Answered step by step

Verified Expert Solution

Question

1 Approved Answer

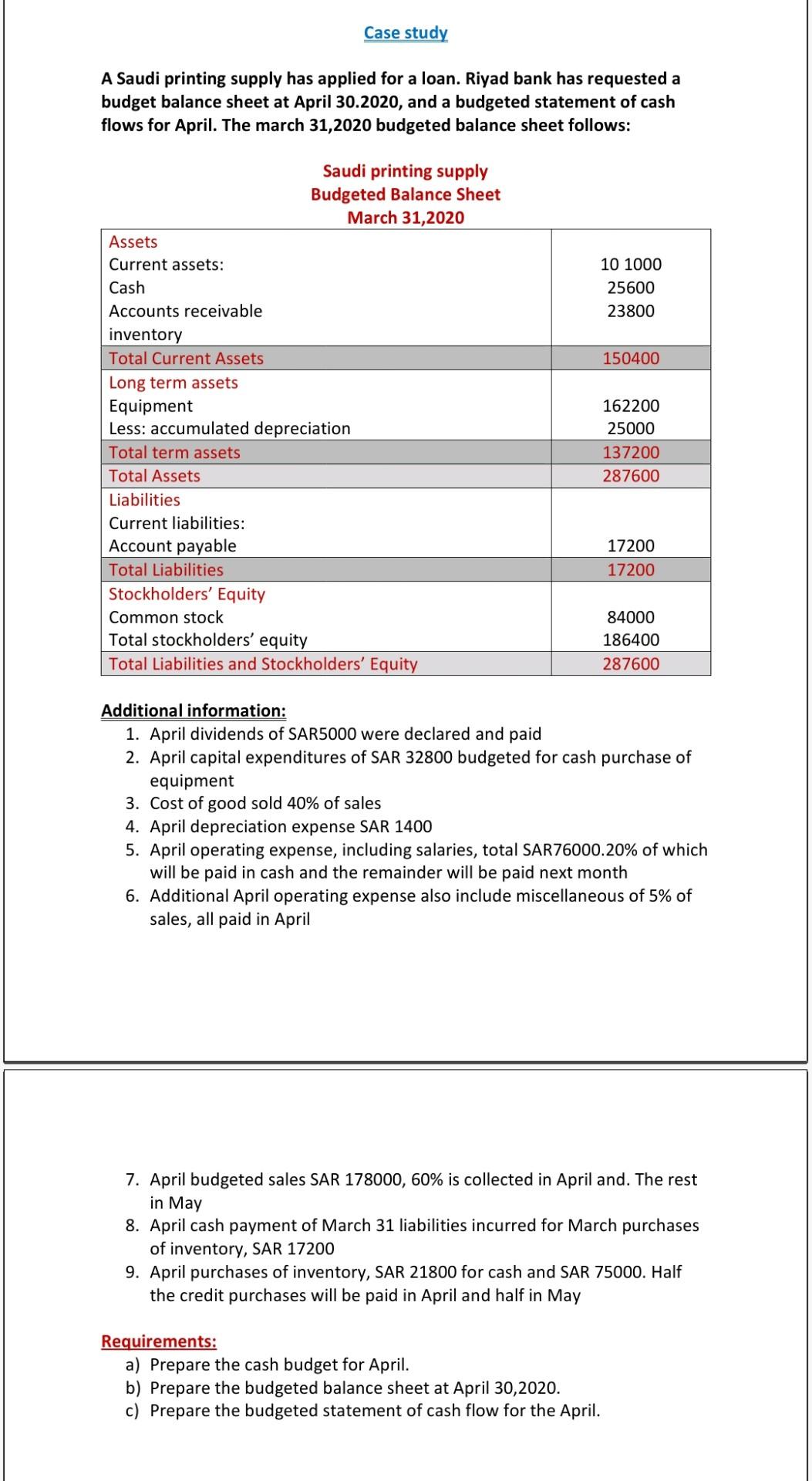

Case study A Saudi printing supply has applied for a loan. Riyad bank has requested a budget balance sheet at April 30.2020, and a budgeted

Case study A Saudi printing supply has applied for a loan. Riyad bank has requested a budget balance sheet at April 30.2020, and a budgeted statement of cash flows for April. The march 31,2020 budgeted balance sheet follows: 10 1000 25600 23800 150400 Saudi printing supply Budgeted Balance Sheet March 31,2020 Assets Current assets: Cash Accounts receivable inventory Total Current Assets Long term assets Equipment Less: accumulated depreciation Total term assets Total Assets Liabilities Current liabilities: Account payable Total Liabilities Stockholders' Equity Common stock Total stockholders' equity Total Liabilities and Stockholders' Equity 162200 25000 137200 287600 17200 17200 84000 186400 287600 Additional information: 1. April dividends of SAR5000 were declared and paid 2. April capital expenditures of SAR 32800 budgeted for cash purchase of equipment 3. Cost of good sold 40% of sales 4. April depreciation expense SAR 1400 5. April operating expense, including salaries, total SAR76000.20% of which will be paid in cash and the remainder will be paid next month 6. Additional April operating expense also include miscellaneous of 5% of sales, all paid in April 7. April budgeted sales SAR 178000, 60% is collected in April and. The rest in May 8. April cash payment of March 31 liabilities incurred for March purchases of inventory, SAR 17200 9. April purchases of inventory, SAR 21800 for cash and SAR 75000. Half the credit purchases will be paid in April and half in May Requirements: a) Prepare the cash budget for April. b) Prepare the budgeted balance sheet at April 30,2020. c) Prepare the budgeted statement of cash flow for the April

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started