Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Audit Procedures for Fair Value Measurements In the realm of auditing, fair value measurements represent a critical aspect of financial reporting, particularly in

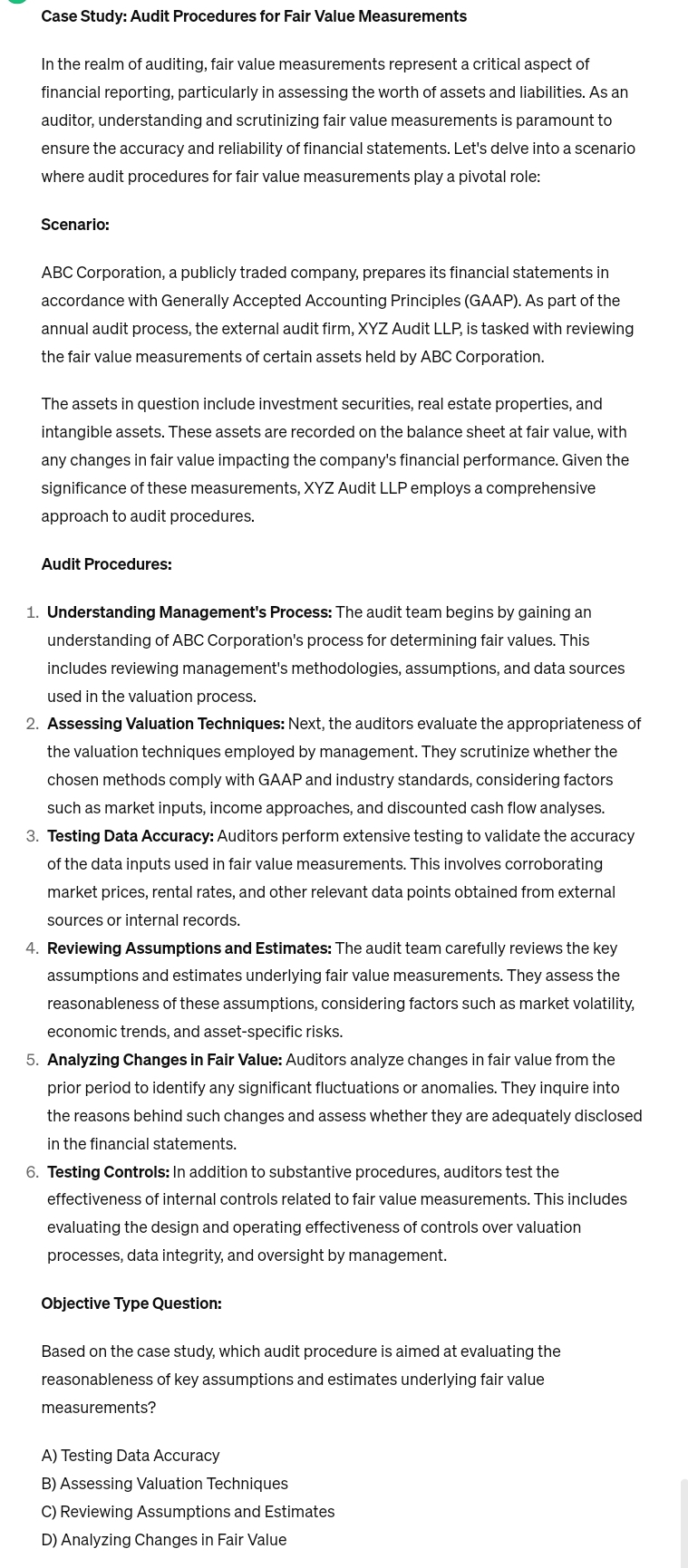

Case Study: Audit Procedures for Fair Value Measurements

In the realm of auditing, fair value measurements represent a critical aspect of financial reporting, particularly in assessing the worth of assets and liabilities. As an auditor, understanding and scrutinizing fair value measurements is paramount to ensure the accuracy and reliability of financial statements. Let's delve into a scenario where audit procedures for fair value measurements play a pivotal role:

Scenario:

ABC Corporation, a publicly traded company, prepares its financial statements in accordance with Generally Accepted Accounting Principles GAAP As part of the annual audit process, the external audit firm, XYZ Audit LLP is tasked with reviewing the fair value measurements of certain assets held by ABC Corporation.

The assets in question include investment securities real estate properties, and intangible assets. These assets are recorded on the balance sheet at fair value, with any changes in fair value impacting the company's financial performance. Given the significance of these measurements, XYZ Audit LLP employs a comprehensive approach to audit procedures.

Audit Procedures:

Understanding Management's Process: The audit team begins by gaining an understanding of ABC Corporation's process for determining fair values. This includes reviewing management's methodologies, assumptions, and data sources used in the valuation process.

Assessing Valuation Techniques: Next, the auditors evaluate the appropriateness of the valuation techniques employed by management. They scrutinize whether the chosen methods comply with GAAP and industry standards, considering factors such as market inputs, income approaches, and discounted cash flow analyses.

Testing Data Accuracy: Auditors perform extensive testing to validate the accuracy of the data inputs used in fair value measurements. This involves corroborating market prices, rental rates, and other relevant data points obtained from external sources or internal records.

Reviewing Assumptions and Estimates: The audit team carefully reviews the key assumptions and estimates underlying fair value measurements. They assess the reasonableness of these assumptions, considering factors such as market volatility, economic trends, and assetspecific risks.

Analyzing Changes in Fair Value: Auditors analyze changes in fair value from the prior period to identify any significant fluctuations or anomalies. They inquire into the reasons behind such changes and assess whether they are adequately disclosed in the financial statements.

Testing Controls: In addition to substantive procedures, auditors test the effectiveness of internal controls related to fair value measurements. This includes evaluating the design and operating effectiveness of controls over valuation processes, data integrity, and oversight by management.

Objective Type Question:

Based on the case study, which audit procedure is aimed at evaluating the reasonableness of key assumptions and estimates underlying fair value measurements?

A Testing Data Accuracy

B Assessing Valuation Techniques

C Reviewing Assumptions and Estimates

D Analyzing Changes in Fair Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started