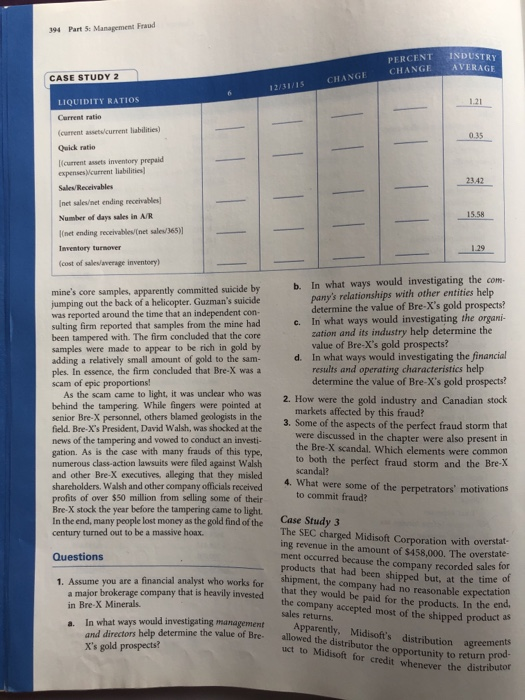

Case study 2, questions 1-4

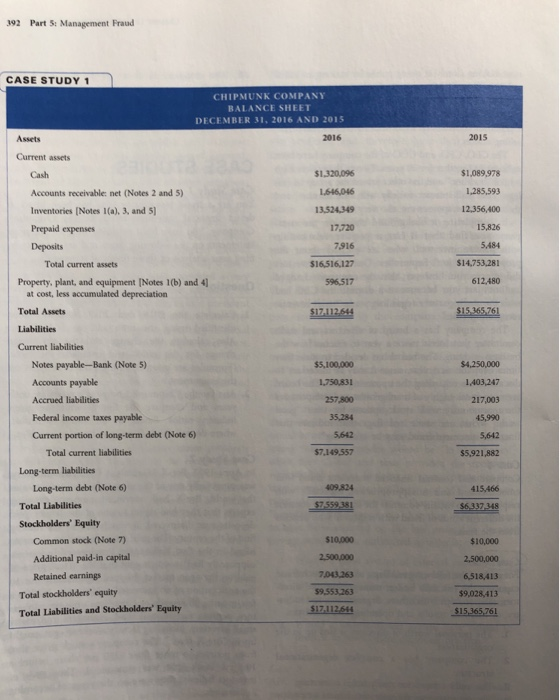

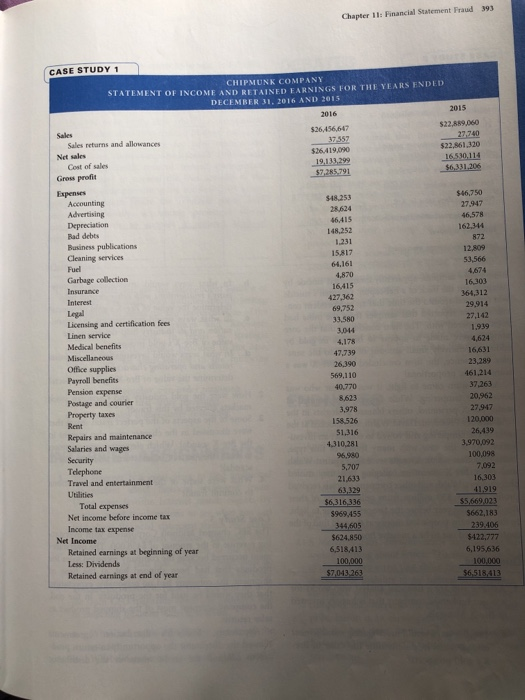

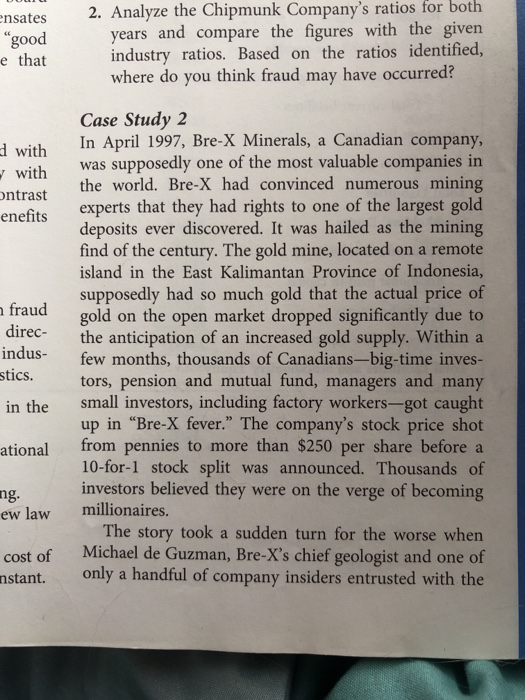

for both 2. Analyze the Chipmunk Company's ratios nsates "good e that years and compare the figures with the given industry ratios. Based on the ratios identified, where do you think fraud may have occurred? Case Study 2 d with In April 1997, Bre-X Minerals, a Canadian company, was supposedly one of the most valuable companies in the world. Bre-X had convinced numerous mining enefits experts that they had rights to one of the largest gold deposits ever discovered. It was hailed as the mining find of the century. The gold mine, located on a remote island in the East Kalimantan Province of Indonesia, supposedly had so much gold that the actual price of fraud gold on the open market dropped significantly due to rec the anticipation of an increased gold supply. Within a indus-few months, thousands of Canadians-big-time inves- stics. tors, pension and mutual fund, managers and many in the small investors, including factory workers-got caught up in "Bre-X fever." The company's stock price shot ational from pennies to more than $250 per share before a 10-for-1 stock split was announced. Thousands of investors believed they were on the verge of becoming with ntrast ng. ew law millionaires cost of nstant. The story took a sudden turn for the worse when Michael de Guzman, Bre-X's chief geologist and one of only a handful of company insiders entrusted with the 392 Part S: Management Fraud CASE STUDY CHIPMUNK COMPANY BALANCE SHEET DECEMBER 31, 2016 AND 2015 Assets 2016 2015 Current assets $1,089,978 1,285,593 12,356,400 15,826 5,484 $14.753.281 612,480 $1.320.096 Cash Accounts receivable: net (Notes 2 and 5) Inventories [Notes I(a), 3, and 5 Prepaid expenses Deposits 13.524,349 7,720 7.916 $16516.127 Total current assets Property, plant, and equipment (Notes 1(b) and 4 at cost, less accumulated depreciation Total Assets Liabilities Current liabilities Notes payable-Bank (Note 5) Accounts payable Accrued liabilities Federal income taxes payable Current portion of long-term debt (Note 6) $5,100,000 1,750831 257 800 217,003 45,990 5,642 $5,921,882 35,284 5,642 Total current liabilities $7,149 557 Long-term liabilities Long-term debt (Note 6) Total Liabilities Stockholders' Equity 409 824 415,466 Common stock (Note 7) Additional paid-in capital Retained earnings $10,000 $10,000 2,500,000 6518,413 $9,028,413 7043263 Total stockholders' equity Total Liabilities and Stockholders' Equity 194 Part 5: Management Fraud PERCENT NDUSTRY CHANGE CHANGE AVERAGE CASE STUDY 2 LIQUIDITY RATIos Corrent ratio (current assets/current liabilities) Quick ratio I(current assets inventory prepaid expensesMcurrent liabilities] Sales/ Receivables Inet saleset ending receivables Number of days sales in A/R 0.35 l(net ending receivables/(net saleu/365)] Inventory turnover (cost of sales/average inventory) b. In what ways would investigating the com mine's core samples, apparently committed suicide by jumping out the back of a helicopter. Guzman's suicide was reported around the time that an independent con- sulting firm reported that samples from the mine had been tampered with. The firm concluded that the core samples were made to appear to be rich in gold by adding a relatively small amount of gold to the sam- ples. In essence, the firm concluded that Bre-X was a pany's relationships with other entities help determine the value of Bre-X's gold prospects? In what ways would investigating the organi- c. zation and its industry help