Case Study

Fill out 1040, Schedule A, and Schedule 1

This is all the information given for the assignment

Please Help

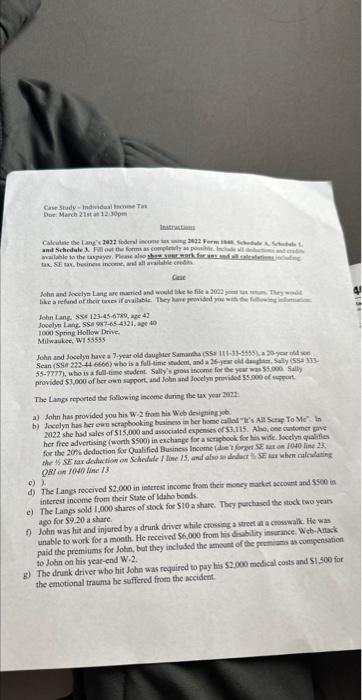

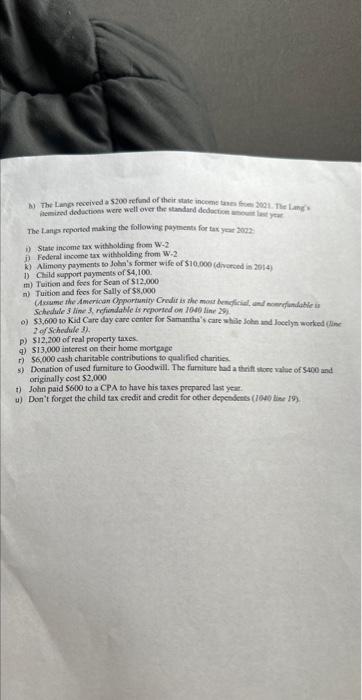

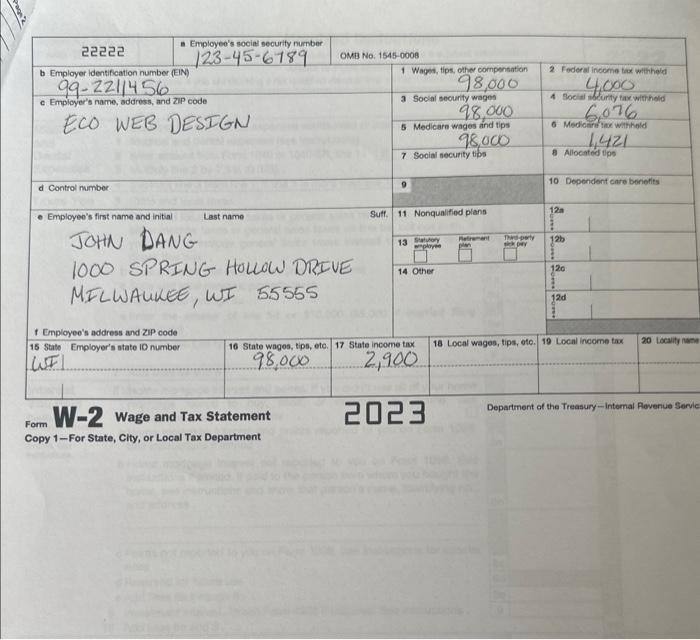

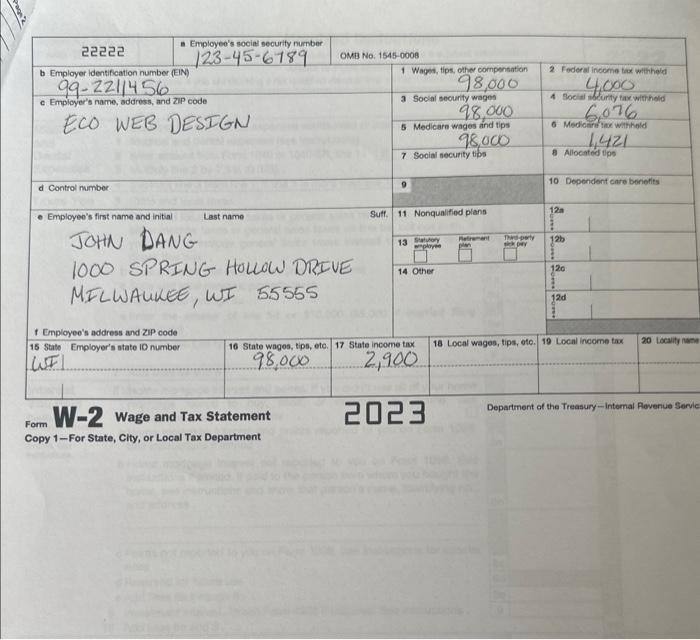

Cine study - ingividaal lsenes Tai Doe: Manch 21st al 1230 ist tak, St ake besinene incoric, and all wealable credin Cate Johin Lang 538 123.45.6Tki, age 42 Jocelyn Lark, SSi 697654321, age 40 1000 Spring Hollow Drive. Milwaukec, WI 54555 John and Hocelyn have a 7-ytar old daupder Samantha (S5s, 111-13-4456) a 20-yar ohd won frovided 53,000 of her own suppoth, and John and Jocelyn prevised s5.90h of whport. The Langs roportod the folioning income during the ux year Joy? a) Anhen has provided you his W.2 frem his Whob dendining iob. her free advertising (worth 5500 ) in exchange for a setapbook fise les wife. locelyti cqualitie QRI nat lo40 Wiec 13 d) The Ianys roceived 52,000 in interts incoent Ifoen their moecy macket acoont and 5$00 in c) ) Thterest incorte from their State of Waho bonds. c) The Langs sold I, 000 shares of stock for 510 a share. They punchascil the stock rwo yearm ago for 5920 a share. f) John was hit and injured by al drunk driver while ctossing a sarcet an a cmosswalk. He was unable to work for a month. He feceived 56,000 from tais disality insarance. Wich-knakts paid the premiums for John, bot they includod the ammount of the prumiams as comgensation b) The drunk driver who hit John was required to pay his 53 .000 modical costs and 51 wor for to John on his year-end W+2. the emotional trauma be saffered froen the accident. b). The Lavg received a 5200 refund of their state inceme tunn fiom 2021 . The lange : hecmind dedaction were well over the standthed dedactore werout last yeat The fangs reportod making the following paytments for tak yat 20ez? 1) State income tax withboldiag froen W-2 i) Federal incoene tax withalding from W-2 k) Alimoey payments to Jolde's former wife of $10.000 (divoraed is 2014) 1) C-ild nupport paymeds of 54,100 . in) Teiticen and foes for S can of 512,000 m) Tuition and focs for Silly of $8,000 Schedule 3 dine 3. refiundable is reported on l040 line 89 . o) 53,600 1o Kid Care day carc center for Samantha's care while Jolen and Jocelyn worked (Iane 2 ef Sichedule i). p) 512,200 of real property tixes. q) $13,000 interest on their home mortpage r) 56,000 eash charitable coritributions to qualified charities. 