Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Fraud Risk Assessment and Detection in Financial Statements Background: ABC Corp, a medium - sized manufacturing company, has been experiencing financial difficulties in

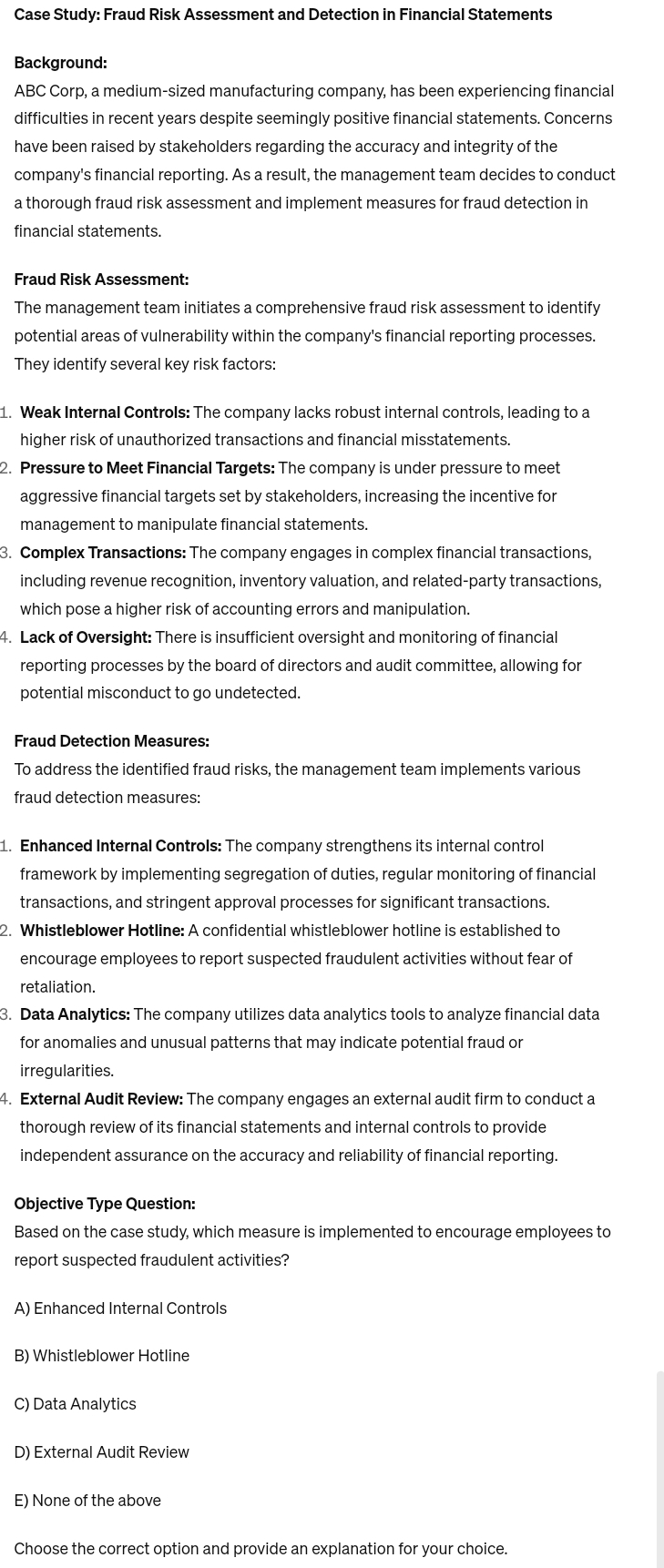

Case Study: Fraud Risk Assessment and Detection in Financial Statements

Background:

ABC Corp, a mediumsized manufacturing company, has been experiencing financial difficulties in recent years despite seemingly positive financial statements. Concerns have been raised by stakeholders regarding the accuracy and integrity of the company's financial reporting. As a result, the management team decides to conduct a thorough fraud risk assessment and implement measures for fraud detection in financial statements.

Fraud Risk Assessment:

The management team initiates a comprehensive fraud risk assessment to identify potential areas of vulnerability within the company's financial reporting processes. They identify several key risk factors:

Weak Internal Controls: The company lacks robust internal controls, leading to a higher risk of unauthorized transactions and financial misstatements.

Pressure to Meet Financial Targets: The company is under pressure to meet aggressive financial targets set by stakeholders, increasing the incentive for management to manipulate financial statements.

Complex Transactions: The company engages in complex financial transactions, including revenue recognition, inventory valuation, and relatedparty transactions, which pose a higher risk of accounting errors and manipulation.

Lack of Oversight: There is insufficient oversight and monitoring of financial reporting processes by the board of directors and audit committee, allowing for potential misconduct to go undetected.

Fraud Detection Measures:

To address the identified fraud risks, the management team implements various fraud detection measures:

Enhanced Internal Controls: The company strengthens its internal control framework by implementing segregation of duties, regular monitoring of financial transactions, and stringent approval processes for significant transactions.

Whistleblower Hotline: A confidential whistleblower hotline is established to encourage employees to report suspected fraudulent activities without fear of retaliation.

Data Analytics: The company utilizes data analytics tools to analyze financial data for anomalies and unusual patterns that may indicate potential fraud or irregularities.

External Audit Review: The company engages an external audit firm to conduct a thorough review of its financial statements and internal controls to provide independent assurance on the accuracy and reliability of financial reporting.

Objective Type Question:

Based on the case study, which measure is implemented to encourage employees to report suspected fraudulent activities?

A Enhanced Internal Controls

B Whistleblower Hotline

C Data Analytics

D External Audit Review

E None of the above

Choose the correct option and provide an explanation for your choice.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started