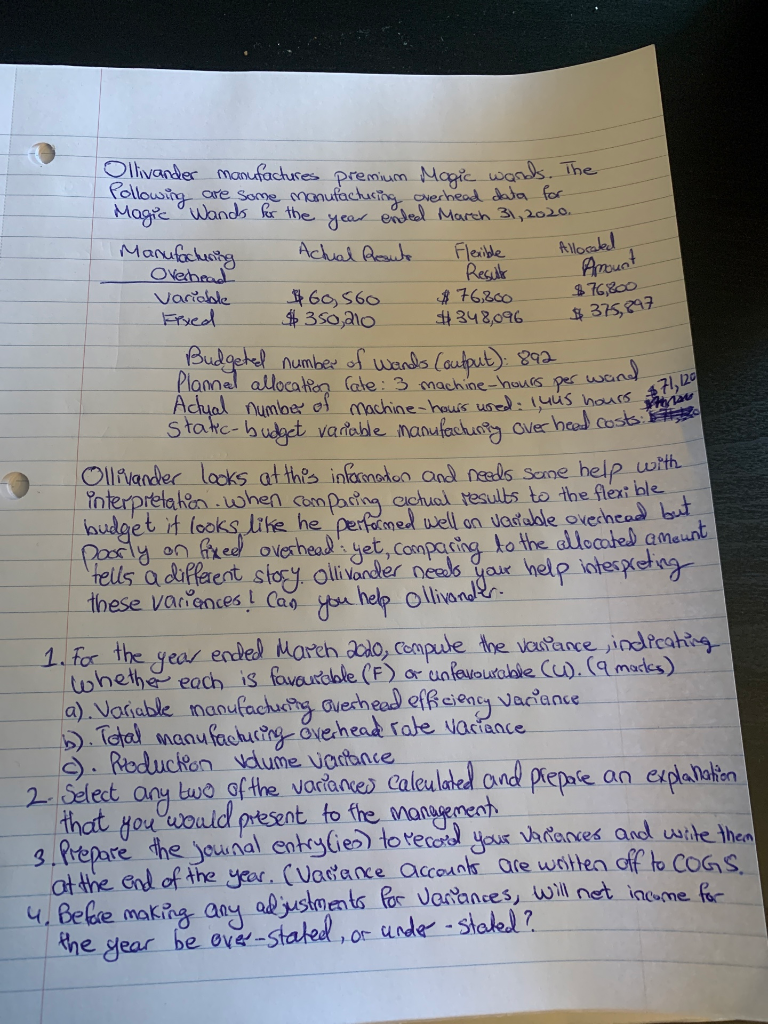

Case Study 1: Ollivander's (19 marks) Ollivander needs your help interpreting these variances! Can you help Ollivander? 1. For the year ended March 2020, compute the variance, indicating whether each is favourable (F) or unfavourable (U). (9 marks) a. Variable manufacturing overhead efficiency variance b. Total manufacturing overhead rate variance C. Production volume variance 2. Select any two of the variances calculated and prepare an explanation (or possible explanation) that you would present to the management team. (4 marks) Suggestion: select two of the more significant variances OR select two that are related to each other, 3. Prepare the journal entry(ies) to record your variances and write them off at the end of the year. Assume the variance accounts are written off to Cost of Goods Sold. Show your work. (5 marks) 4. Before making any adjustments for variances, (ie. The journal entry you wrote in part 3) will net income for the year be over-stated, or under-stated? (1 mark) Ollivander manufactures premium Magic wards. The Collowing are some manufacturing overhead data for Magic Wands for the year ended March 31, 2020. Manufachering Achial Route Flexible Allocated Overhead Results Variable 360, 56o # 76,800 Irxed $350,210 $348,096 $375,847 Amount $ 76,800 Budgeted number of wands Coutput): 892 Plannel allocation rate: 3 machine-hours per wan Actual number of machine-hours ured: 14u5 hours Stakic-budget variable manufactuning over heed to $71,120 urs now Ollivander looks at this information and needs some help will interpretation when comparing elctual results to the flexible budget it looks like he performed well on variable overhead but poorly on fixed overhead: yet, comparing to the allocated amount tells a different story Ollivander needs your help interpreting these variances ! Cas you help ollivanter. 1. For the year ended March 2020, compute the variance indicating whether each is favourable (F) or unfavourable (u). (9 marks) a). Variable manufacturing overhead efficiency variance b). Total manufacturing overhead rate Naciance c). Production volume variance 2. Select any two of the variances Caleulated and prepare an explanation that you would present to the management 3. Prepare the journal entrylies) to record your variances and write then at the end of the year. (Vacance accounts are written off to COGS 4. Before making any adjustments for Variances, will net income for the year be over-stated, or under stated? Case Study 1: Ollivander's (19 marks) Ollivander needs your help interpreting these variances! Can you help Ollivander? 1. For the year ended March 2020, compute the variance, indicating whether each is favourable (F) or unfavourable (U). (9 marks) a. Variable manufacturing overhead efficiency variance b. Total manufacturing overhead rate variance C. Production volume variance 2. Select any two of the variances calculated and prepare an explanation (or possible explanation) that you would present to the management team. (4 marks) Suggestion: select two of the more significant variances OR select two that are related to each other, 3. Prepare the journal entry(ies) to record your variances and write them off at the end of the year. Assume the variance accounts are written off to Cost of Goods Sold. Show your work. (5 marks) 4. Before making any adjustments for variances, (ie. The journal entry you wrote in part 3) will net income for the year be over-stated, or under-stated? (1 mark) Ollivander manufactures premium Magic wards. The Collowing are some manufacturing overhead data for Magic Wands for the year ended March 31, 2020. Manufachering Achial Route Flexible Allocated Overhead Results Variable 360, 56o # 76,800 Irxed $350,210 $348,096 $375,847 Amount $ 76,800 Budgeted number of wands Coutput): 892 Plannel allocation rate: 3 machine-hours per wan Actual number of machine-hours ured: 14u5 hours Stakic-budget variable manufactuning over heed to $71,120 urs now Ollivander looks at this information and needs some help will interpretation when comparing elctual results to the flexible budget it looks like he performed well on variable overhead but poorly on fixed overhead: yet, comparing to the allocated amount tells a different story Ollivander needs your help interpreting these variances ! Cas you help ollivanter. 1. For the year ended March 2020, compute the variance indicating whether each is favourable (F) or unfavourable (u). (9 marks) a). Variable manufacturing overhead efficiency variance b). Total manufacturing overhead rate Naciance c). Production volume variance 2. Select any two of the variances Caleulated and prepare an explanation that you would present to the management 3. Prepare the journal entrylies) to record your variances and write then at the end of the year. (Vacance accounts are written off to COGS 4. Before making any adjustments for Variances, will net income for the year be over-stated, or under stated