Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a fashion jewelry buyer for a major specialty store. On November 1, one of enhance your holiday gifts-to-go assortment. The vendor has

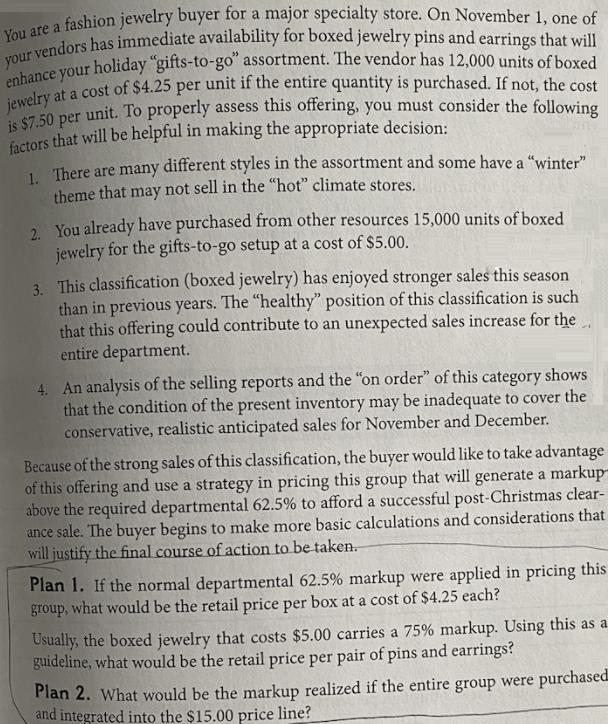

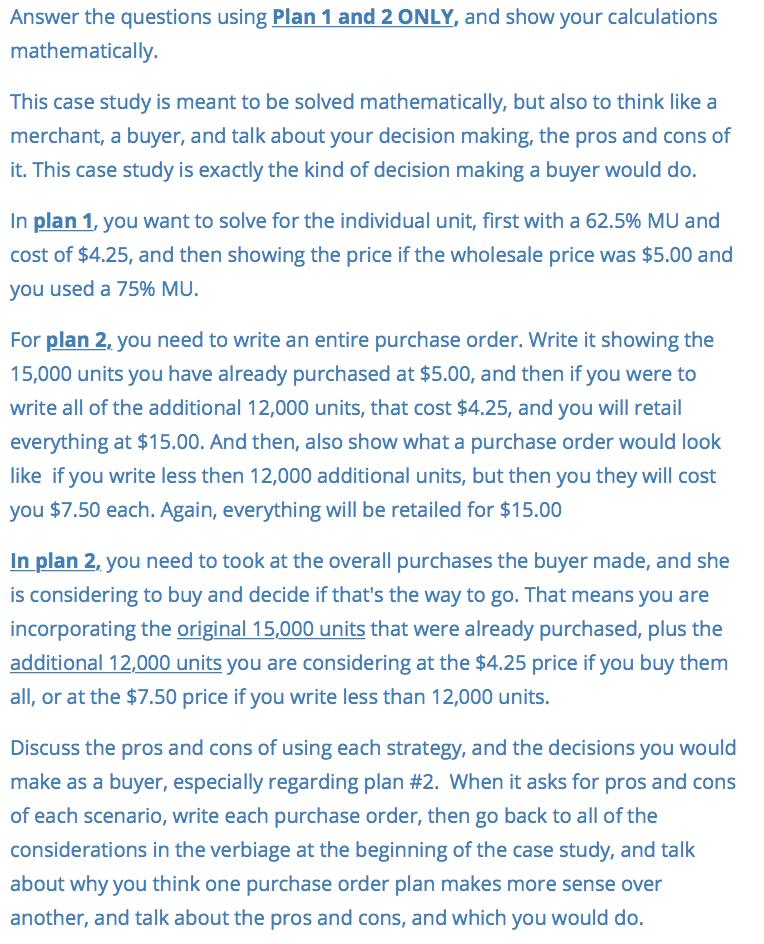

You are a fashion jewelry buyer for a major specialty store. On November 1, one of enhance your holiday "gifts-to-go" assortment. The vendor has 12,000 units of boxed jewelry at a cost of $4.25 per unit if the entire quantity is purchased. If not, the cost is $7.50 per unit. To properly assess this offering, you must consider the following factors that will be helpful in making the appropriate decision: 1. There are many different styles in the assortment and some have a "winter" theme that may not sell in the "hot" climate stores. 2. You already have purchased from other resources 15,000 units of boxed jewelry for the gifts-to-go setup at a cost of $5.00. 3. This classification (boxed jewelry) has enjoyed stronger sales this season than in previous years. The "healthy" position of this classification is such that this offering could contribute to an unexpected sales increase for the entire department. 4. An analysis of the selling reports and the "on order" of this category shows that the condition of the present inventory may be inadequate to cover the conservative, realistic anticipated sales for November and December. Because of the strong sales of this classification, the buyer would like to take advantage of this offering and use a strategy in pricing this group that will generate a markup above the required departmental 62.5% to afford a successful post-Christmas clear- ance sale. The buyer begins to make more basic calculations and considerations that will justify the final course of action to be taken. Plan 1. If the normal departmental 62.5% markup were applied in pricing this group, what would be the retail price per box at a cost of $4.25 each? Usually, the boxed jewelry that costs $5.00 carries a 75% markup. Using this as a guideline, what would be the retail price per pair of pins and earrings? Plan 2. What would be the markup realized if the entire group were purchased and integrated into the $15.00 price line? Answer the questions using Plan 1 and 2 ONLY, and show your calculations mathematically. This case study is meant to be solved mathematically, but also to think like a merchant, a buyer, and talk about your decision making, the pros and cons of it. This case study is exactly the kind of decision making a buyer would do. In plan 1, you want to solve for the individual unit, first with a 62.5% MU and cost of $4.25, and then showing the price if the wholesale price was $5.00 and you used a 75% MU. For plan 2, you need to write an entire purchase order. Write it showing the 15,000 units you have already purchased at $5.00, and then if you were to write all of the additional 12,000 units, that cost $4.25, and you will retail everything at $15.00. And then, also show what a purchase order would look like if you write less then 12,000 additional units, but then you they will cost you $7.50 each. Again, everything will be retailed for $15.00 In plan 2, you need to took at the overall purchases the buyer made, and she is considering to buy and decide if that's the way to go. That means you are incorporating the original 15,000 units that were already purchased, plus the additional 12,000 units you are considering at the $4.25 price if you buy them all, or at the $7.50 price if you write less than 12,000 units. Discuss the pros and cons of using each strategy, and the decisions you would make as a buyer, especially regarding plan #2. When it asks for pros and cons of each scenario, write each purchase order, then go back to all of the considerations in the verbiage at the beginning of the case study, and talk about why you think one purchase order plan makes more sense over another, and talk about the pros and cons, and which you would do.

Step by Step Solution

★★★★★

3.61 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

In Plan 1 if the unit cost is 425 and the markup is 625 then the retail price is Retail Price Unit Cost x 1 Markup Percentage Retail Price 425 x 1 062...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started