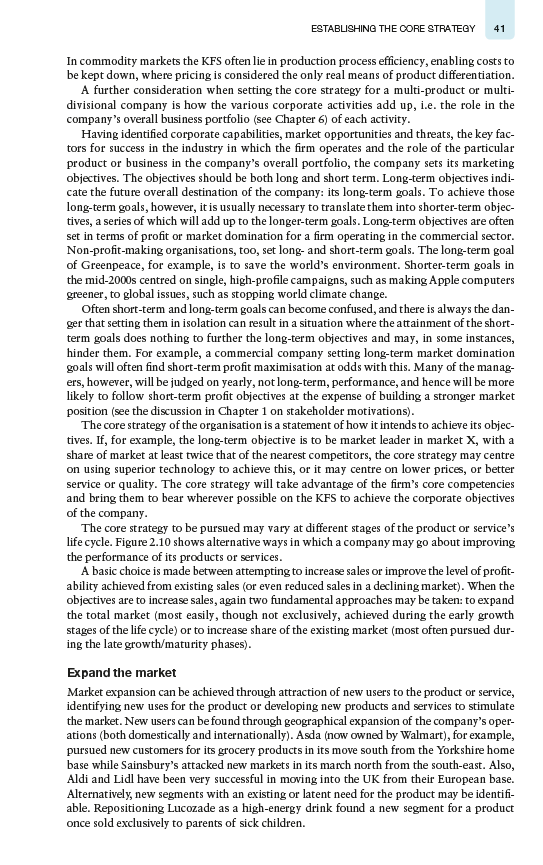

Case study Amazon eyes online sales boost through 'Fire' smartphone Amazon has a decent shot at shaking up a smart- phone market controlled by Samsung and Apple as well as selling more of everything to its customers with its new Fire smartphone, unveiled on Wednesday fire in Seattle. But first, it has to find a way to convince consum- BYamazon ers to buy the phone. Is it a good product and a neat idea? Yup. Will it DRAPER be a success? Question mark,' says Mohan Sawhney, EXPOSE a management professor at Northwestem University who has studied Amazon. Another question is just what constitutes success: muscle in on the smartphone market or driving more sales of the multitude of products sold via Amazon? The phone is likely to funnel users towards buying on whether they will like a new device in two years had more from Amazon, says Michael Graham, an inter- stymied many purchases - some early phones from net analyst at Canaccord Genuity. Getting users of Microsoft sold fewer than 20,000, he says. its hardware to buy more goods from its online store Bringing more users into Prime and trying to sell is how Amazon profited from the Kindle line of tablet more Amazon goods 'are shrewd and calculated and e-readers, in spite of selling many of those at or moves, and the phone in theory could be a tremen- below cost. dous extension of that strategy, but you've got to get The phone also comes with a free year of Amazon people to want one , he says. 'I'm not sure [the Fire] Prime membership, worth $99, allowing unlimited free will impress consumers to the tune of millions of them shipping and a catalogue of digital music, movies and running out to buy it. television shows. Users can store in Amazon's cloud The Fire starts with a 32GB model that sells for an unlimited number of photos that they take with $199 on a two-year contract through AT&T, the only the device. US carrier offering the device. Without a contract, it Prime users are more lucrative for Amazon than costs $649. regular customers, says Mr Graham, and Firefly could That places the Fire on par with Apple's iPhone encourage phone owners to use Amazon, rather than and Samsung's high-end Galaxy line of devices - a use search engine Google, as their main place to part of the market that is increasingly competitive search for purchases. as sales slow and users are reluctant to switch from But the challenge, says James McQuivey, an ana- familiar brands and operating systems. Many other lyst with Forrester, is that entry into the phone market is would-be contenders, including HTC, Motorola and tough to crack. Buying a phone typically means locking Nokia have struggled to gain market share. into a two-year contract, or paying more for a faster To help Amazon succeed where others failed, upgrade. The difficulty convincing consumers to wager Jeff Bezos, Amazon's chief executive, brought to theCASE STUDY 51 launch in a Seattle warehouse a device that mixes company say it is holding discussions with Vodafone content, customer services and hardware. and 02 in the UK about possibly launching there. Best known for its online shopping mall, Ama- By December or January - after the big back to zon also controls a global network of warehouses, school and holiday sales - it should be clear how well one of the world's largest commercial cloud stor- the phone is doing in the US, says Mr McQuivey. If age operations, and has access to a growing Amazon reduces the price or adds more benefits, catalogue of digital music, movies and films - such as an additional year of Prime membership, it expanded weekly with the launch of a Spotify-like would be a sign that the initial launch underwhelmed music streaming service. the market and a rethink was needed. The Fire sports a 3D display that uses four infrared 'There are levers that Amazon could still pull if it cameras to track users' head motion and pivot games needs to, he says. or maps in line with how the viewer is looking at them. Source: from 'Amazzon eyes online sales boost through "Fire" smart- It also has a visual search tool named Firefly. phone', Anancia' Times, 19/06/2014 (Mishkh, S.]