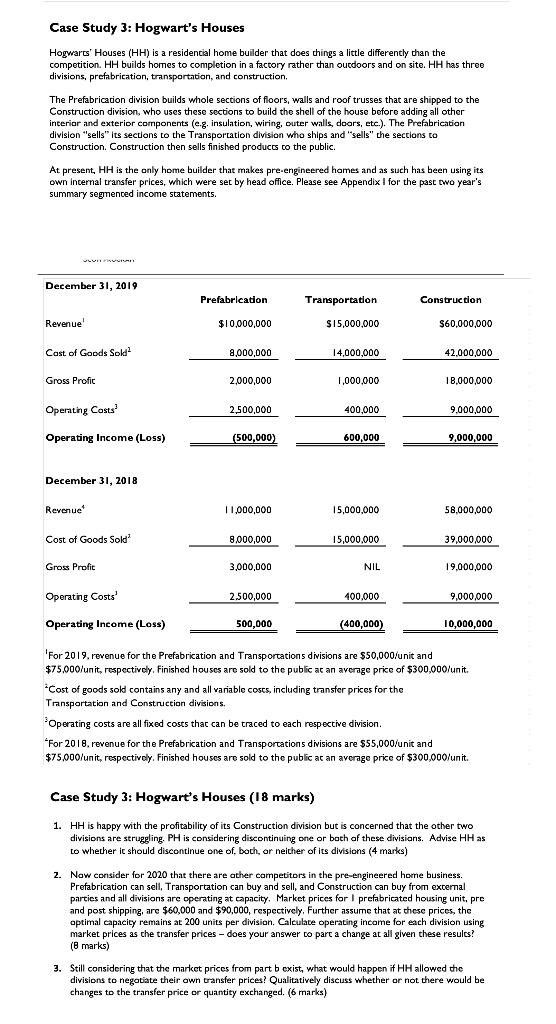

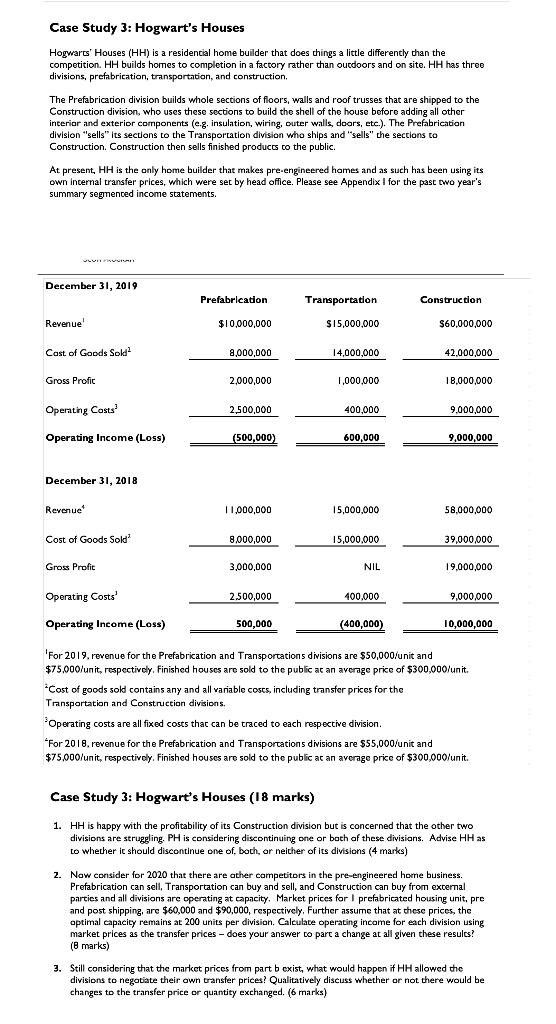

Case Study 3: Hogwart's Houses Hogwarts' Houses (HH) is a residencial home builder that does things a little differently than the competition. HH builds homes to completion in a factory rather than outdoors and on site. HH has three divisions, prefabrication, transportation, and construction. The Prefabrication division builds whole sections of floors, walls and roof trusses that are shipped to the Construction division, who uses these sections to build the shell of the house before adding all other Interior and exterior components (eg. insulation, wiring, outer walls, doors, etc.). The Prefabrication division "sells" its sections to the Transportation division who ships and sells the sections to Construction. Construction then sells finished products to the public. At present, HH is the only home builder that makes pre-engineered homes and as such has been using its own internal transfer prices, which were set by head office. Please see Appendix I for the past two year's summary segmented income statements. December 31, 2019 Prefabrication Transportation Construction Revenue $10,000,000 $15,000,000 $60,000,000 Cost of Goods Sold 8.000.000 14,000,000 42.000.000 Gross Profit 2,000,000 1,000,000 18,000,000 Operating costs 2,500,000 400,000 9,000,000 Operating Income (Loss) (500,000) 600,000 9,000,000 December 31, 2018 Revenue 11,000,000 15,000,000 58,000,000 Cost of Goods Sold 8,000,000 15.000.000 39,000,000 Gross Profit 3,000,000 NIL 19,000,000 Operating Costs' 2.500,000 400.000 9,000,000 Operating Income (Loss) 500,000 (400,000) 10,000,000 'For 2019, revenue for the Prefabrication and Transportations divisions are $50,000/unit and $75.000/unit, respectively. Finished houses are sold to the public at an average price of $300,000/unit *Cost of goods sold contains any and all variable costs, including transfer prices for the Transportation and Construction divisions. Operating costs are all fixed costs that can be traced to each respective division For 2018.revenue for the Prefabrication and Transportations divisions are $55,000/unit and $75.000/unit, respectively. Finished houses are sold to the public at an average price of $300,000/unit. Case Study 3: Hogwart's Houses (18 marks) 1. HH is happy with the profitability of its Construction division but is concerned that the other two divisions are struggling, PH is considering discontinuing one or both of these divisions. Advise HH as to whether it should discontinue one of, boch, or neither of its divisions (4 marks) 2. Now consider for 2020 that there are other competitors in the pre-engineered home business. Prefabrication can sell, Transportation can buy and sell, and Construction can buy from external parties and all divisions are operating at capacity. Market prices for prefabricated housing unit. pre and post shipping, are $60,000 and $90,000, respectively. Further assume that at these prices, the optimal capacity remains at 200 units per division. Calculate operating income for each division using market prices as the transfer prices - does your answer to part a change at all given these results! (8 marks) 3. Still considering that the market prices from part b exist, what would happen if HH allowed the divisions to negotiate their own transfer prices! Qualitatively discuss whether or not there would be changes to the transfer