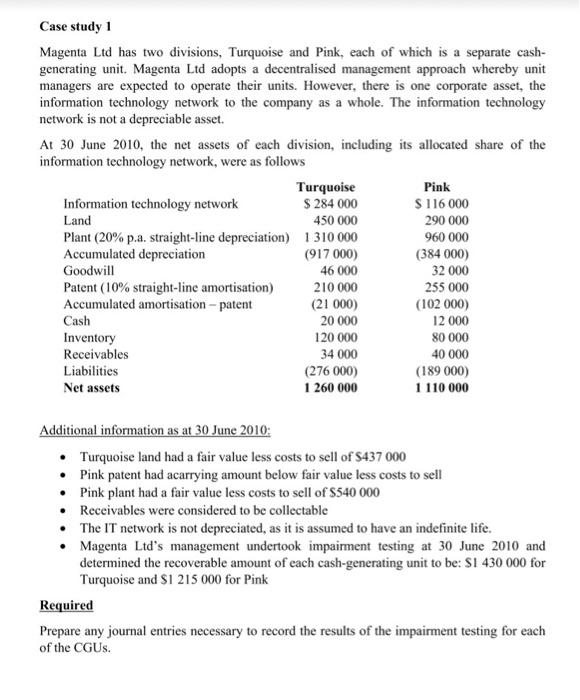

Case study 1 Magenta Ltd has two divisions, Turquoise and Pink, each of which is a separate cashgenerating unit. Magenta Ltd adopts a decentralised management approach whereby unit managers are expected to operate their units. However, there is one corporate asset, the information technology network to the company as a whole. The information technology network is not a depreciable asset. At 30 June 2010, the net assets of each division, including its allocated share of the information technology network, were as follows Additional information as at 30 June 2010: - Turquoise land had a fair value less costs to sell of $437000 - Pink patent had acarrying amount below fair value less costs to sell - Pink plant had a fair value less costs to sell of $540000 - Receivables were considered to be collectable - The IT network is not depreciated, as it is assumed to have an indefinite life. - Magenta Ltd's management undertook impairment testing at 30 June 2010 and determined the recoverable amount of each cash-generating unit to be: \$1 430000 for Turquoise and $1215000 for Pink Required Prepare any journal entries necessary to record the results of the impairment testing for each of the CGUs. Case study 1 Magenta Ltd has two divisions, Turquoise and Pink, each of which is a separate cashgenerating unit. Magenta Ltd adopts a decentralised management approach whereby unit managers are expected to operate their units. However, there is one corporate asset, the information technology network to the company as a whole. The information technology network is not a depreciable asset. At 30 June 2010, the net assets of each division, including its allocated share of the information technology network, were as follows Additional information as at 30 June 2010: - Turquoise land had a fair value less costs to sell of $437000 - Pink patent had acarrying amount below fair value less costs to sell - Pink plant had a fair value less costs to sell of $540000 - Receivables were considered to be collectable - The IT network is not depreciated, as it is assumed to have an indefinite life. - Magenta Ltd's management undertook impairment testing at 30 June 2010 and determined the recoverable amount of each cash-generating unit to be: \$1 430000 for Turquoise and $1215000 for Pink Required Prepare any journal entries necessary to record the results of the impairment testing for each of the CGUs