. With Firefly, a user can point the phone's camera at anything from a book to a shaker of salt or a poster and either extract and save information - such as an email address - or navigate directly to a product page on Amazon to buy it. What we saw was an opportunity to prove some new capabilities that really hadn't been done before in premium smartphones, says lan Freed, Amazon's vice-president for the Fire phone. We've seen inno- vation stagnate a bit over the past two to three years.' Analysts with Jefferies, the brokerage, estimate that Foxconn, the phone's manufacturer, will produce roughly 200,000 phones a month in the coming months. Amazon decline to comment on plans to launch the phone in Europe, but people familiar with theESTABLISHING THE CORE STRATEGY 41 In commodity markets the KFS often lie in production process efficiency, enabling costs to be kept down, where pricing is considered the only real means of product differentiation. A further consideration when setting the core strategy for a multi-product or multi- divisional company is how the various corporate activities add up, i.e. the role in the company's overall business portfolio (see Chapter 6) of each activity. Having identified corporate capabilities, market opportunities and threats, the key fac- tors for success in the industry in which the firm operates and the role of the particular product or business in the company's overall portfolio, the company sets its marketing objectives. The objectives should be both long and short term. Long-term objectives indi- cate the future overall destination of the company: its long-term goals. To achieve those long-term goals, however, it is usually necessary to translate them into shorter-term object tives, a series of which will add up to the longer-term goals. Long-term objectives are often set in terms of profit or market domination for a firm operating in the commercial sector. Non-profit-making organisations, too, set long- and short-term goals. The long-term goal of Greenpeace, for example, is to save the world's environment. Shorter-term goals in the mid-2000s centred on single, high-profile campaigns, such as making Apple computers greener, to global issues, such as stopping world climate change. Often short-term and long-term goals can become confused, and there is always the dan- ger that setting them in isolation can result in a situation where the attainment of the short- term goals does nothing to further the long-term objectives and may, in some instances, hinder them. For example, a commercial company setting long-term market domination goals will often find short-term profit maximisation at odds with this. Many of the manag- ers, however, will be judged on yearly, not long-term, performance, and hence will be more likely to follow short-term profit objectives at the expense of building a stronger market position (see the discussion in Chapter 1 on stakeholder motivations). The core strategy of the organisation is a statement of how it intends to achieve its object tives. If, for example, the long-term objective is to be market leader in market X, with a share of market at least twice that of the nearest competitors, the core strategy may centre on using superior technology to achieve this, or it may centre on lower prices, or better service or quality. The core strategy will take advantage of the firm's core competencies and bring them to bear wherever possible on the KFS to achieve the corporate objectives of the company. The core strategy to be pursued may vary at different stages of the product or service's life cycle. Figure 2.10 shows alternative ways in which a company may go about improving the performance of its products or services. A basic choice is made between attempting to increase sales or improve the level of profit- ability achieved from existing sales (or even reduced sales in a declining market). When the objectives are to increase sales, again two fundamental approaches may be taken: to expand the total market (most easily, though not exclusively, achieved during the early growth stages of the life cycle) or to increase share of the existing market (most often pursued dur- ing the late growth/maturity phases). Expand the market Market expansion can be achieved through attraction of new users to the product or service, identifying new uses for the product or developing new products and services to stimulate the market. New users can be found through geographical expansion of the company's oper- ations (both domestically and internationally). Asda (now owned by Walmart), for example, pursued new customers for its grocery products in its move south from the Yorkshire home base while Sainsbury's attacked new markets in its march north from the south-east. Also, Aldi and Lidl have been very successful in moving into the UK from their European base. Alternatively, new segments with an existing or latent need for the product may be identifi- able. Repositioning Lucozade as a high-energy drink found a new segment for a product once sold exclusively to parents of sick children.42 Gl-IAFTEFI 2 B'I'Fbk'l'EGIG HIFIKEI'INE F'UtNNIMI-l FlgLro 21D Strut-gin focus The spectacular growth of the 'no-frills' airlines, easyJet and Ryanair, is founded not simply on taking market share but on growing the market i.e. 