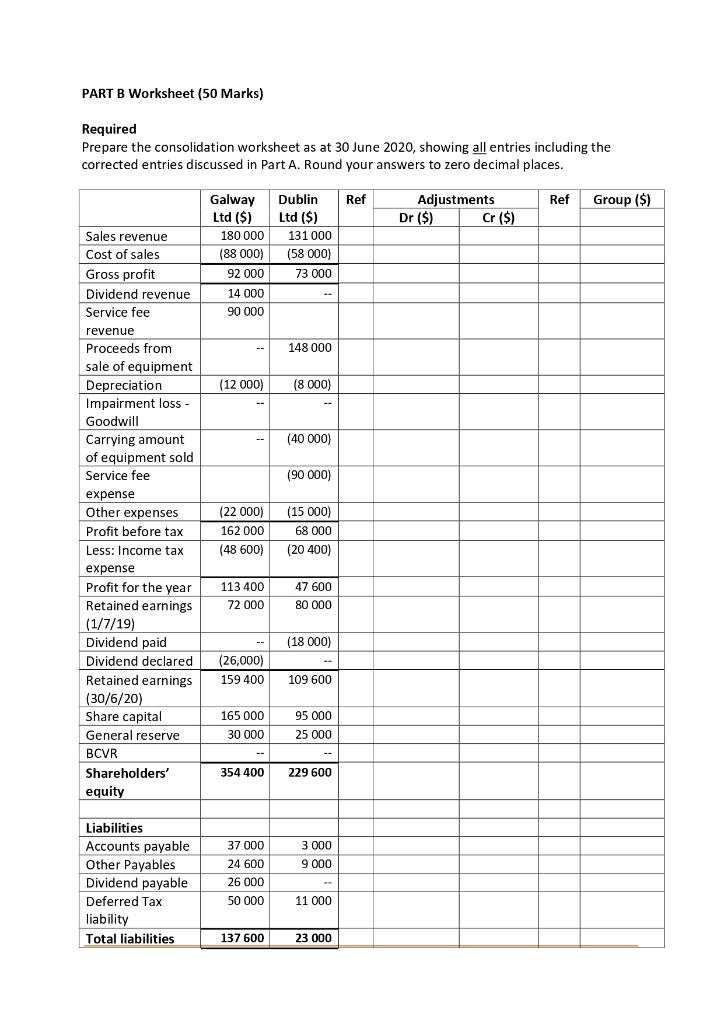

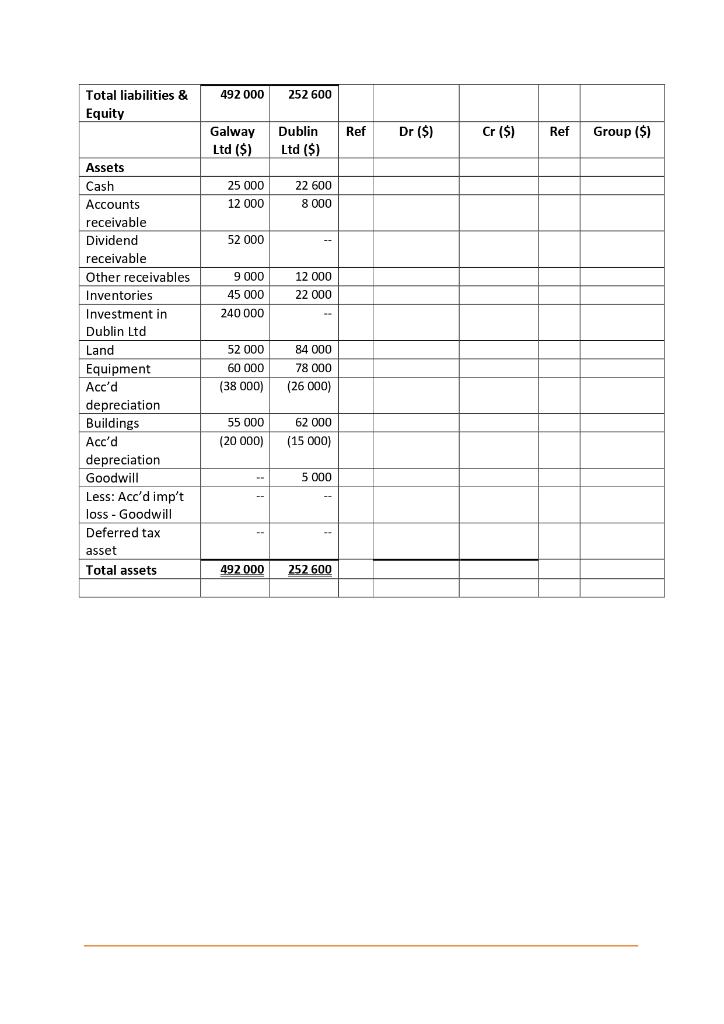

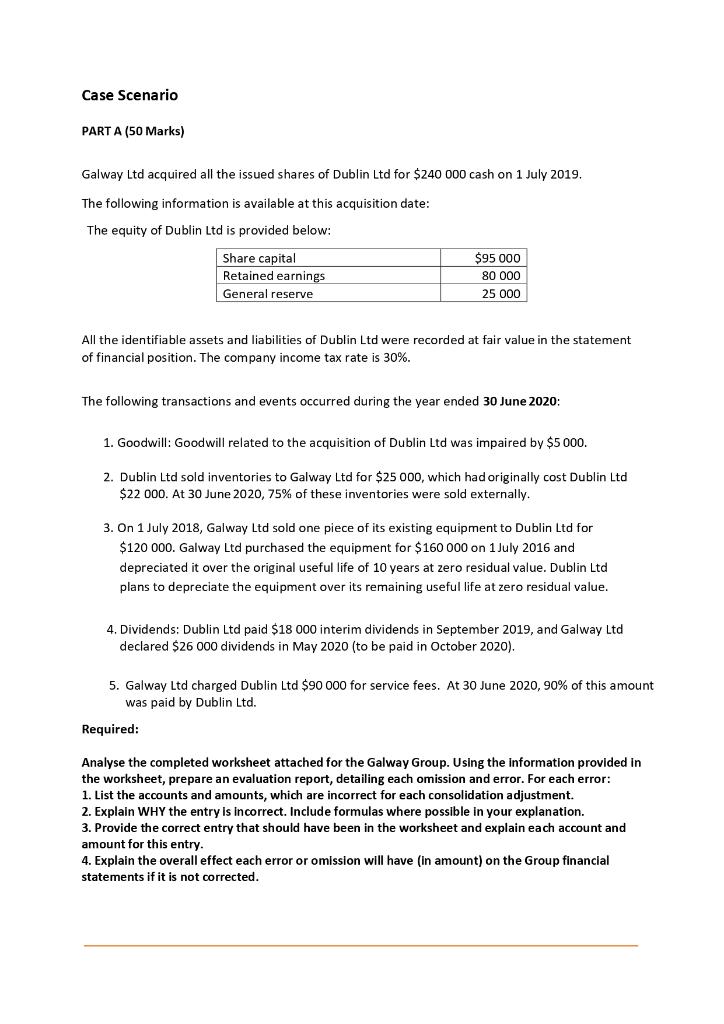

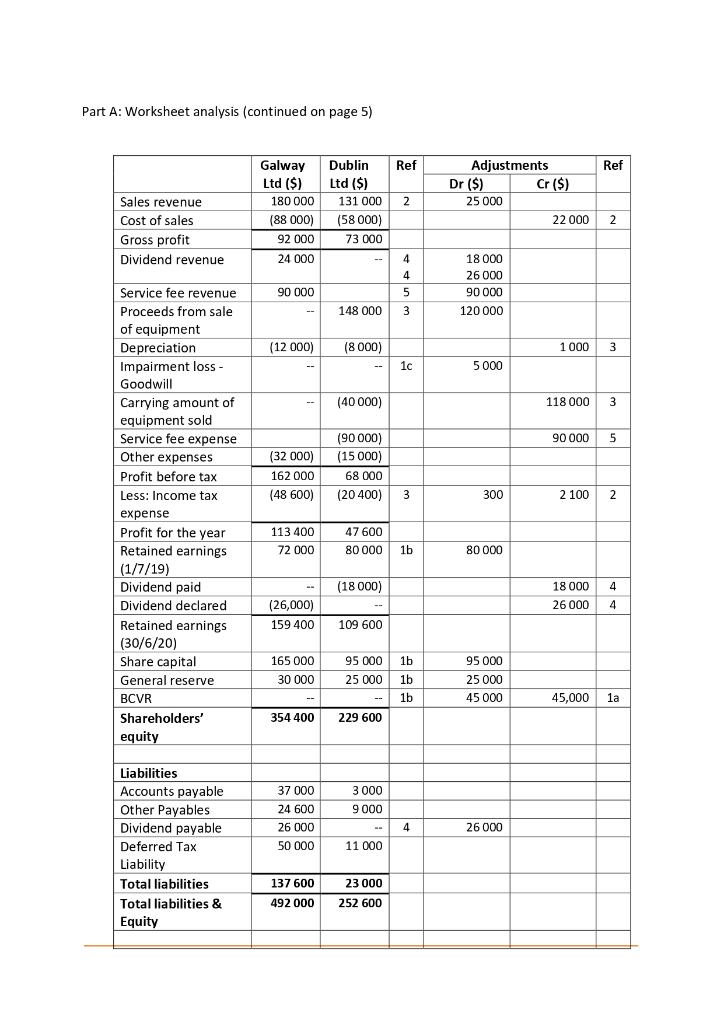

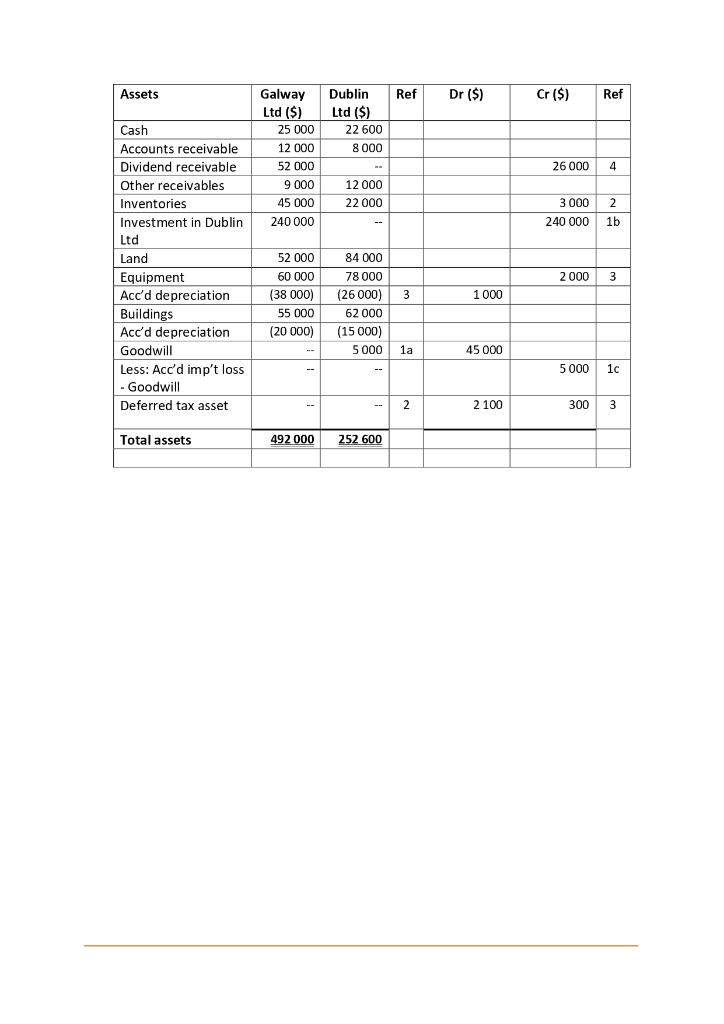

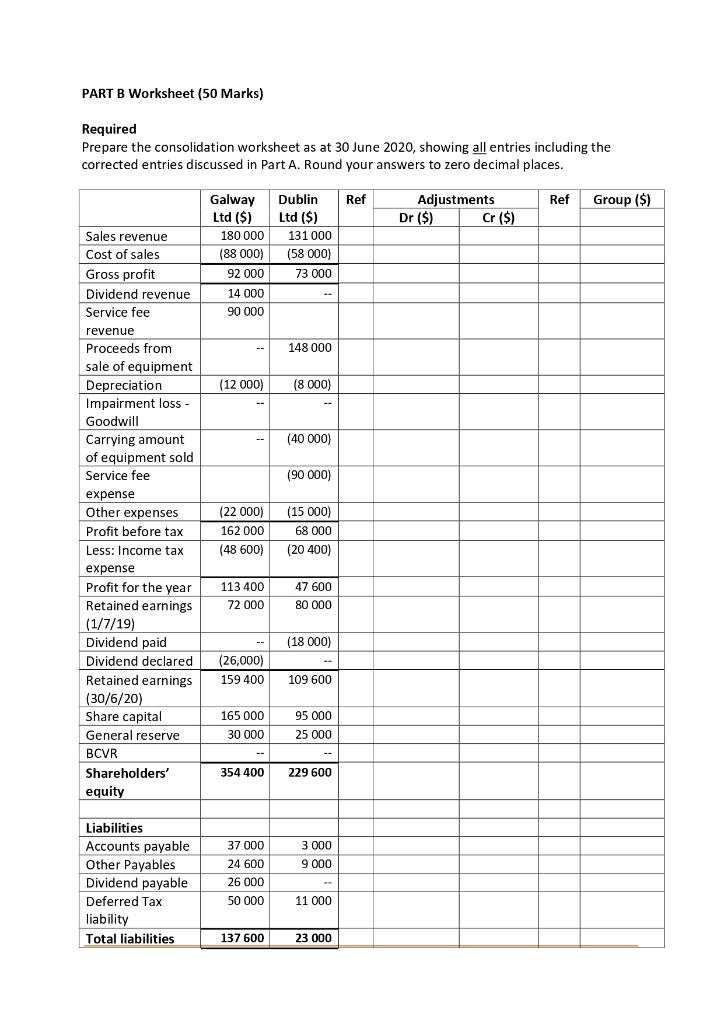

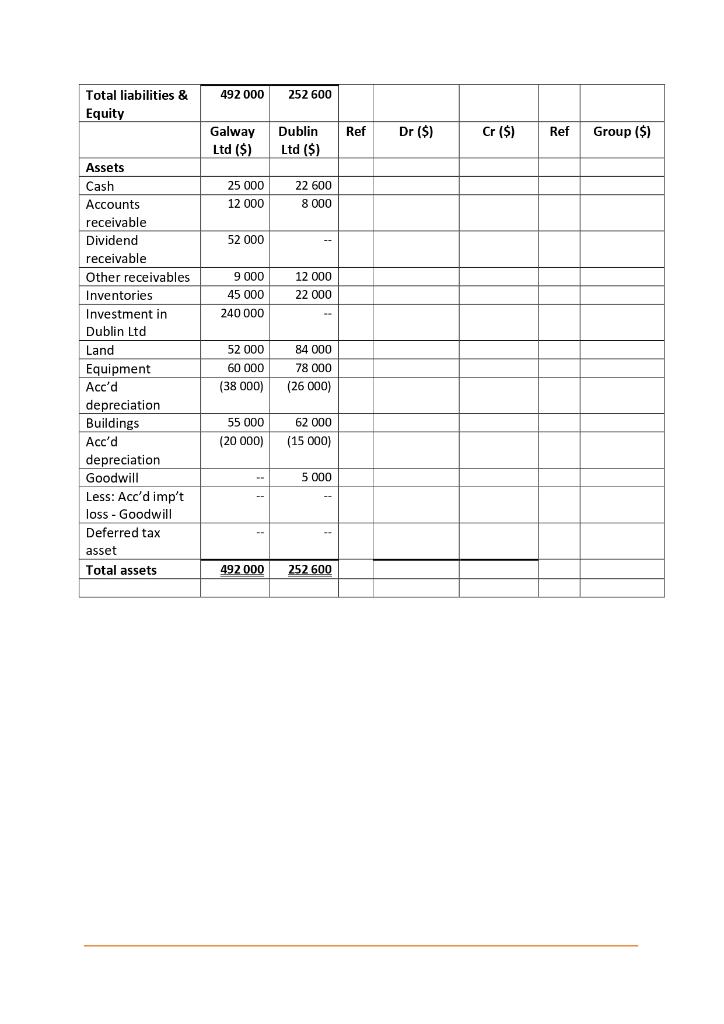

Case Scenario PART A (50 Marks) Galway Ltd acquired all the issued shares of Dublin Ltd for $240 000 cash on 1 July 2019, The following information is available at this acquisition date: The equity of Dublin Ltd is provided below: Share capital Retained earnings General reserve $95 000 80 000 25 000 All the identifiable assets and liabilities of Dublin Ltd were recorded at fair value in the statement of financial position. The company income tax rate is 30%. The following transactions and events occurred during the year ended 30 June 2020: 1. Goodwill: Goodwill related to the acquisition of Dublin Ltd was impaired by $5 000. 2. Dublin Ltd sold inventories to Galway Ltd for $25 000, which had originally cost Dublin Ltd $22 000. At 30 June 2020, 75% of these inventories were sold externally. 3. On 1 July 2018, Galway Ltd sold one piece of its existing equipment to Dublin Ltd for $120 000. Galway Ltd purchased the equipment for $160 000 on 1 July 2016 and depreciated it over the original useful life of 10 years at zero residual value. Dublin Ltd plans to depreciate the equipment over its remaining useful life at zero residual value. 4. Dividends: Dublin Ltd paid $18 000 interim dividends in September 2019, and Galway Ltd declared $26 000 dividends in May 2020 (to be paid in October 2020). 