price or quantity exchanged. (6 marks) Case Study 3: Hogwart's Houses Hogwarts' Houses (HH) is a residencial home builder that does things a little differently than the competition. HH builds homes to completion in a factory rather than outdoors and on site. HH has three divisions, prefabrication, transportation, and construction. The Prefabrication division builds whole sections of floors, walls and roof trusses that are shipped to the Construction division, who uses these sections to build the shell of the house before adding all other Interior and exterior components (eg. insulation, wiring, outer walls, doors, etc.). The Prefabrication division "sells" its sections to the Transportation division who ships and sells the sections to Construction. Construction then sells finished products to the public. At present, HH is the only home builder that makes pre-engineered homes and as such has been using its own internal transfer prices, which were set by head office. Please see Appendix I for the past two year's summary segmented income statements. December 31, 2019 Prefabrication Transportation Construction Revenue $10,000,000 $15,000,000 $60,000,000 Cost of Goods Sold 8.000.000 14,000,000 42.000.000 Gross Profit 2,000,000 1,000,000 18,000,000 Operating costs 2,500,000 400,000 9,000,000 Operating Income (Loss) (500,000) 600,000 9,000,000 December 31, 2018 Revenue 11,000,000 15,000,000 58,000,000 Cost of Goods Sold 8,000,000 15.000.000 39,000,000 Gross Profit 3,000,000 NIL 19,000,000 Operating Costs' 2.500,000 400.000 9,000,000 Operating Income (Loss) 500,000 (400,000) 10,000,000 'For 2019, revenue for the Prefabrication and Transportations divisions are $50,000/unit and $75.000/unit, respectively. Finished houses are sold to the public at an average price of $300,000/unit *Cost of goods sold contains any and all variable costs, including transfer prices for the Transportation and Construction divisions. Operating costs are all fixed costs that can be traced to each respective division For 2018.revenue for the Prefabrication and Transportations divisions are $55,000/unit and $75.000/unit, respectively. Finished houses are sold to the public at an average price of $300,000/unit. Case Study 3: Hogwart's Houses (18 marks) 1. HH is happy with the profitability of its Construction division but is concerned that the other two divisions are struggling, PH is considering discontinuing one or both of these divisions. Advise HH as to whether it should discontinue one of, boch, or neither of its divisions (4 marks) 2. Now consider for 2020 that there are other competitors in the pre-engineered home business. Prefabrication can sell, Transportation can buy and sell, and Construction can buy from external parties and all divisions are operating at capacity. Market prices for prefabricated housing unit. pre and post shipping, are $60,000 and $90,000, respectively. Further assume that at these prices, the optimal capacity remains at 200 units per division. Calculate operating income for each division using market prices as the transfer prices - does your answer to part a change at all given these results! (8 marks) 3. Still considering that the market prices from part b exist, what would happen if HH allowed the divisions to negotiate their own transfer prices! Qualitatively discuss whether or not there would be changes to the transfer price or quantity exchanged. (6 marks)