'more people y more often'. Ryanair, in particular, witii its carefully chosen routes where it is the only ilyer, has on occasion experienced fourfold trafc growth. Land Rover, tire hugely successful manufacturer of the Freelander, Discovery and Range Rover brands, aimed to increase the demand for 4 K 4 vehicles by encouraging drivers of other types of car to switch. It rst identied car drivers who were keert on adventure through leaets and direct mail, and this was followed up by a campaign of telemarketing, direct mail and dealer contact, offering extended test drives without the dealer present. In 11 months the campaign added so,ooo high-quality prospects to the datab ase , and generated 10,000 test drives of which 18 per cent were converted into sales. The company estimates that its investmertt of just under 1 million has resulted in 111} million worth of extra sales. For some products it may be possible to identify new uses. An example is the use ofthe condom {largely abandoned as a means of contraceptive for the more popular pill and [LTD in the liens and 197m: as a defence against contracting HIV-AIDS. [n household cleaners Flash was originally marketed as a product for cleaning floors, but now is also promoted as an all-purpose product for cleaning baths and basins. Increase altars Increasing market share, especially in mature markets, usually comes at the expense of existing competition. The ntain routes to increasing share include: winning competitors' customers, merging with {or acquiring: the competitors, or entering into strategic alliances with competitors, suppliers andl'or distributors. Winning competitors' customers requires that the company serves them better than tile competition. This may come about through identification of competitor weaknesses, or through better exploitation of the comp any's own strengths and competencies. Each of the elements of the marketing mix products, price, promotion and distribution could he used to offer the customer added value, or something exua, to induce switching. Increasing usage rate may be a viable approach to expanding the market for some products. For example, breakfast cereals are now being promoted as healthy, any time of day snacks or, even, slimming aids {such as Kellogg's Special Ki. Also, a signicant trend CREATION OF THE COMPETITIVE POSITIONING 43 during the recent global economic crisis was for organisations to offer loyalty schemes for customers in order to increase purchase frequency, share of 'purse' and customer retention. Improving profitability With existing levels, or even reduced levels, of sales, profitability can be improved through improving margins. This is usually achieved through increasing price, reducing costs, or both. In the multi-product firm it may also be possible through weeding of the product line, removing poorly performing products and concentrating effort on the more financially viable. The longer-term positioning implications of this weeding should, however, be care- fully considered prior to wielding the axe. It may be, for example, that maintenance of seemingly unprofitable lines is essential to allow the company to continue to operate in the market as a whole or its own specifically chosen niches of that market. They may be viewed as the ground stakes in the strategic game essential to reserve a seat at the competitive table.2.3.4 Core strategy On the basis of the above analysis the company seeks to define the key factors for success (KFS, sometimes termed 'critical success factors") in its particular markets. Key factors for success in the industry are those factors that are crucial to doing business. The KFS are identified through examining the differences between winners and losers, or leaders and also-rans in the industry. They often represent the factors where the greatest leverage can be exerted, i.e. where the most effect can be obtained for a given amount of effort. In the grocery industry, for example, the KFS can centre on the relationships built up between the manufacturer and the retailer. The power of the major multiples (less than half a dozen major food retail chains now account for around 80 per cent of food sales in the United Kingdom) is such that if a new food product does not obtain distri- bution through the major outlets a substantial sector of the potential market is denied