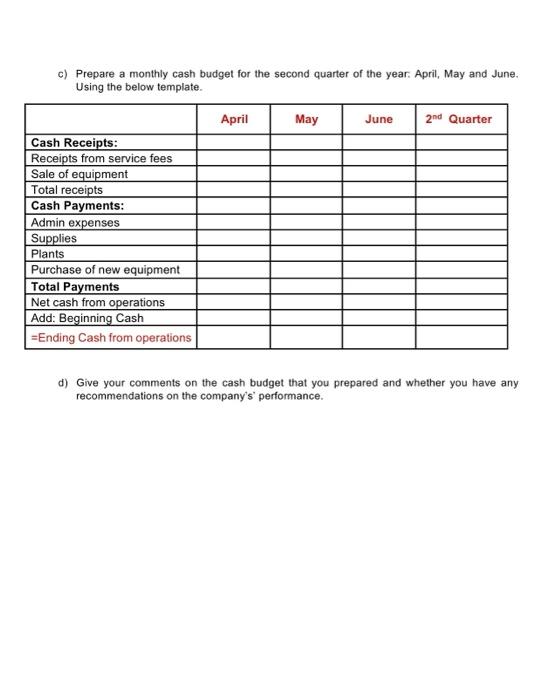

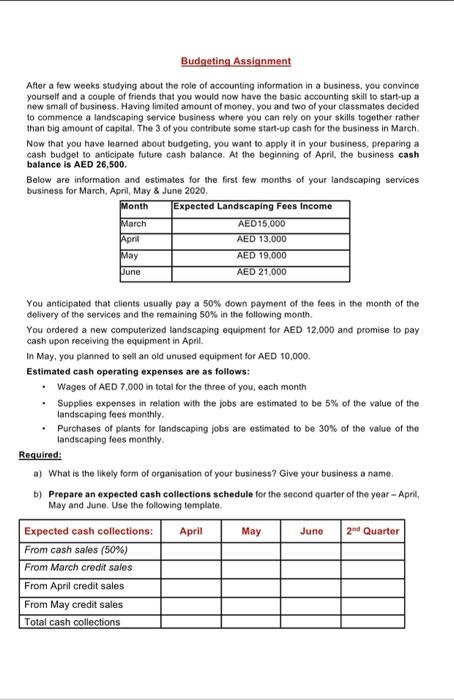

c) Prepare a monthly cash budget for the second quarter of the year. April, May and June. Using the below template April May June 2nd Quarter Cash Receipts: Receipts from service fees Sale of equipment Total receipts Cash Payments: Admin expenses Supplies Plants Purchase of new equipment Total Payments Net cash from operations Add: Beginning Cash =Ending Cash from operations d) Give your comments on the cash budget that you prepared and whether you have any recommendations on the company's performance. Budgeting Assignment After a few weeks studying about the role of accounting information in a business, you convince yourself and a couple of friends that you would now have the basic accounting skill to start-up a new small of business. Having limited amount of money you and two of your classmates decided to commence a landscaping service business where you can rely on your skills together father than big amount of capital. The 3 of you contribute some start-up cash for the business in March Now that you have learned about budgeting, you want to apply it in your business, preparing a cash budget to anticipate future cash balance. At the beginning of April, the business cash balance is AED 26,500. Below are information and estimates for the first few months of your landscaping services business for March April May & June 2020. Month Expected Landscaping Fees Income March AED15,000 April AED 13.000 May AED 19.000 June AED 21.000 You anticipated that clients usually pay a 50% down payment of the fees in the month of the delivery of the services and the remaining 50% in the following month. You ordered a new computerized landscaping equipment for AED 12,000 and promise to pay cash upon receiving the equipment in April. In May, you planned to sell an old unused equipment for AED 10.000. Estimated cash operating expenses are as follows: Wages of AED 7.000 in total for the three of you, each month Supplies expenses in relation with the jobs are estimated to be 5% of the value of the landscaping fees monthly Purchases of plants for landscaping jobs are estimated to be 30% of the value of the landscaping fees monthly Required: a) What is the likely form of organisation of your business? Give your business a name. b) Prepare an expected cash collections schedule for the second quarter of the year-April, May and June. Use the following template April May June 2nd Quarter Expected cash collections: From cash sales (50%) From March credit sales From April credit sales From May credit sales Total cash collections