Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Audit Procedures for Research and Development ( R&D ) Costs Background: XYZ Corporation, a leading technology company, invests heavily in research and development

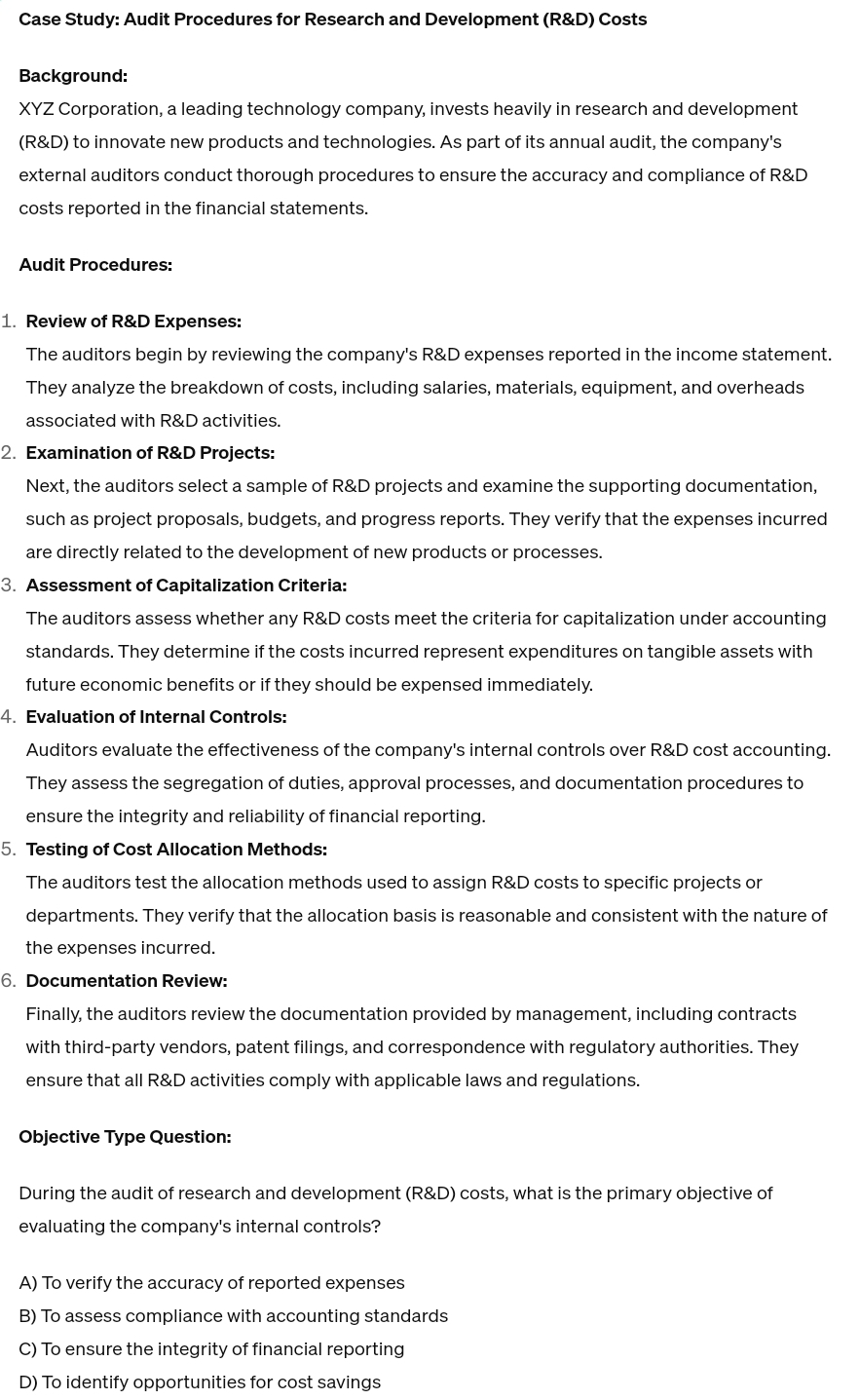

Case Study: Audit Procedures for Research and Development R&D Costs Background: XYZ Corporation, a leading technology company, invests heavily in research and development R&D to innovate new products and technologies. As part of its annual audit, the company's external auditors conduct thorough procedures to ensure the accuracy and compliance of R&D costs reported in the financial statements. Audit Procedures: Review of R&D Expenses: The auditors begin by reviewing the company's R&D expenses reported in the income statement. They analyze the breakdown of costs, including salaries, materials, equipment, and overheads associated with R&D activities. Examination of R&D Projects: Next, the auditors select a sample of R&D projects and examine the supporting documentation, such as project proposals, budgets, and progress reports. They verify that the expenses incurred are directly related to the development of new products or processes. Assessment of Capitalization Criteria: The auditors assess whether any R&D costs meet the criteria for capitalization under accounting standards. They determine if the costs incurred represent expenditures on tangible assets with future economic benefits or if they should be expensed immediately. Evaluation of Internal Controls: Auditors evaluate the effectiveness of the company's internal controls over R&D cost accounting. They assess the segregation of duties, approval processes, and documentation procedures to ensure the integrity and reliability of financial reporting. Testing of Cost Allocation Methods: The auditors test the allocation methods used to assign R&D costs to specific projects or departments. They verify that the allocation basis is reasonable and consistent with the nature of the expenses incurred. Documentation Review: Finally, the auditors review the documentation provided by management, including contracts with thirdparty vendors, patent filings, and correspondence with regulatory authorities. They ensure that all R&D activities comply with applicable laws and regulations. Objective Type Question: During the audit of research and development R&D costs, what is the primary objective of evaluating the company's internal controls? A To verify the accuracy of reported expenses B To assess compliance with accounting standards C To ensure the integrity of financial reporting D To identify opportunities for cost savings

Case Study: Audit Procedures for Research and Development R&D Costs

Background:

XYZ Corporation, a leading technology company, invests heavily in research and development R&D to innovate new products and technologies. As part of its annual audit, the company's external auditors conduct thorough procedures to ensure the accuracy and compliance of R&D costs reported in the financial statements.

Audit Procedures:

Review of R&D Expenses:

The auditors begin by reviewing the company's R&D expenses reported in the income statement. They analyze the breakdown of costs, including salaries, materials, equipment, and overheads associated with R&D activities.

Examination of R&D Projects:

Next, the auditors select a sample of R&D projects and examine the supporting documentation, such as project proposals, budgets, and progress reports. They verify that the expenses incurred are directly related to the development of new products or processes.

Assessment of Capitalization Criteria:

The auditors assess whether any R&D costs meet the criteria for capitalization under accounting standards. They determine if the costs incurred represent expenditures on tangible assets with future economic benefits or if they should be expensed immediately.

Evaluation of Internal Controls:

Auditors evaluate the effectiveness of the company's internal controls over R&D cost accounting. They assess the segregation of duties, approval processes, and documentation procedures to ensure the integrity and reliability of financial reporting.

Testing of Cost Allocation Methods:

The auditors test the allocation methods used to assign R&D costs to specific projects or departments. They verify that the allocation basis is reasonable and consistent with the nature of the expenses incurred.

Documentation Review:

Finally, the auditors review the documentation provided by management, including contracts with thirdparty vendors, patent filings, and correspondence with regulatory authorities. They ensure that all R&D activities comply with applicable laws and regulations.

Objective Type Question:

During the audit of research and development R&D costs, what is the primary objective of evaluating the company's internal controls?

A To verify the accuracy of reported expenses

B To assess compliance with accounting standards

C To ensure the integrity of financial reporting

D To identify opportunities for cost savings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started