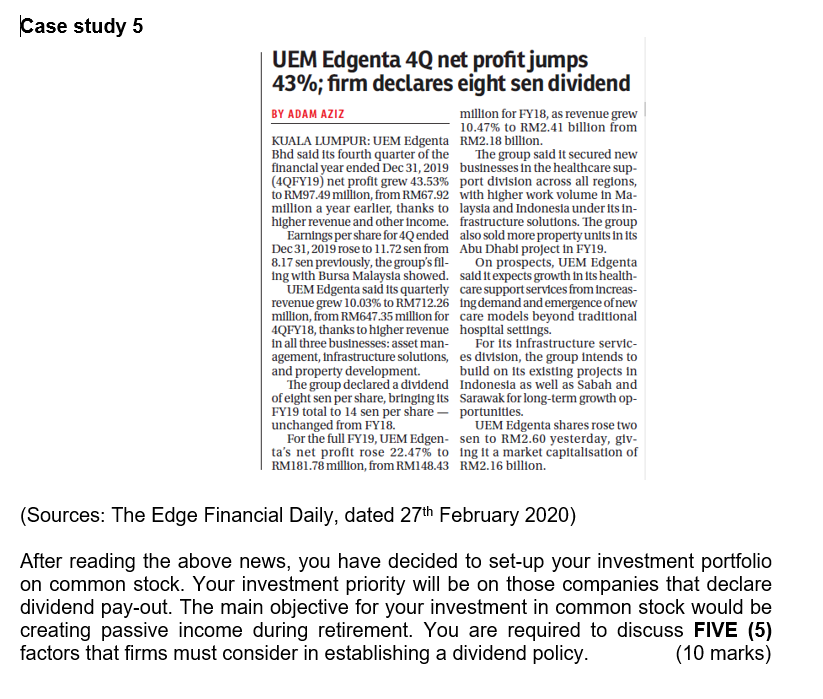

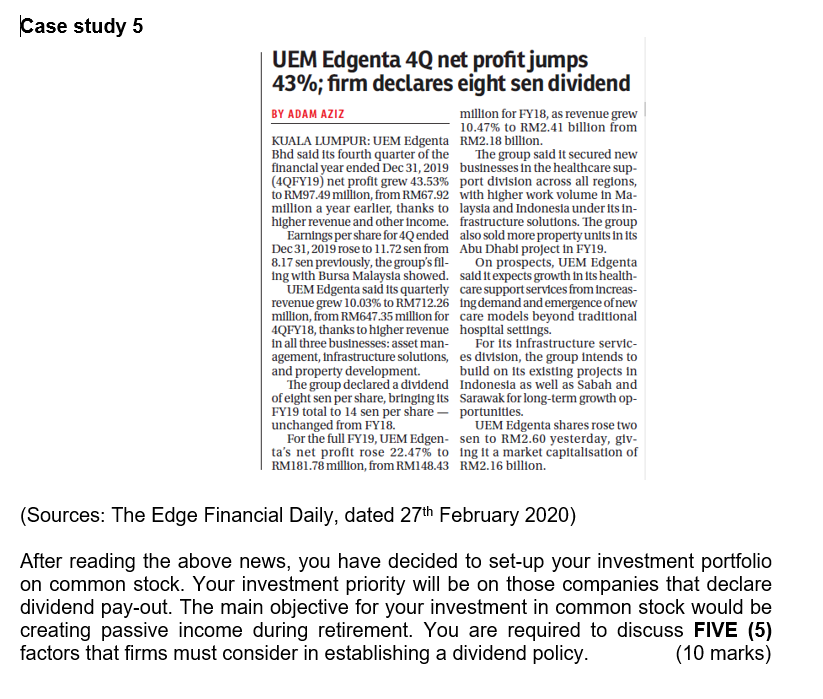

Case study 5 UEM Edgenta 4Q net profit jumps 43%; firm declares eight sen dividend BY ADAM AZIZ million for FY18, as revenue grew 10.47% to RM2.41 billion from KUALA LUMPUR: UEM Edgenta RM2.18 billion. Bhd said its fourth quarter of the The group said it secured new financial year ended Dec 31, 2019 businesses in the healthcare sup- (4QFY19) net profit grew 43.53% port division across all regions, to RM97.49 million, from RM67.92 with higher work volume in Ma- million a year earlier, thanks to laysia and Indonesia under its in- higher revenue and other income. frastructure solutions. The group Earnings per share for 4Q ended also sold more property units in its Dec 31, 2019 rose to 11.72 sen from Abu Dhabi project in FY19. 8.17 sen previously, the group's fil- On prospects, UEM Edgenta ing with Bursa Malaysia showed. said it expects growth in its health- UEM Edgenta said its quarterly care support services from increas- revenue grew 10.03% to RM712.26 ing demand and emergence of new million, from RM647.35 million for care models beyond traditional 4QFY18, thanks to higher revenue hospital settings. in all three businesses: asset man- For its infrastructure servic- agement, infrastructure solutions, es division, the group intends to and property development. build on its existing projects in The group declared a dividend Indonesia as well as Sabah and of eight sen per share, bringing its Sarawak for long-term growth op- FY19 total to 14 sen per share portunities. unchanged from FY18. UEM Edgenta shares rose two For the full FY19, UEM Edgen- sen to RM2.60 yesterday, giv- ta's net profit rose 22.47% to ing it a market capitalisation of RM181.78 million, from RM148.43 RM2.16 billion. (Sources: The Edge Financial Daily, dated 27th February 2020) After reading the above news, you have decided to set-up your investment portfolio on common stock. Your investment priority will be on those companies that declare dividend pay-out. The main objective for your investment in common stock would be creating passive income during retirement. You are required to discuss FIVE (5) factors that firms must consider in establishing a dividend policy. (10 marks)