Question

CASE STUDY ON MS. A Historically, over the years Singapore has drawn the attention of many businessmen and investors from overseas based on its tremendous

CASE STUDY ON MS. A Historically, over the years Singapore has drawn the attention of many businessmen and investors from overseas based on its tremendous and continuous growth and successes. Ms. A, who is one such foreign investor, came across various news reports since the beginning of the year that a large number of foreigners are already invested or are showing a keen interest in the Singapore real estate sector. As an ultra-high net worth individual (UHNWI) investor herself with at least an equivalent of SGD 500 million in net investable assets, Ms. A has now decided to allocate SGD 10 million in cash to invest in Singapore real estate but is clueless as to the wide range of choices available in the real estate sector and related investment opportunities here.

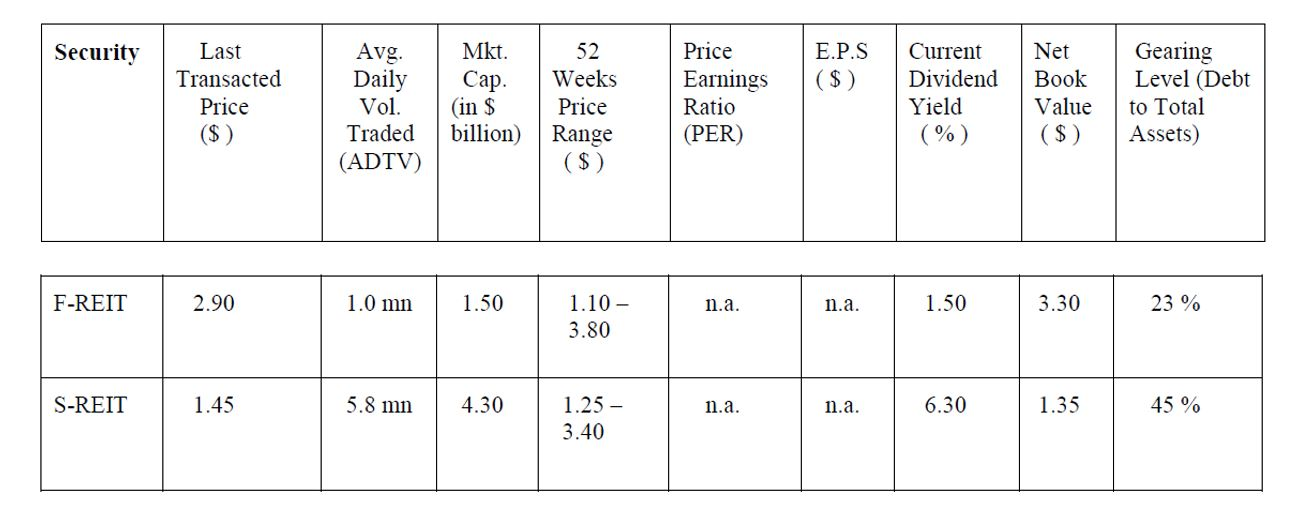

Additional information on the above securities that Ms. A is able to obtain are as follows: 1. XLL a MNC with global hotel operations and mixed development assets (comprising commercial, retail and residential) including substantial local real estate operations. 2. UPL a medium-sized developer with mainly residential projects in Singapore although it has diversified into Cambodia, Vietnam, Australia and the UK over the last 3 years. 3. F-REIT Its assets comprise mainly industrial factories and warehouses, purpose-built storage and data centres, logistic hubs and distribution facilities. 4. S-REIT Its portfolio consists of mainly retail malls, and some Grade A office and commercial space in prime CBD areas.

Remarks:

Remarks:

F-Reits - its portfolio consists mainly of industrial factories and warehouses

S-Reits - Assets comprise mainly retail malls and Grade A office space

Compare and analyse the market capitalization, liquidity, earnings, book values, and income distribution. Which is a better investment for Mrs. B?

Security | E.P.S ($) Last Transacted Price ($) Avg. Daily Vol. Traded (ADTV) Mkt. Cap. (in $ billion) 52 Weeks Price Range ($) Price Earnings Ratio (PER) Current Dividend Yield (%) Net Book Value ($) Gearing Level (Debt to Total Assets) F-REIT 2.90 1.0 mn 1.50 n.a. n.a. 1.50 3.30 23 % 1.10 - 3.80 S-REIT 1.45 5.8 mn 4.30 n.a. 1.25 - 3.40 n.a. 6.30 1.35 45 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started