You just began a position as a financial accountant at Peyton Approved. In this role, your first task is to prepare the companys financials for

| You just began a position as a financial accountant at Peyton Approved. In this role, your first task is to prepare the company’s financials for the year-end audit. Additionally, the company is interested in expanding its business within the next year. They would like your support in assessing their ability to meet their goals. | |||||||||||

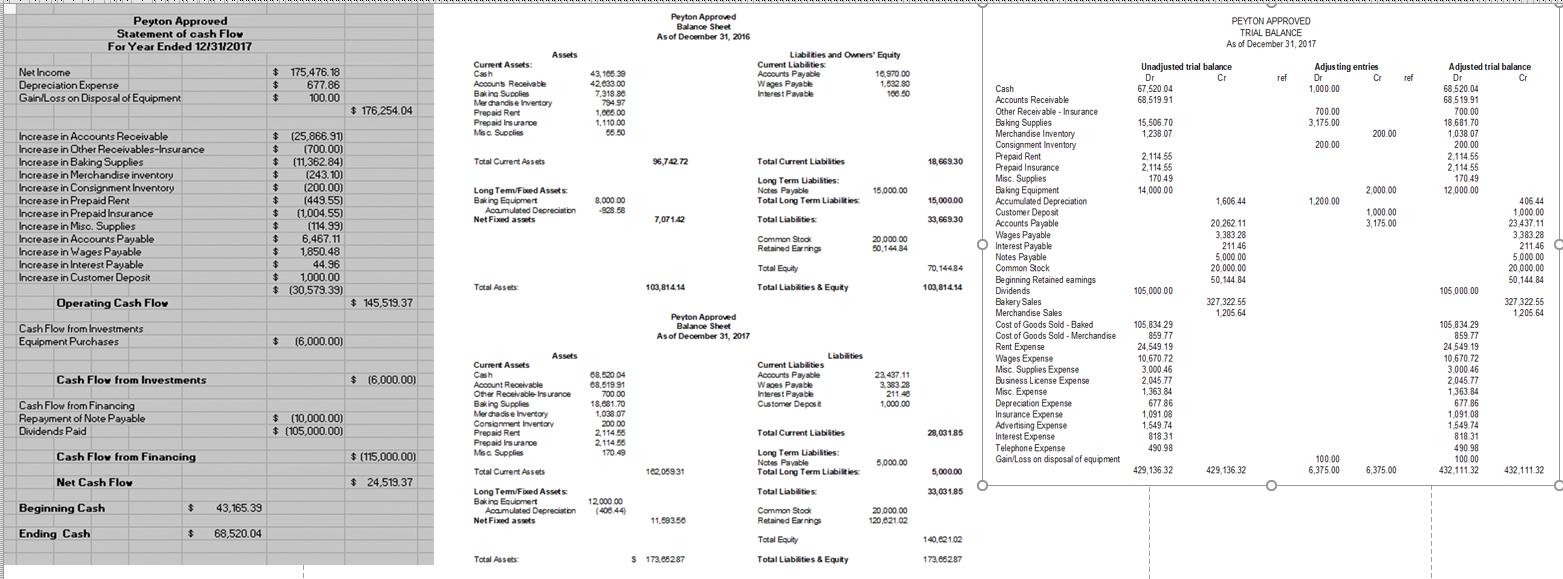

| TRIAL BALANCE 2017 TAB | |||||||||||

| Using the Peyton Approved financial data (see bottom of page): | |||||||||||

| Create the necessary adjusting journal entries. Use the REF column to reference the entry to each event | |||||||||||

| Complete the adjusted trial balance | |||||||||||

| REVISED FINANCIAL STATEMENTS | |||||||||||

| Using the preliminary financial statements (yellow tabs) and the Trial Balance 2017, prepare the following statements: | |||||||||||

| Balance Sheet (BS 2017 Revised tab) | |||||||||||

| Income Statement (IS 2017 Revised tab) | |||||||||||

| Retained Earnings Statement (RE 2017 Revised tab) | |||||||||||

| Statement of Cash Flows (CF 2017 Revised tab) | |||||||||||

The company is planning to open another location in 2018. Using the Preliminary Statements as a base, prepare pro forma (budgeted) financials for 2018 for the new location using the following information.