5) Donation of used furmiture to Goodwill. The furmiture had a thenft ilanc value of 5400 and originally cost 52,000 t) John paid 5600 to a CPA to have his tates prepared las yeie. 4) Don't forget the child exs eredit and crodit for ocher dependests (leat lise I9) Copy 1-For State, City, or Local Tax Department Cine study - ingividaal lsenes Tai Doe: Manch 21st al 1230 ist tak, St ake besinene incoric, and all wealable credin Cate Johin Lang 538 123.45.6Tki, age 42 Jocelyn Lark, SSi 697654321, age 40 1000 Spring Hollow Drive. Milwaukec, WI 54555 John and Hocelyn have a 7-ytar old daupder Samantha (S5s, 111-13-4456) a 20-yar ohd won frovided 53,000 of her own suppoth, and John and Jocelyn prevised s5.90h of whport. The Langs roportod the folioning income during the ux year Joy? a) Anhen has provided you his W.2 frem his Whob dendining iob. her free advertising (worth 5500 ) in exchange for a setapbook fise les wife. locelyti cqualitie QRI nat lo40 Wiec 13 d) The Ianys roceived 52,000 in interts incoent Ifoen their moecy macket acoont and 5$00 in c) ) Thterest incorte from their State of Waho bonds. c) The Langs sold I, 000 shares of stock for 510 a share. They punchascil the stock rwo yearm ago for 5920 a share. f) John was hit and injured by al drunk driver while ctossing a sarcet an a cmosswalk. He was unable to work for a month. He feceived 56,000 from tais disality insarance. Wich-knakts paid the premiums for John, bot they includod the ammount of the prumiams as comgensation b) The drunk driver who hit John was required to pay his 53 .000 modical costs and 51 wor for to John on his year-end W+2. the emotional trauma be saffered froen the accident. b). The Lavg received a 5200 refund of their state inceme tunn fiom 2021 . The lange : hecmind dedaction were well over the standthed dedactore werout last yeat The fangs reportod making the following paytments for tak yat 20ez? 1) State income tax withboldiag froen W-2 i) Federal incoene tax withalding from W-2 k) Alimoey payments to Jolde's former wife of $10.000 (divoraed is 2014) 1) C-ild nupport paymeds of 54,100 . in) Teiticen and foes for S can of 512,000 m) Tuition and focs for Silly of $8,000 Schedule 3 dine 3. refiundable is reported on l040 line 89 . o) 53,600 1o Kid Care day carc center for Samantha's care while Jolen and Jocelyn worked (Iane 2 ef Sichedule i). p) 512,200 of real property tixes. q) $13,000 interest on their home mortpage r) 56,000 eash charitable coritributions to qualified charities. 5) Donation of used furmiture to Goodwill. The furmiture had a thenft ilanc value of 5400 and originally cost 52,000 t) John paid 5600 to a CPA to have his tates prepared las yeie. 4) Don't forget the child exs eredit and crodit for ocher dependests (leat lise I9) Copy 1-For State, City, or Local Tax Department