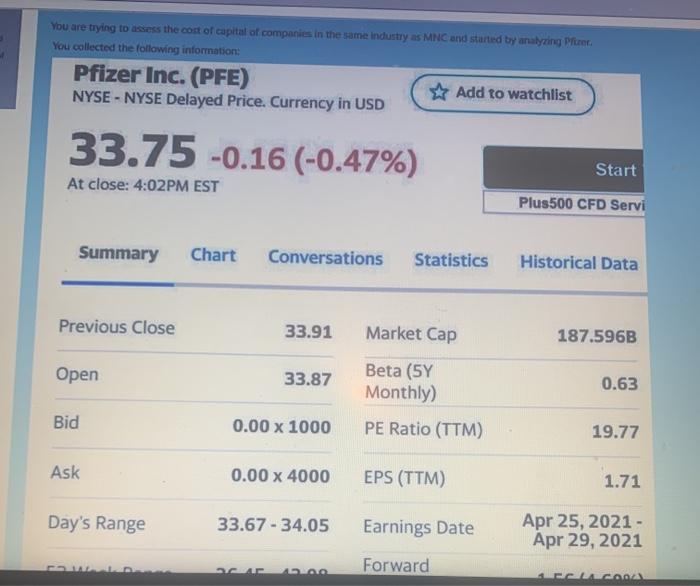

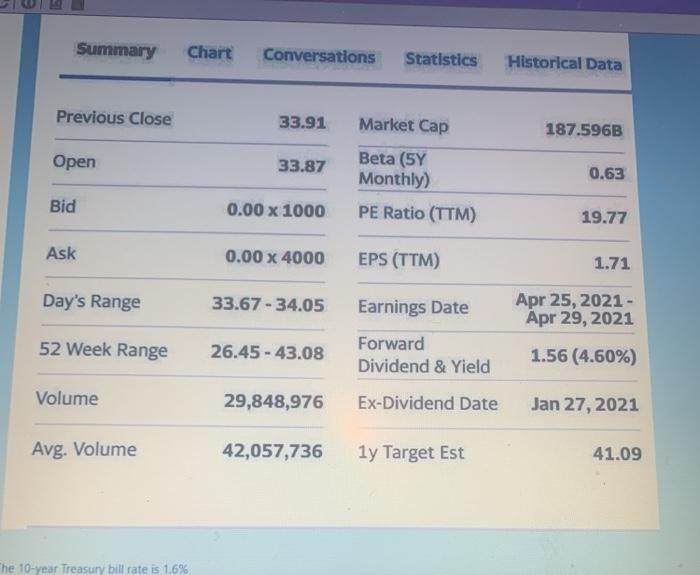

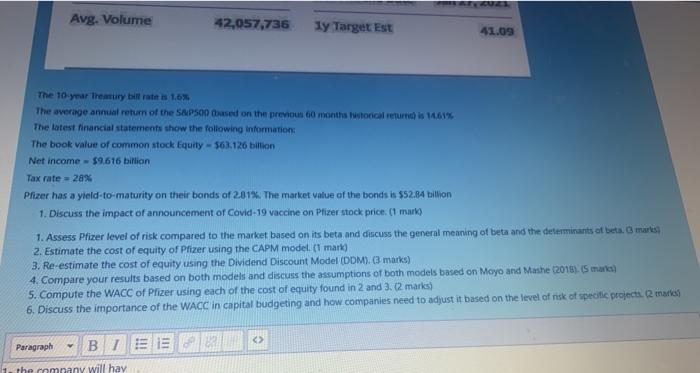

You are trying to assess the cost of capital of companies in the same industry as MNC and started by analyzing Pferer You collected the following information: Pfizer Inc. (PFE) Add to watchlist NYSE - NYSE Delayed Price. Currency in USD 33.75 -0.16 (-0.47%) Start At close: 4:02PM EST Plus500 CFD Servi Summary Chart Conversations Statistics Historical Data Previous Close 33.91 Market Cap 187.596B Open 33.87 0.63 Beta (5Y Monthly) PE Ratio (TTM) Bid 0.00 x 1000 19.77 Ask 0.00 x 4000 EPS (TTM) 1.71 Day's Range 33.67 - 34.05 Earnings Date Apr 25, 2021 - Apr 29, 2021 Forward CA LELAGODA Summary Chart Conversations Statistics Historical Data Previous Close 33.91 187.596B Open 33.87 Market Cap Beta (5Y Monthly) PE Ratio (TTM) 0.63 Bid 0.00 x 1000 19.77 Ask 0.00 x 4000 EPS (TTM) 1.71 Day's Range 33.67 - 34.05 Apr 25, 2021- Apr 29, 2021 52 Week Range 26.45 - 43.08 Earnings Date Forward Dividend & Yield Ex-Dividend Date 1.56 (4.60%) Volume 29,848,976 Jan 27, 2021 Avg. Volume 42,057,736 1y Target Est 41.09 he 10-year Treasury bill rate is 1.6% Avg. Volume 42,057,736 1y Target Est 41.09 The 10 year Treasury bill rate is 1.6% The average annual return of the SAPS based on the previous 60 months Norical returned 14.67% The latest financial statements show the following information: The book value of common stock Equity - 563.126 billion Net income - $9.616 billion Tax rate = 28% Pfizer has a yield-to-maturity on their bonds of 201%. The market value of the bonds is 552.84 billion 1. Discuss the impact of announcement of Covid-19 vaccine on Pfizer stock price (1 mark) 1. Assess Pfizer level of risk compared to the market based on its beta and discuss the general meaning of beta and the determinants at beta.marles 2. Estimate the cost of equity of Pfizer using the CAPM model. (1 marko 3. Re-estimate the cost of equity using the Dividend Discount Model (ODM). (3 marks) 4. Compare your results based on both models and discuss the assumptions of both models based on Moyo and Mathe 2018). S maria 5. Compute the WACC of Pfizer using each of the cost of equity found in 2 and 3. (2 marks) 6. Discuss the importance of the WACC in capital budgeting and how companies need to adjust it based on the level of risk of