Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Individual Income Tax Filing Requirements and Deductions Meet Emily, a working professional residing in the United States. She is navigating the complexities of

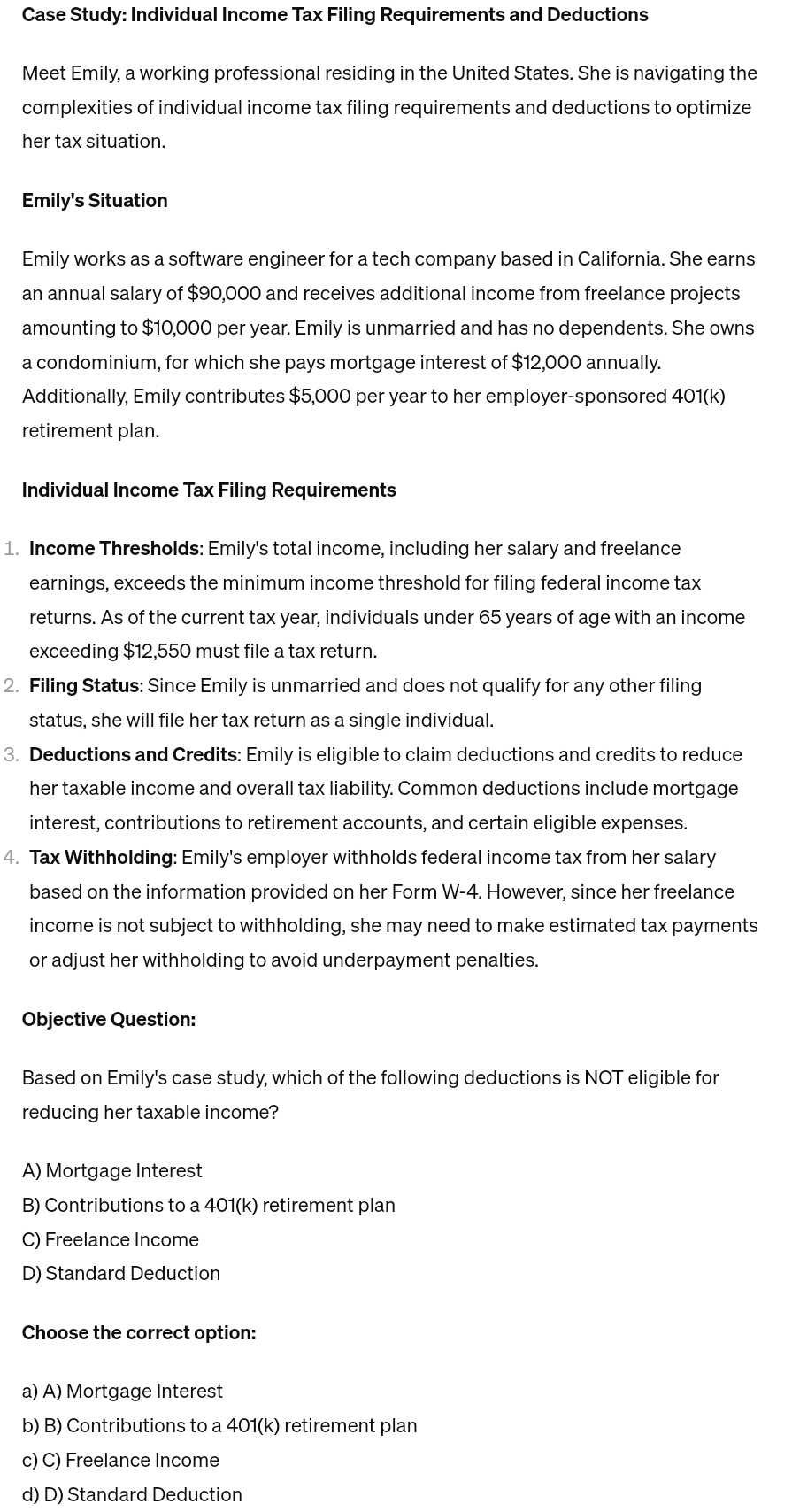

Case Study: Individual Income Tax Filing Requirements and Deductions

Meet Emily, a working professional residing in the United States. She is navigating the complexities of individual income tax filing requirements and deductions to optimize her tax situation.

Emily's Situation

Emily works as a software engineer for a tech company based in California. She earns an annual salary of $ and receives additional income from freelance projects amounting to $ per year. Emily is unmarried and has no dependents. She owns a condominium, for which she pays mortgage interest of $ annually.

Additionally, Emily contributes $ per year to her employersponsored retirement plan.

Individual Income Tax Filing Requirements

Income Thresholds: Emily's total income, including her salary and freelance earnings, exceeds the minimum income threshold for filing federal income tax returns. As of the current tax year, individuals under years of age with an income exceeding $ must file a tax return.

Filing Status: Since Emily is unmarried and does not qualify for any other filing status, she will file her tax return as a single individual.

Deductions and Credits: Emily is eligible to claim deductions and credits to reduce her taxable income and overall tax liability. Common deductions include mortgage interest, contributions to retirement accounts, and certain eligible expenses.

Tax Withholding: Emily's employer withholds federal income tax from her salary based on the information provided on her Form W However, since her freelance income is not subject to withholding, she may need to make estimated tax payments or adjust her withholding to avoid underpayment penalties.

Objective Question:

Based on Emily's case study, which of the following deductions is NOT eligible for reducing her taxable income?

A Mortgage Interest

B Contributions to a k retirement plan

C Freelance Income

D Standard Deduction

Choose the correct option:

a A Mortgage Interest

b B Contributions to a retirement plan

c C Freelance Income

d D Standard Deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started