Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE STUDY - ANNA BAKERY CAFE PROJECT Case Study Objectives Upon completion of this case study report, you should be able to: 1. apply engineering

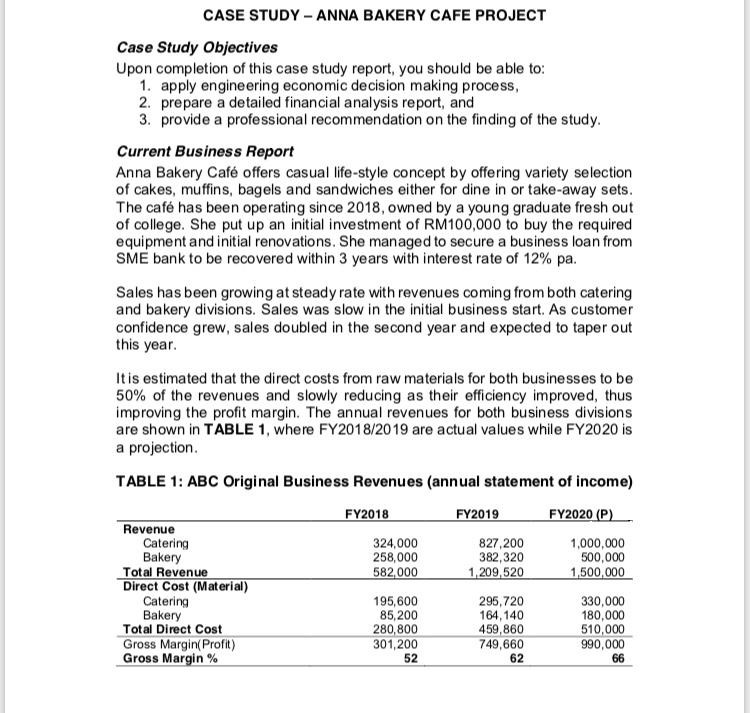

CASE STUDY - ANNA BAKERY CAFE PROJECT Case Study Objectives Upon completion of this case study report, you should be able to: 1. apply engineering economic decision making process, 2. prepare a detailed financial analysis report, and 3. provide a professional recommendation on the finding of the study. Current Business Report Anna Bakery Caf offers casual life-style concept by offering variety selection of cakes, muffins, bagels and sandwiches either for dine in or take-away sets The caf has been operating since 2018, owned by a young graduate fresh out of college. She put up an initial investment of RM100,000 to buy the required equipment and initial renovations. She managed to secure a business loan from SME bank to be recovered within 3 vears with interest rate of 12% pa. Sales has been growing at steady rate with revenues coming from both catering and bakery divisions. Sales was slow in the initial business start. As customer confidence grew, sales doubled in the second year and expected to taper out this year. It is estimated that the direct costs from raw materials for both businesses to be 50% of the revenues and slowly reducing as their efficiency improved, thus improving the profit margin. The annual revenues for both business divisions are shown in TABLE 1, where FY2018/2019 are actual values while FY2020 is a projection TABLE 1: ABC Original Business Revenues (annual statement of income) FY2018 FY2019 FY2020 (P) 324,000 258,000 582,000 827,200 382,320 1,209,520 1,000,000 500,000 1,500,000 Revenue Catering Bakery Total Revenue Direct Cost (Material) Catering Bakery Total Direct Cost Gross Margin( Profit) Gross Margin % 195,600 85,200 280,800 301,200 52 295,720 164,140 459,860 749,660 62 330,000 180,000 510,000 990,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started