5. Galway Ltd charged Dublin Ltd $90 000 for service fees. At 30 June 2020, 90% of this amount was paid by Dublin Ltd. Required: Analyse the completed worksheet attached for the Galway Group. Using the information provided in the worksheet, prepare an evaluation report, detailing each omission and error. For each error: 1. List the accounts and amounts, which are incorrect for each consolidation adjustment. 2. Explain WHY the entry is incorrect. Include formulas where possible in your explanation. 3. Provide the correct entry that should have been in the worksheet and explain each account and amount for this entry. 4. Explain the overall effect each error or omission will have (In amount) on the Group financial statements if it is not corrected. Part A: Worksheet analysis (continued on page 5) Galway Ltd ($) 180 000 (88 000) 92 000 24 000 Adjustments Ref Dr ($) Cr ($) 25 000 22000 2 Sales revenue Cost of sales Gross profit Dividend revenue Dublin Ref Ltd ($) 131 000 2 (58 000) 73 000 4 4 5 148 000 3 90 000 18 000 26 000 90 000 120 000 (12 000) (8 000) 1000 3 1c 5 000 (40 000) 118 000 3 90 000 5 (32 000) 162 000 (48 600) (90 000) (15 000) 68 000 (20400) 3 300 2 100 2 Service fee revenue Proceeds from sale of equipment Depreciation Impairment loss - Goodwill Carrying amount of equipment sold Service fee expense Other expenses Profit before tax Less: Income tax expense Profit for the year Retained earnings (1/7/19) Dividend paid Dividend declared Retained earnings (30/6/20) Share capital General reserve BCVR