Peyton Approved Statement of cash Flow For Year Ended 12/31/2017 Net Income Depreciation Expense Gain/Loss on Disposal of Equipment Increase in Accounts Receivable Increase in Other Receivables-Insurance Increase in Baking Supplies Increase in Merchandise inventory Increase in Consignment Inventory Increase in Prepaid Rent Increase in Prepaid Insurance Increase in Miso. Supplies Increase in Accounts Payable Increase in Wages Payable Increase in Interest Payable Increase in Customer Deposit Operating Cash Flow Cash Flow from Investments Equipment Purchases Cash Flow from Investments Cash Flow from Financing Repayment of Note Payable Dividends Paid Cash Flow from Financing Net Cash Flow Beginning Cash Ending Cash $ $ 43,165.39 68,520.04 $ $ $ $ $ (25,866.91) (700.00) (11,362.84) (243.10) (200.001 (449.55) (1,004.55) (114.99) 6.467.11 1,850.48 44.96 $ 1,000.00 $ (30,579.39) 175,476.18 677.86 100.00 $ $ $ $ $ $ $ $ $ $ (6,000.00) $(10,000.00) $ (105,000.00) $ 176,254.04 $ 145,519.37 $ (6,000.00) $(115,000.00) $ 24,519.37 Current Assets: Cash Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Total Current Assets Long Tem/Fixed Assets Baking Equipment Assets Accumulated Depreciation Net Fixed assets Total Assets Current Assets Cash Assets Account Receivable Other Receivable Insurance Baking Supplies Merchadise Inventory Consignment Inventory Prepaid Rent Prepaid Insurance Msc Supplies Total Current Assets Long Tem/Fixed Assets laking Equipmert Total Assets Accumulated Depreciation Net Fixed assets 43,105.39 42,633.00 7,318 90 794.97 1,005.00 1,110.00 55.50 8,000.00 -908.58 68,520.04 68,519.91 700.00 18,061.70 1,038.07 200 00 2,114.56 2,114.55 170.49 12,000.00 (400.44) Peyton Approved Balance Sheet As of December 31, 2016 96,742.72 7,07142 103,81414 Peyton Approved Balance Sheet As of December 31, 2017 162,059.31 11.593.50 $ 173.66287 Liabilities and Owners Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Total Current Liabilities Long Term Liabilities: Notes Payable Total Long Term Liabilities: Total Liabilities: Common Stock Retained Earnings Total Equity Total Liabilities & Equity Current Liabilities Accounts Payable Wages Payable Interest Payable Customer Deposit Liabilities Total Current Liabilities Long Term Liabilities: Notes Payable Total Long Term Liabilities: Total Liabilities Common Stock Retained Earnings Total Equity Total Liabilities & Equity 16,970.00 1,532.80 106.50 15,000.00 20,000.00 50,144.84 23,437,11 3,383.28 211.40 1,000.00 5,000.00 20.000.00 120,621.02 18,669.30 15,000.00 33,669.30 70,14484 103,81414 28,03185 5,000.00 33,031.85 140.621.02 173,65287 Cash Accounts Receivable Other Receivable-Insurance. Baking Supplies Merchandise Inventory Consignment Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Baking Equipment Accumulated Depreciation Customer Deposit Accounts Payable Wages Payable O Interest Payable Notes Payable Common Stock Beginning Retained earnings Dividends Bakery Sales Merchandise Sales Cost of Goods Sold-Baked Cost of Goods Sold - Merchandise Rent Expense Wages Expense Misc Supplies Expense Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Gain/Loss on disposal of equipment Unadjusted trial balance Dr Cr 67,520.04 68,519.91 15,506.70 1,238.07 2,114.55 2,114 55 170.49 14,000.00 105,000.00 105,834 29 859.77 24,549.19 10,670.72 3,000 46 2.045.77 1.363.84 677 86 1,091.08 1,549.74 818.31 490.98 PEYTON APPROVED TRIAL BALANCE As of December 31, 2017 429,136.32 1,606.44 20,262.11 3.383.28 211.46 5,000.00 20,000.00 50,144.84 327,322.55 1,205.64 429,136.32 ref Adjusting entries Cr Dr 1,000.00 700.00 3,175.00 200.00 1,200.00 100.00 6,375.00 200.00 2.000.00 1.000.00 3.175.00 6,375.00 ref Cr Adjusted trial balance Dr 68.520.04 68,519.91 700.00 18.681.70 1.038.07 200.00 2,114.55 2,114.55 170.49 12,000.00 105,000.00 105.834.29 859.77 24,549.19 10.670.72 3.000.46 2,045.77 1,363.84 677.86 1,091.08 1,549.74 818 31 490.98 100.00 432.111.32 406 44 1,000.00 23.437.11 3.383 28 211.46 5.000.00 20,000.00 50,144.84 327,322.55 1205.64 432,111.32

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Required solution is given below ANSWER Calculations for 2016 Current RatioWorking Capital Values ta...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started