determine the value of Bre-X's gold prospects? In what ways would investigating the financial determine the value of Bre-X's gold prospects? d. results and operating characteristics help scam of epic proportions! As the scam came to light, it was uncdlear who was . How were the gold industry and Canadian stoo field. Bre-X's President, David Walsh, was shocked at the 3. Some of the aspects of the perfect fraud storm that to both the perfect fraud storm and the Bre-X 4. What were some of the perpetrators' motivations behind the tampering While fingers were pointed at markets affected by this fraud? news of the tampering and vowed to conduct an investi-were discussed in the chapter were also present in the Bre-X scandal. Which elements were common gation. As is the case with many frauds of this type, numerous class-action lawsuits were filed against Walsh and other Bre-X executives, alleging that they misled shareholders. Walsh and other company officials received profits of over $50 million from selling some of their Bre-X stock the year before the tampering came to light. In the end, many people lost money as the gold find of the scandal? century turned out to be a massive hoax. Questions 1. Assume to commit fraud? Case Study 3 ment occurred because the company recorded sales tor The SEC charged Midisoft Corporation with overstat- ing revenue in the amount of $458,000. The overstate- products that had been shipped but, at the time shi of who works for a major brokerage company that is heavily invested pment, the company had no reasonable expectation that they would be sales returns. you are a financial analyst paid for the products. In the in Bre-X Minerals. investigating management Apparently. Midisoft's distribution agreements .In what ways Would ter mine the value of Bre allowed the distributor the opportunity to return prod- X's gold prospects? uct to Midisoft for credit whenever the distributor for both 2. Analyze the Chipmunk Company's ratios nsates "good e that years and compare the figures with the given industry ratios. Based on the ratios identified, where do you think fraud may have occurred? Case Study 2 d with In April 1997, Bre-X Minerals, a Canadian company, was supposedly one of the most valuable companies in the world. Bre-X had convinced numerous mining enefits experts that they had rights to one of the largest gold deposits ever discovered. It was hailed as the mining find of the century. The gold mine, located on a remote island in the East Kalimantan Province of Indonesia, supposedly had so much gold that the actual price of fraud gold on the open market dropped significantly due to rec the anticipation of an increased gold supply. Within a indus-few months, thousands of Canadians-big-time inves- stics. tors, pension and mutual fund, managers and many in the small investors, including factory workers-got caught up in "Bre-X fever." The company's stock price shot ational from pennies to more than $250 per share before a 10-for-1 stock split was announced. Thousands of investors believed they were on the verge of becoming with ntrast ng. ew law millionaires cost of nstant. The story took a sudden turn for the worse when Michael de Guzman, Bre-X's chief geologist and one of only a handful of company insiders entrusted with the 392 Part S: Management Fraud CASE STUDY CHIPMUNK COMPANY BALANCE SHEET DECEMBER 31, 2016 AND 2015 Assets 2016 2015 Current assets $1,089,978 1,285,593 12,356,400 15,826 5,484 $14.753.281 612,480 $1.320.096 Cash Accounts receivable: net (Notes 2 and 5) Inventories [Notes I(a), 3, and 5 Prepaid expenses Deposits 13.524,349 7,720 7.916 $16516.127 Total current