Shareholders' equity 113 400 72 000 47 600 80 000 1b 80 000 (18000) 18 000 4 26000 4 (26,000) 159 400 109 600 1b 165 000 30 000 95 000 25 000 1b 95 000 25 000 45 000 1b 45,000 1a 354 400 229 600 3 000 9 000 37 000 24 600 26 000 50 000 4 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax Liability Total liabilities Total liabilities & Equity 26 000 11 000 137 600 23 000 252 600 492 000 Assets Ref Dr ($) Cr ($) Ref Dublin Ltd ($) 22 600 8 8 000 Galway Ltd ($) 25 000 12 000 52 000 9 000 45 000 240 000 26000 4 12 000 22 000 3 000 2 240 000 1b Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Dublin Ltd Land Equipment Acc'd depreciation Buildings Acc'd depreciation Goodwill Less: Acc'd imp't loss - Goodwill Deferred tax asset 2 000 3 52 000 60 000 (38 000) ) 55 000 (20 000) 1 000 84 000 78 000 ( (26000) 3 62 000 (15 000) 5 000 La 45 000 -- 5 000 1c 2 2 100 300 3 Total assets 492 000 252 600 PART B Worksheet (50 Marks) Required Prepare the consolidation worksheet as at 30 June 2020, showing all entries including the corrected entries discussed in Part A. Round your answers to zero decimal places. Ref Ref Group ($) Adjustments Dr ($) Cr ($) Galway Dublin Ltd ($) Ltd ($) 180 000 131 000 (88 000) (58 000) 92 000 73 000 14 000 90 000 148 000 Sales revenue Cost of sales Gross profit Dividend revenue Service fee revenue Proceeds from sale of equipment Depreciation Impairment loss - Goodwill Carrying amount of equipment sold Service fee (12 000) (8 000) (40 000) (90 000) expense (22 000) 162 000 (48 600) (15 000) 68 000 (20 400) 113 400 72 000 47 600 80 000 (18 000) Other expenses Profit before tax Less: Income tax expense Profit for the year Retained earnings (1/7/19) Dividend paid Dividend declared Retained earnings (30/6/20) Share capital General reserve BCVR Shareholders' equity (26,000) 159 400 109 600 165 000 30 000 95 000 25 000 354 400 229 600 3 000 9 000 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax liability Total liabilities 37 000 24 600 26 000 50 000 11 000 137 600 23 000 492 000 252 600 Total liabilities & Equity Ref Dr ($) Cr ($) Ref Group ($) Galway Ltd ($) Dublin Ltd ($) 25 000 12 000 22 600 8 000 52 000 9 000 45 000 240 000 12 000 22 000 Assets Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Dublin Ltd Land Equipment Acc'd depreciation Buildings Acc'd depreciation Goodwill Less: Acc'd imp't loss - Goodwill Deferred tax asset Total assets 52 000 60 000 (38 000) ) 84 000 78 000 (26 000) 55 000 (20 000) 62 000 (15 000) 5 000 -- 492 000 252 600 Case Scenario PART A (50 Marks) Galway Ltd acquired all the issued shares of Dublin Ltd for $240 000 cash on 1 July 2019, The following information is available at this acquisition date: The equity of Dublin Ltd is provided below: Share capital Retained earnings General reserve $95 000 80 000 25 000 All the identifiable assets and liabilities of Dublin Ltd were recorded at fair value in the statement of financial position. The company income tax rate is 30%. The following transactions and events occurred during the year ended 30 June 2020: 1. Goodwill: Goodwill related to the acquisition of Dublin Ltd was impaired by $5 000. 