Question

Case Study 1 You have been appointed as a financial analyst for the Axis International Company, a profitable retail company. The director of Finance, belonging

Case Study 1\ You have been appointed as a financial analyst for the Axis International Company, a profitable retail company. The director of Finance, belonging to the capital budgeting division has asked you to analyze a replacement decision that the company is currently facing. As a financial analyst you need to evaluate the proposed acquisition of a new machine for the company's R&D department. The existing equipment can run for five more years, producing annual revenues of Rs 60,000 with cash expenses of Rs 30,000 . The book value of the existing machine is Rs20,000, and it is being depreciated at Rs 4,000 a year down to a zero book value. The machine can be sold today to net Rs 8,000 , or it can be sold in five years to net Rs5,000. The replacement machine will cost Rs50,000, plus an additional Rs20,000 to transport it to the factory and install it. It will generate revenues of Rs 90,000 , but will have cash expenses of Rs40,000. It will be depreciated using the straight-line method over five years when it will have a book of Rs20,000 and cash salvage value of Rs25,000. Using the equipment requires an increase in net working of Rs5,000. The tax rate of the company is 50 percent, and cost of capital is 10 percent. What is the differential after-tax cash flow for this proposal? Determine the NPV, IRR and PI of the proposal. Should the company replace the machine or continue with the existing one?

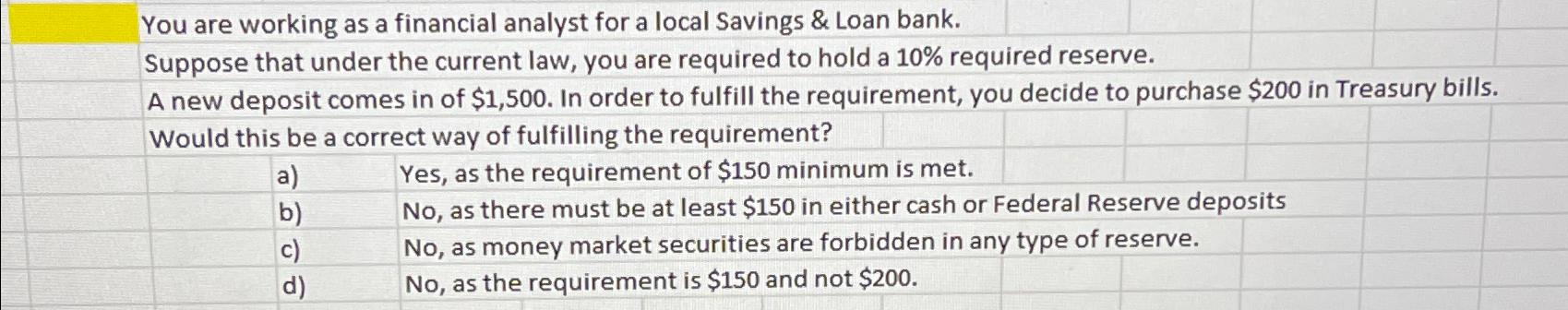

Question: You are working as a financial analyst for a local Savings & Loan bank.\\nSuppose that under the current law, you are required to hold a 10% required reserve.\\nA new deposit comes in of $1,500. In order to fulfill the requirement, you decide to purchase $200 in Treasury bills. Would this be a correct way of fulfilling the

You are working as a financial analyst for a local Savings

&Loan bank.\\nSuppose that under the current law, you are required to hold a

10%required reserve.\\nA new deposit comes in of

$1,500. In order to fulfill the requirement, you decide to purchase

$200in Treasury bills. Would this be a correct way of fulfilling the requirement?\\na) Yes, as the requirement of

$150minimum is met.\\nb) No, as there must be at least

$150in either cash or Federal Reserve deposits\\nc) No, as money market securities are forbidden in any type of reserve.\\nd) No, as the requirement is

$150and not

$200.

You are working as a financial analyst for a local Savings & Loan bank. Suppose that under the current law, you are required to hold a 10% required reserve. A new deposit comes in of $1,500. In order to fulfill the requirement, you decide to purchase $200 in Treasury bills. Would this be a correct way of fulfilling the requirement? a) Yes, as the requirement of $150 minimum is met. b) No, as there must be at least $150 in either cash or Federal Reserve deposits c) No, as money market securities are forbidden in any type of reserve. d) No, as the requirement is $150 and not $200.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started