Answered step by step

Verified Expert Solution

Question

1 Approved Answer

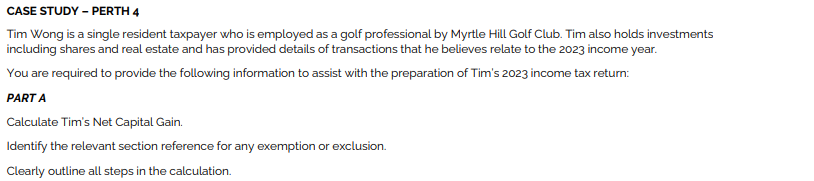

CASE STUDY - PERTH 4 Tim Wong is a single resident taxpayer who is employed as a golf professional by Myrtle Hill Golf Club.

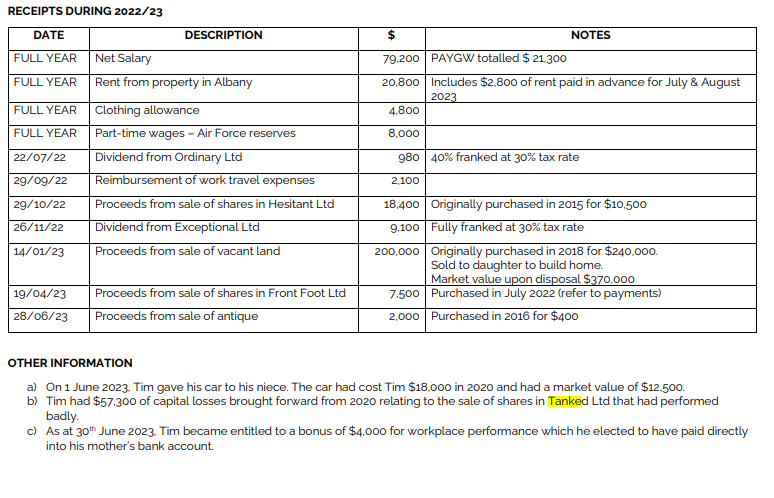

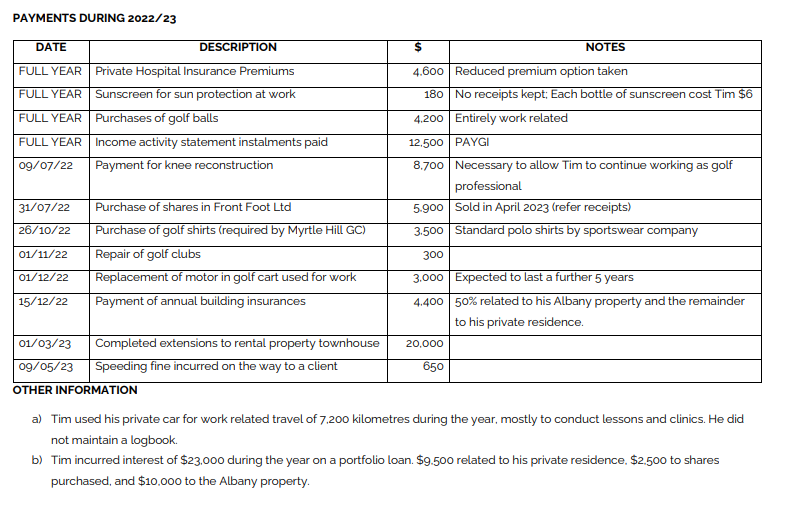

CASE STUDY - PERTH 4 Tim Wong is a single resident taxpayer who is employed as a golf professional by Myrtle Hill Golf Club. Tim also holds investments including shares and real estate and has provided details of transactions that he believes relate to the 2023 income year. You are required to provide the following information to assist with the preparation of Tim's 2023 income tax return: PART A Calculate Tim's Net Capital Gain. Identify the relevant section reference for any exemption or exclusion. Clearly outline all steps in the calculation. RECEIPTS DURING 2022/23 NOTES 79.200 PAYGW totalled $ 21,300 20,800 Includes $2,800 of rent paid in advance for July & August 4.800 2023 DATE DESCRIPTION $ FULL YEAR Net Salary FULL YEAR Rent from property in Albany FULL YEAR Clothing allowance FULL YEAR Part-time wages - Air Force reserves 8,000 22/07/22 29/09/22 Dividend from Ordinary Ltd Reimbursement of work travel expenses 29/10/22 26/11/22 Proceeds from sale of shares in Hesitant Ltd Dividend from Exceptional Ltd 14/01/23 Proceeds from sale of vacant land 980 40% franked at 30% tax rate 2,100 18,400 Originally purchased in 2015 for $10,500 9.100 Fully franked at 30% tax rate 200,000 Originally purchased in 2018 for $240.000. Sold to daughter to build home. 19/04/23 28/06/23 Proceeds from sale of shares in Front Foot Ltd Proceeds from sale of antique 7.500 2,000 Market value upon disposal $370,000 Purchased in July 2022 (refer to payments) Purchased in 2016 for $400 OTHER INFORMATION a) On 1 June 2023. Tim gave his car to his niece. The car had cost Tim $18,000 in 2020 and had a market value of $12.500. b) Tim had $57.300 of capital losses brought forward from 2020 relating to the sale of shares in Tanked Ltd that had performed badly. c) As at 30th June 2023. Tim became entitled to a bonus of $4,000 for workplace performance which he elected to have paid directly into his mother's bank account. PAYMENTS DURING 2022/23 DATE DESCRIPTION $ NOTES FULL YEAR Private Hospital Insurance Premiums FULL YEAR Sunscreen for sun protection at work FULL YEAR Purchases of golf balls FULL YEAR 09/07/22 Income activity statement instalments paid Payment for knee reconstruction Purchase of shares in Front Foot Ltd 31/07/22 26/10/22 01/11/22 Purchase of golf shirts (required by Myrtle Hill GC) Repair of golf clubs 01/12/22 15/12/22 Replacement of motor in golf cart used for work Payment of annual building insurances 01/03/23 09/05/23 Completed extensions to rental property townhouse Speeding fine incurred on the way to a client 4.600 Reduced premium option taken 180 | No receipts kept; Each bottle of sunscreen cost Tim $6 4.200 Entirely work related 12,500 PAYGI 8,700 Necessary to allow Tim to continue working as golf professional 5.900 Sold in April 2023 (refer receipts) 3.500 Standard polo shirts by sportswear company 300 3.000 Expected to last a further 5 years 4.400 50% related to his Albany property and the remainder to his private residence. 20,000 650 OTHER INFORMATION a) Tim used his private car for work related travel of 7,200 kilometres during the year, mostly to conduct lessons and clinics. He did not maintain a logbook. b) Tim incurred interest of $23,000 during the year on a portfolio loan. $9.500 related to his private residence, $2.500 to shares purchased, and $10,000 to the Albany property.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started