2. Dublin Ltd sold inventories to Galway Ltd for $25 000, which had originally cost Dublin Ltd $22 000. At 30 June 2020, 75% of these inventories were sold externally. 3. On 1 July 2018, Galway Ltd sold one piece of its existing equipment to Dublin Ltd for $120 000. Galway Ltd purchased the equipment for $160 000 on 1 July 2016 and depreciated it over the original useful life of 10 years at zero residual value. Dublin Ltd plans to depreciate the equipment over its remaining useful life at zero residual value. 4. Dividends: Dublin Ltd paid $18 000 interim dividends in September 2019, and Galway Ltd declared $26 000 dividends in May 2020 (to be paid in October 2020). 5. Galway Ltd charged Dublin Ltd $90 000 for service fees. At 30 June 2020, 90% of this amount was paid by Dublin Ltd. Required: Analyse the completed worksheet attached for the Galway Group. Using the information provided in the worksheet, prepare an evaluation report, detailing each omission and error. For each error: 1. List the accounts and amounts, which are incorrect for each consolidation adjustment. 2. Explain WHY the entry is incorrect. Include formulas where possible in your explanation. 3. Provide the correct entry that should have been in the worksheet and explain each account and amount for this entry. 4. Explain the overall effect each error or omission will have (In amount) on the Group financial statements if it is not corrected. Part A: Worksheet analysis (continued on page 5) Galway Ltd ($) 180 000 (88 000) 92 000 24 000 Adjustments Ref Dr ($) Cr ($) 25 000 22000 2 Sales