assets Property, plant, and equipment (Notes 1(b) and 4 at cost, less accumulated depreciation Total Assets Liabilities Current liabilities Notes payable-Bank (Note 5) Accounts payable Accrued liabilities Federal income taxes payable Current portion of long-term debt (Note 6) $5,100,000 1,750831 257 800 217,003 45,990 5,642 $5,921,882 35,284 5,642 Total current liabilities $7,149 557 Long-term liabilities Long-term debt (Note 6) Total Liabilities Stockholders' Equity 409 824 415,466 Common stock (Note 7) Additional paid-in capital Retained earnings $10,000 $10,000 2,500,000 6518,413 $9,028,413 7043263 Total stockholders' equity Total Liabilities and Stockholders' Equity 194 Part 5: Management Fraud PERCENT NDUSTRY CHANGE CHANGE AVERAGE CASE STUDY 2 LIQUIDITY RATIos Corrent ratio (current assets/current liabilities) Quick ratio I(current assets inventory prepaid expensesMcurrent liabilities] Sales/ Receivables Inet saleset ending receivables Number of days sales in A/R 0.35 l(net ending receivables/(net saleu/365)] Inventory turnover (cost of sales/average inventory) b. In what ways would investigating the com mine's core samples, apparently committed suicide by jumping out the back of a helicopter. Guzman's suicide was reported around the time that an independent con- sulting firm reported that samples from the mine had been tampered with. The firm concluded that the core samples were made to appear to be rich in gold by adding a relatively small amount of gold to the sam- ples. In essence, the firm concluded that Bre-X was a pany's relationships with other entities help determine the value of Bre-X's gold prospects? In what ways would investigating the organi- c. zation and its industry help determine the value of Bre-X's gold prospects? In what ways would investigating the financial determine the value of Bre-X's gold prospects? d. results and operating characteristics help scam of epic proportions! As the scam came to light, it was uncdlear who was . How were the gold industry and Canadian stoo field. Bre-X's President, David Walsh, was shocked at the 3. Some of the aspects of the perfect fraud storm that to both the perfect fraud storm and the Bre-X 4. What were some of the perpetrators' motivations behind the tampering While fingers were pointed at markets affected by this fraud? news of the tampering and vowed to conduct an investi-were discussed in the chapter were also present in the Bre-X scandal. Which elements were common gation. As is the case with many frauds of this type, numerous class-action lawsuits were filed against Walsh and other Bre-X executives, alleging that they misled shareholders. Walsh and other company officials received profits of over $50 million from selling some of their Bre-X stock the year before the tampering came to light. In the end, many people lost money as the gold find of the scandal? century turned out to be a massive hoax. Questions 1. Assume to commit fraud? Case Study 3 ment occurred because the company recorded sales tor The SEC charged Midisoft Corporation with overstat- ing revenue in the amount of $458,000. The overstate- products that had been shipped but, at the time shi of who works for a major brokerage company that is heavily invested pment, the company had no reasonable expectation that they would be sales returns. you are a financial analyst paid for the products. In the in Bre-X Minerals. investigating management Apparently. Midisoft's distribution agreements .In what ways Would ter mine the value of Bre allowed the distributor the opportunity to return prod- X's gold prospects? uct to Midisoft for credit whenever the distributor