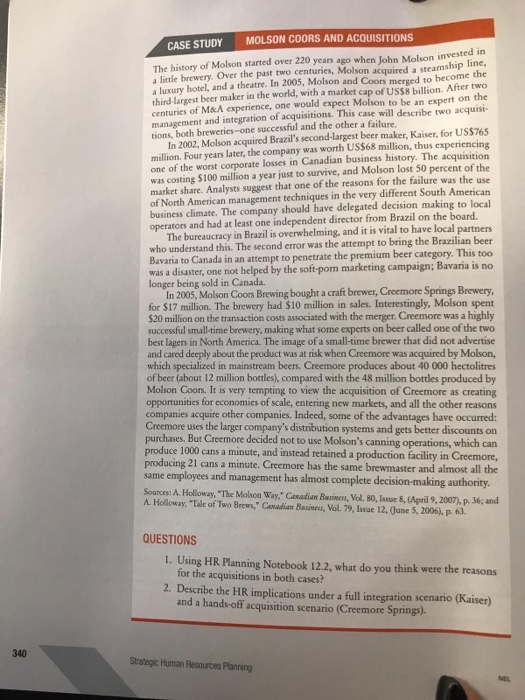

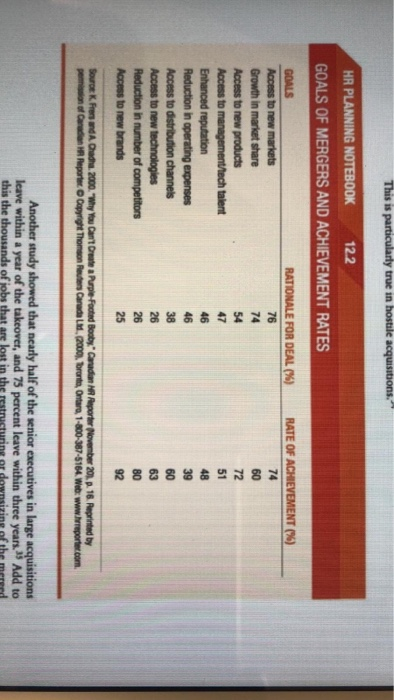

CASE STUDY MOLSON COORS AND ACQUISITIONS The history of Molson started over 220 years ago when John Molson invested in a little brewery. Over the past two centuries, Molson acquired a steamship line, a luxury hotel, and a theatre. In 2005, Molson and Coors merged to become the third-largest beer maker in the world, with a market cap of USS8 billion. After two centuries of M&A experience, one would expect Molson to be an expert on the management and integration of acquisitions. This case will describe two acquisi- tions, both breweries-one successful and the other a failure In 2002, Molson acquired Brazil's second-largest beer maker, Kaiser, for US$765 million. Four years later, the company was worth USS68 million, thus experiencing one of the worst corporate losses in Canadian business history. The acquisition was costing $100 million a year just to survive, and Molson lost 50 percent of the market share. Analysts suggest that one of the reasons for the failure was the use of North American management techniques in the very different South American business climate. The company should have delegated decision making to local operators and had at least one independent director from Brazil on the board. The bureaucracy in Brazil is overwhelming, and it is vital to have local partners who understand this. The second error was the attempt to bring the Brazilian beer his too Bavaria to Canada in an attempt to penetrate the premium beer category. T was a disaster, one not helped by the soft-porm marketing campaign; Bavaria is no longer being sold in Canada. In 2005, Molson Coors Brewing bought a craft brewer, Creemore Springs Brewery, for $17 million. The brewery had $10 million in sales. Interestingly, Molson spent $20 million on the transaction costs associated with the merger. Creemore was a highly successful smalltime brewery, making what some experts on beer called one of the two best lagers in North America. The image of a small-time brewer that did not advertise and cared deeply about the product was at risk when Creemore was acquired by Molson, which specialized in mainstream beers. Creemore produces about 40 000 hectolitres of beer (about 12 million bottles), compared with the 48 million bottles produced by Molson Coors. It is very tempting to view the acquisition of Creemore as creating opportunities for economies of scale, entering new markets, and all the other reasons companies acquire other companies. Indeed, some of the advantages have occurred: Creemore uses the larger company's distribution systems and gets better discounts on purchases. But Creemore decided not to use Molson's canning operations, which can 1000 cans a minute, and instead retained a production facility in Creemore producing 21 cans a minute. Creemore has the same brewmaster and almost all the same employees and management has almost complete decision-making authority Sources: A. Holloway,"The Molson Way, Canadian Basines, Vol. 80, Issue&(April 9,200), p. 36 and A. Holloway, Tale of Two Beews, Canadian Busines, Vol. 79, Issue 12, (Oune 5, 2006), p. 63. QUESTIONS 1. Using HR lanning Notebook 122, what do you think were the reasons 2. Describe the HR implications under a full integration scenario (Kaiser) for the acquisitions in both cases? and a hands-off acquisition scenario (Creemore Springs). 340 Strategic Human Resources Planning HR PLANNING 12.2 GOALS OF MERGERS AND ACHIEVEMENT RATES Acc to new products 47 Access to new