revenue Cost of sales Gross profit Dividend revenue Dublin Ref Ltd ($) 131 000 2 (58 000) 73 000 4 4 5 148 000 3 90 000 18 000 26 000 90 000 120 000 (12 000) (8 000) 1000 3 1c 5 000 (40 000) 118 000 3 90 000 5 (32 000) 162 000 (48 600) (90 000) (15 000) 68 000 (20400) 3 300 2 100 2 Service fee revenue Proceeds from sale of equipment Depreciation Impairment loss - Goodwill Carrying amount of equipment sold Service fee expense Other expenses Profit before tax Less: Income tax expense Profit for the year Retained earnings (1/7/19) Dividend paid Dividend declared Retained earnings (30/6/20) Share capital General reserve BCVR Shareholders' equity 113 400 72 000 47 600 80 000 1b 80 000 (18000) 18 000 4 26000 4 (26,000) 159 400 109 600 1b 165 000 30 000 95 000 25 000 1b 95 000 25 000 45 000 1b 45,000 1a 354 400 229 600 3 000 9 000 37 000 24 600 26 000 50 000 4 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax Liability Total liabilities Total liabilities & Equity 26 000 11 000 137 600 23 000 252 600 492 000 Assets Ref Dr ($) Cr ($) Ref Dublin Ltd ($) 22 600 8 8 000 Galway Ltd ($) 25 000 12 000 52 000 9 000 45 000 240 000 26000 4 12 000 22 000 3 000 2 240 000 1b Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Dublin Ltd Land Equipment Acc'd depreciation Buildings Acc'd depreciation Goodwill Less: Acc'd imp't loss - Goodwill Deferred tax asset 2 000 3 52 000 60 000 (38 000) ) 55 000 (20 000) 1 000 84 000 78 000 ( (26000) 3 62 000 (15 000) 5 000 La 45 000 -- 5 000 1c 2 2 100 300 3 Total assets 492 000 252 600 PART B Worksheet (50 Marks) Required