specific projects. (2 marks Paragraph BI SE V 1. the mnany will hav You are trying to assess the cost of capital of companies in the same industry as MNC and started by analyzing Pferer You collected the following information: Pfizer Inc. (PFE) Add to watchlist NYSE - NYSE Delayed Price. Currency in USD 33.75 -0.16 (-0.47%) Start At close: 4:02PM EST Plus500 CFD Servi Summary Chart Conversations Statistics Historical Data Previous Close 33.91 Market Cap 187.596B Open 33.87 0.63 Beta (5Y Monthly) PE Ratio (TTM) Bid 0.00 x 1000 19.77 Ask 0.00 x 4000 EPS (TTM) 1.71 Day's Range 33.67 - 34.05 Earnings Date Apr 25, 2021 - Apr 29, 2021 Forward CA LELAGODA Summary Chart Conversations Statistics Historical Data Previous Close 33.91 187.596B Open 33.87 Market Cap Beta (5Y Monthly) PE Ratio (TTM) 0.63 Bid 0.00 x 1000 19.77 Ask 0.00 x 4000 EPS (TTM) 1.71 Day's Range 33.67 - 34.05 Apr 25, 2021- Apr 29, 2021 52 Week Range 26.45 - 43.08 Earnings Date Forward Dividend & Yield Ex-Dividend Date 1.56 (4.60%) Volume 29,848,976 Jan 27, 2021 Avg. Volume 42,057,736 1y Target Est 41.09 he 10-year Treasury bill rate is 1.6% Avg. Volume 42,057,736 1y Target Est 41.09 The 10 year Treasury bill rate is 1.6% The average annual return of the SAPS based on the previous 60 months Norical returned 14.67% The latest financial statements show the following information: The book value of common stock Equity - 563.126 billion Net income - $9.616 billion Tax rate = 28% Pfizer has a yield-to-maturity on their bonds of 201%. The market value of the bonds is 552.84 billion 1. Discuss the impact of announcement of Covid-19 vaccine on Pfizer stock price (1 mark) 1. Assess Pfizer level of risk compared to the market based on its beta and discuss the general meaning of beta and the determinants at beta.marles 2. Estimate the cost of equity of Pfizer using the CAPM model. (1 marko 3. Re-estimate the cost of equity using the Dividend Discount Model (ODM). (3 marks) 4. Compare your results based on both models and discuss the assumptions of both models based on Moyo and Mathe 2018). S maria 5. Compute the WACC of Pfizer using each of the cost of equity found in 2 and 3. (2 marks) 6. Discuss the importance of the WACC in capital budgeting and how companies need to adjust it based on the level of risk of specific projects. (2 marks Paragraph BI SE V 1. the mnany will hav