Prepare the consolidation worksheet as at 30 June 2020, showing all entries including the corrected entries discussed in Part A. Round your answers to zero decimal places. Ref Ref Group ($) Adjustments Dr ($) Cr ($) Galway Dublin Ltd ($) Ltd ($) 180 000 131 000 (88 000) (58 000) 92 000 73 000 14 000 90 000 148 000 Sales revenue Cost of sales Gross profit Dividend revenue Service fee revenue Proceeds from sale of equipment Depreciation Impairment loss - Goodwill Carrying amount of equipment sold Service fee (12 000) (8 000) (40 000) (90 000) expense (22 000) 162 000 (48 600) (15 000) 68 000 (20 400) 113 400 72 000 47 600 80 000 (18 000) Other expenses Profit before tax Less: Income tax expense Profit for the year Retained earnings (1/7/19) Dividend paid Dividend declared Retained earnings (30/6/20) Share capital General reserve BCVR Shareholders' equity (26,000) 159 400 109 600 165 000 30 000 95 000 25 000 354 400 229 600 3 000 9 000 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax liability Total liabilities 37 000 24 600 26 000 50 000 11 000 137 600 23 000 492 000 252 600 Total liabilities & Equity Ref Dr ($) Cr ($) Ref Group ($) Galway Ltd ($) Dublin Ltd ($) 25 000 12 000 22 600 8 000 52 000 9 000 45 000 240 000 12 000 22 000 Assets Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Dublin Ltd Land Equipment Acc'd depreciation Buildings Acc'd depreciation Goodwill Less: Acc'd imp't loss - Goodwill Deferred tax asset Total assets 52 000 60 000 (38 000) ) 84 000 78 000 (26 000) 55 000 (20 000) 62 000 (15 000) 5 000 -- 492 000 252 600